Stocks Rally – Finally

The stock market finally skyrocketed as I expected on Tuesday. Stocks were intensely oversold heading into the day. Short term indicators signaled stocks should burst higher soon.

The performance over the next 12 months is still dependent on the fundamentals. The S&P 500 increased 2.15%, the Nasdaq increased 2.89%, and the Russell 2000 increased by 2.82%. Earnings helped stocks.

Putting the cherry on top of this great performance, Netflix spiked after hours after reporting a great quarter. I will review later in this article. It’s important for the leaders to regain their mojo.

On Tuesday the NYSE had its highest advance-decline ratio since July 2016. This shows most stocks did well. The S&P 500 had its best day since March.

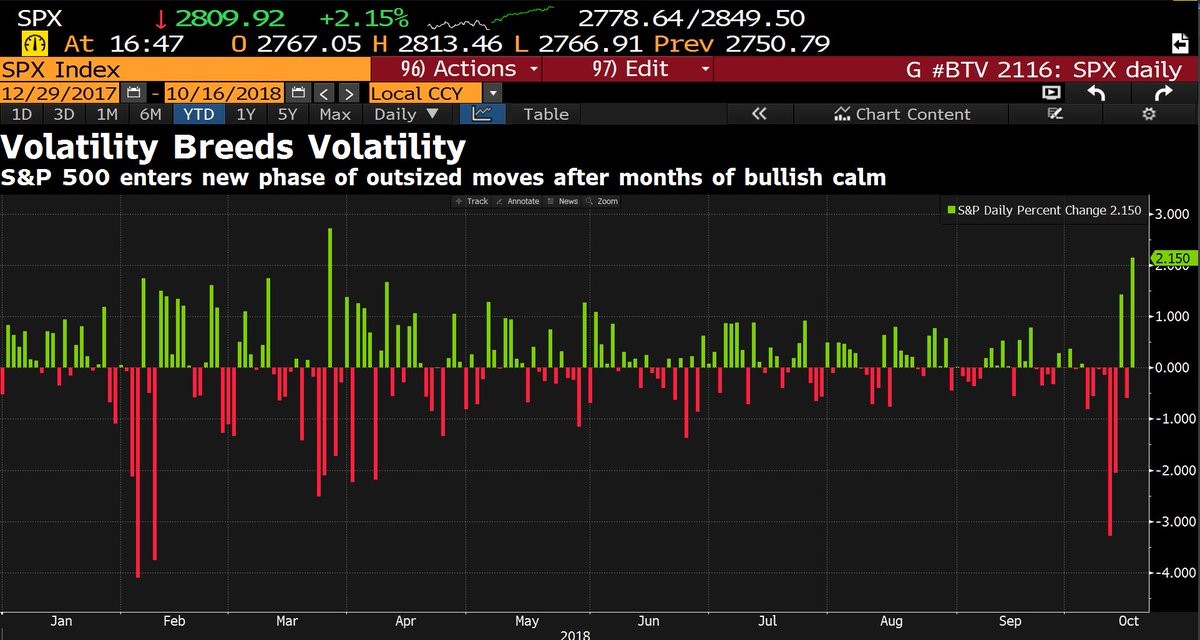

As you can see from the chart below, after several months of nothingness, there has been a spike in large movements to the upside and downside. This is the type of activity you see in bear markets, but the fundamentals don’t indicate one is coming soon.

The VIX fell 17.28% to 17.62. The S&P 500 is now only down 4.11% from its record high. CNN Fear and Greed index is at 15 which still signals extreme fear. I’m still bullish on stocks in the near term, but one more day like today or a few slightly positive days will push me to be neutral.

Stocks Rally – Earnings season is coming at the perfect time to save the stock market.

Tech stocks led the market higher as the two best performers in the S&P 500 were Adobe and Advanced Micro Devices. They were up 9.5% and 7.3%. Every sector was up in the S&P 500. The best two sectors were technology and healthcare as they increased 3.02% and 2.9%. The worst sectors were energy and consumer staples which increased by 0.87% and 1.05%.

Once again, the Treasury market had very little movement as the 10-year yield increased 1 basis point to 3.16% and the 2-year yield increased 1 basis point to 2.87%, making the difference between the two yields 29 basis points. It’s almost as if all traders have decided to focus on the stock market and ignore other markets. Emerging markets also did well as the EEM ETF increased 2.51%.

Leave A Comment