Whatever you do – remember “all is well”

Dow ended higher (with MMM and HD the biggest drivers) as Trannies, Small Caps (ugly into the close), and the Nasdaq red with S&P clinging to unchanged… until the very last minute…

NOTE – this is Nasdaq’s first down day in the last five – and that was a very unusual ugly close.

Futures show that US stocks were weak in Asia, bid in Europe, ramped at the US open, then dumped at the EU close…

And don’t forget Friday’s flash crash in VIX…

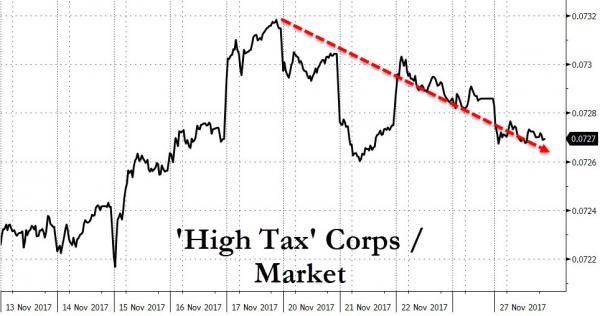

It seems hope for a tax cut is fading a little…

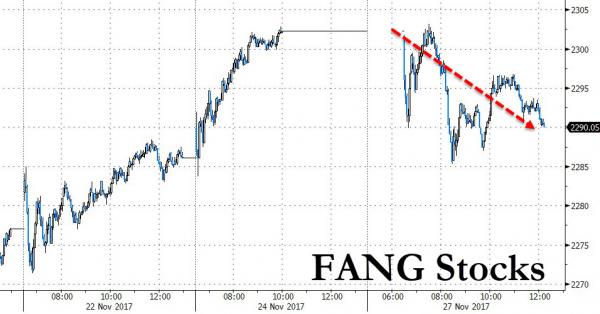

It’s Cyber Monday – so FANG stocks were lower, and of course, Amazon and Bitcoin were higher.

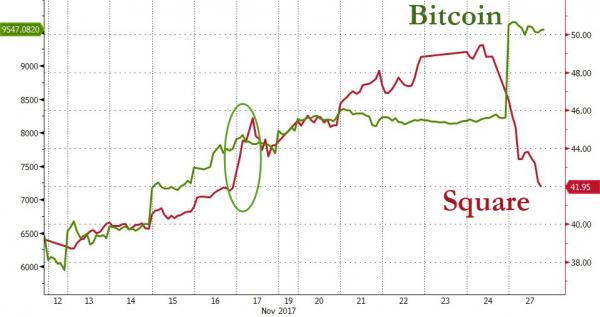

We’ll begin with Bitcoin’s massive weekend surge towards $10,000…

FANG Stocks sank

But Amazon hit $1200…

While Bitcoin grabbed all the headlines, Square was a bloodbath today on a downgrade (after bouncing last week on news it would test Bitcoin payments)…

The second worst day in the stock’s history…

Did capital just rotate into Bitcoin?

High yield bond prices managed to scramble back up to their 200DMA… but that was it and HYG rolled over…biggest drop in 8 days

Treasuries were bid today with the belly of the curve outperforming long- and short-ends…

2s30s and 2s10s were dumped and pumped back to unchanged but ended with a very minor flattening.

The Dollar Index v-shape-recovered, troughing around the US cash open…

Gold was pushed all the way up to $1299 before ‘someone’ decided it was time to slam dump Yen and hammer gold… (North Korea headlines lit it up briefly)

Perhaps notably, it appears gold is playing catchup (relatively speaking) to the surge in Bitcoin recently… certainly the correlation is loose but positive…

Leave A Comment