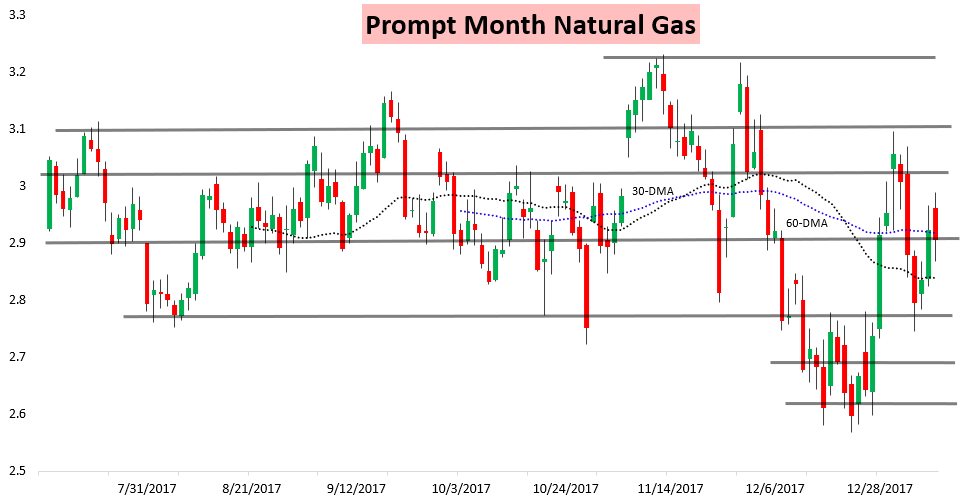

Natural gas prices pulled back modestly today, settling down half a percent on a day where they started trading significantly up following a short-covering rally yesterday afternoon.

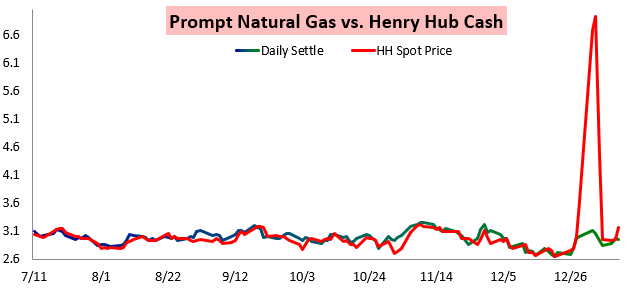

Bulls looked to strong cash prices today to support futures today, with Henry Hub cash averaging $3.11 today, but futures seem to shrug that off, as cash initially seemed to prop prices up early in the trading session before a mid-day decline.

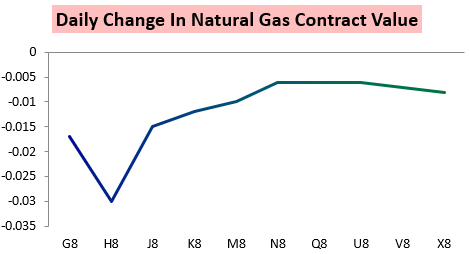

As has been the case recently, the entire strip did catch a bit of a bid into the settle, and the March contract is the one that ended up coming out with the largest losses on the day.

In our Afternoon Update for subscribers, we broke down what that means for our natural gas sentiment and forward expectations into the EIA print tomorrow. The most clear result was a ballooning to new highs in the G/H February/March spread.

Certainly, some mid-day losses came from the operational 12z GFS weather model late this morning. As shown below, the model lost a significant number of Heating Degree Days (courtesy of TrueWx/TrueEnergy).

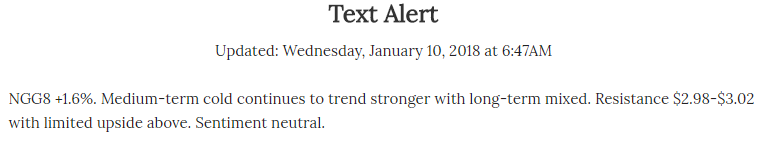

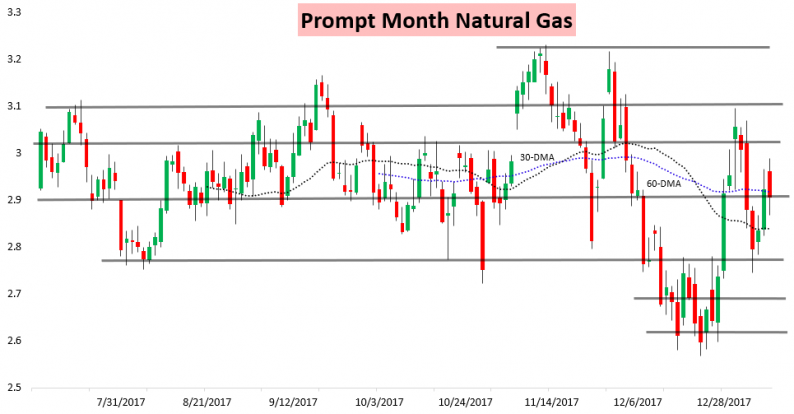

The pullback fit with our Morning Text Message Alert, which warned that upside was limited above the $2.98-$3.02 resistance level prices were sitting near and eventually pulled back from.

It also fit with our Morning Update analysis that if anything weather guidance this morning appeared to pose more bearish risks for prices, especially compared to yesterday.

Tomorrow we expect to see a record storage withdrawal, and though the price action today showed the natural gas market is not especially concerned about the print it is certainly expected to add further volatility to the market. As we explained to clients last week, though the draw announced last week was large, when weather-adjusted it was actually quite loose, thanks in part to the Christmas Holiday. (In the below image, the red dot represents last week’s print, with the blue dot the week before and the orange dot the week prior to that one).

Leave A Comment