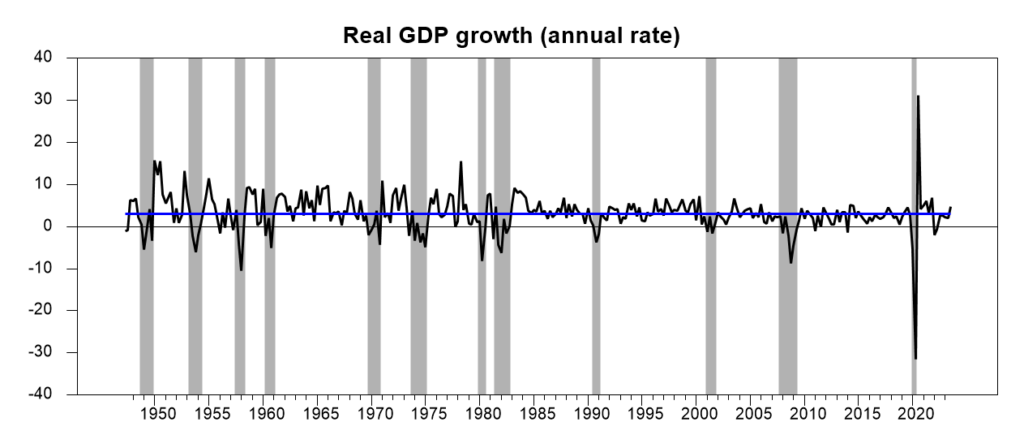

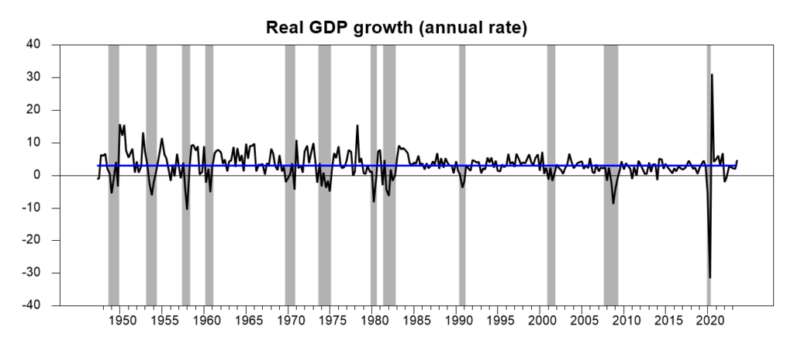

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 4.9% annual rate in the third quarter. That’s well above the U.S. historical average growth rate of 3.1%.

Real GDP growth at an annual rate, 1947:Q2-2023:Q3, with the historical average (3.1%) in blue. Calculated as 400 times the difference in the natural log of GDP from the previous quarter.The new data put the Econbrowser recession indicator index at 3.0%. The current U.S. expansion has now continued for over three years, despite some rockiness a year ago.

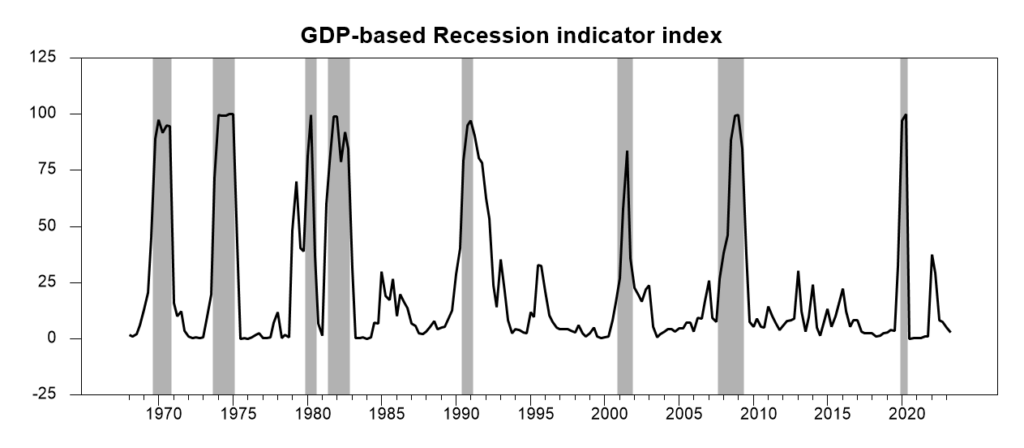

GDP-based recession indicator index. The plotted value for each date is based solely on the GDP numbers that were publicly available as of one quarter after the indicated date, with 2023:Q2 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index.The drop in GDP last year and rapidly rising interest rates had led our Little Econ Watcher to get rather worried. Some concerns certainly remain, but he doesn’t seem to be feeling quite so glum right at the moment.![]()

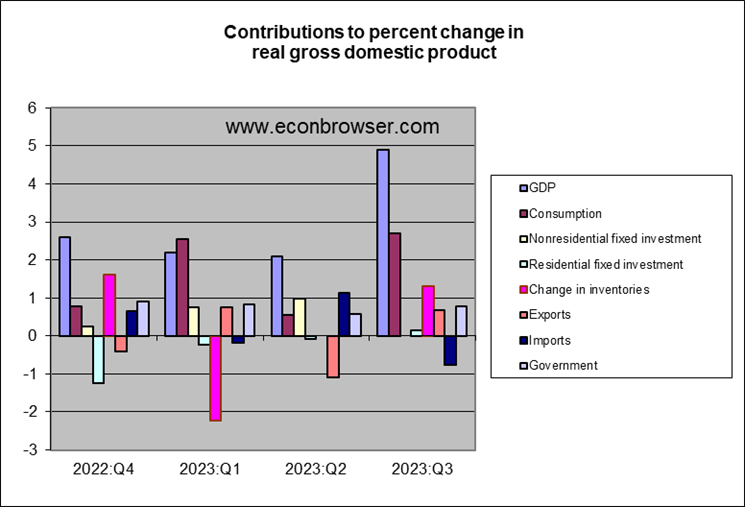

The biggest factor in the strong Q3 GDP growth was consumer spending, likely still supported in part by cash people accumulated from the COVID stimulus packages. Another 1.3% of the 4.9% Q3 annual growth rate came from inventory accumulation. But even subtracting the change in inventories, real final sales grew faster than usual. Even residential fixed investment made a positive contribution, despite 30-year mortgage rates nearing 8%.

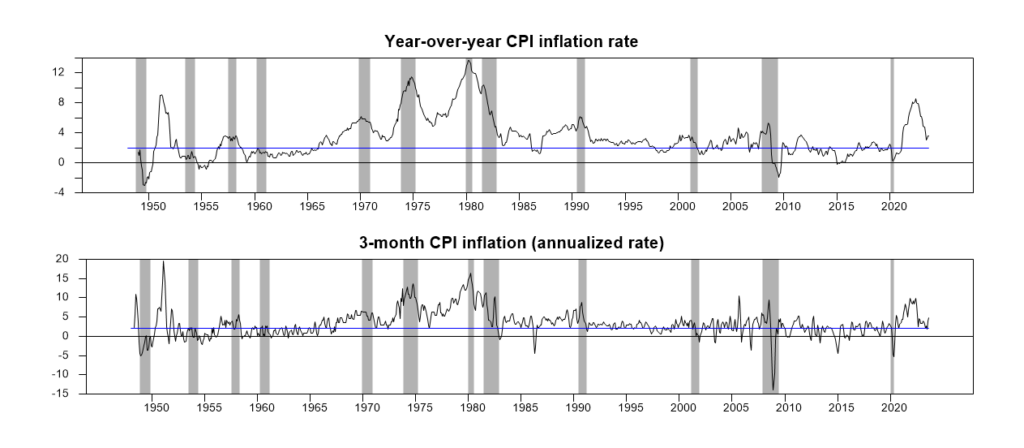

The Fed’s goal in raising rates was to slow the economy enough to bring inflation down. Inflation had been falling up until this summer. But it has been creeping back up since then, averaging 3.6% over the last 12 months.  Two measures of the annual inflation rate. Top panel: 100 times the year-over-year change in the natural logarithm of headline CPI Bottom panel: 400 times the 3-month change. Blue lines correspond to a 2% inflation rate.That’s well above where the Fed wants inflation to be. Five percent GDP growth and 3.8% unemployment don’t sound like a recipe to bring inflation down. Is the Fed finished raising interest rates? Our Little Econ Watcher would like to know.More By This Author:Does The Confidence Index Say We’re In A Recession? Consumer Spending Is Up, Saving Is Down. What Does This Mean For The Economy? More On China Q3 GDP

Two measures of the annual inflation rate. Top panel: 100 times the year-over-year change in the natural logarithm of headline CPI Bottom panel: 400 times the 3-month change. Blue lines correspond to a 2% inflation rate.That’s well above where the Fed wants inflation to be. Five percent GDP growth and 3.8% unemployment don’t sound like a recipe to bring inflation down. Is the Fed finished raising interest rates? Our Little Econ Watcher would like to know.More By This Author:Does The Confidence Index Say We’re In A Recession? Consumer Spending Is Up, Saving Is Down. What Does This Mean For The Economy? More On China Q3 GDP

Leave A Comment