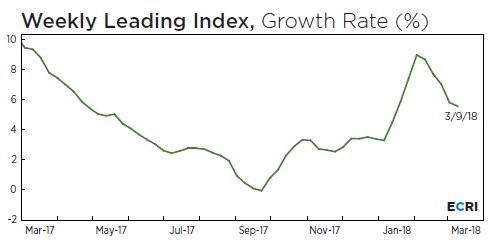

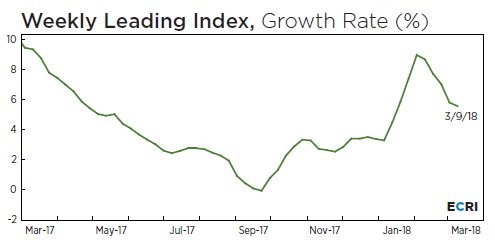

My favorite indicator for studying future economic growth is the ECRI weekly leading index. While the ISM reports told you growth was accelerating in the first two months of the year, the ECRI forecast growth would fall. Not only did it likely get the forecast right, it also told you this a few months before the ISM reports came out. It makes sense that Q1 will see cyclical weakness because last quarter was helped by storm rebuilding efforts. Two straight months with declining month over month retail sales results isn’t a recipe for strong GDP growth. As you can see from the chart below, the ECRI growth rate on its weekly index ticked down to 5.6%. That’s not a bad growth rate in of itself, but the trend is obviously not looking promising. After improving growth in Q3, there might be a deceleration.

The most important part of the chart above is the deceleration in the indicator last summer and fall because that’s the prediction for growth this quarter. The Atlanta Fed GDP Now model for Q1 growth has fallen to 1.8% growth from 1.9% growth. The latest decline came because the downward revisions for Q1 contributions from real consumer spending, real net exports, and real inventory investment. On the bright side, the estimate for private fixed investment growth increased from 2.4% to 3.3% because of the new residential construction report and the capacity to utilization report. The NY Fed’s GDP Now forecast has fallen from 2.83% to 2.73%. It’s still probably too optimistic. It’s down from its peak which was 3.45% growth. It’s interesting to see how the models have diverged. Speaking of divergence, the St. Louis Fed model is at 3.78% growth. I think the weak consumer prevents growth above 2.5%, but there’s still a month more of data to digest before we have a good idea of where growth will be.

Decent Philly Fed Report

In general manufacturing surveys have been strong in the past few months. The March Philly Fed manufacturing report was similar to the past few. The current activity diffusion index was 22.3 which missed the consensus for 23 and was below the prior report of 25.8. While that’s slightly negative, the six month forecast improved from 41.2 to 47.9. This is positive news because my worry is declines in manufacturing in the next 12 months will be the precursor for the next recession. The new orders index increased from 24.5 to 35.7. That might be why the six month forecast improved. The prices paid index actually declined from 45 to 42.6. That’s a big change in my eyes because these Fed surveys are where the inflation estimates have garnered their optimism. If even Fed surveys are seeing less pricing strength, it supports my narrative of disinflation. The prices received index also fell as it went from 23.9 to 20.7.

Leave A Comment