The US Dollar has had the fundamental backdrop for a breakout even the most optimistic US Dollar Bulls should be thankful. However, after the Brexit vote was confirmed on June 24, the US Dollar has failed to make significant headway. A lack of upside appears worrisome because what the market is not doing can be as significant (if not more so) than what is doing because investors, therefore, do not see the value in bidding up an asset with an ideal fundamental backdrop.

Of the four counterparts for the US Dollar of the EUR, GBP, JPY, & AUD, only the AUD had a great run post-Brexit that could help make the argument that there was a better purchase over the US Dollar. The JPY initially strengthened to 98.77 on the Brexit confirmation but has since weakened to ~106 JPY per USD. GBP has been volatile as expected, though it has firmed post-Theresa May’s appointment as PM along with her cabinet.

If the US Dollar cannot find lift-off here, it’s tough to imagine the scenario that it will. Thankfully, we can look to the charts for guidance from here.

The Fundamentals And Technical Picture May Be Aligning to US Dollar Strength

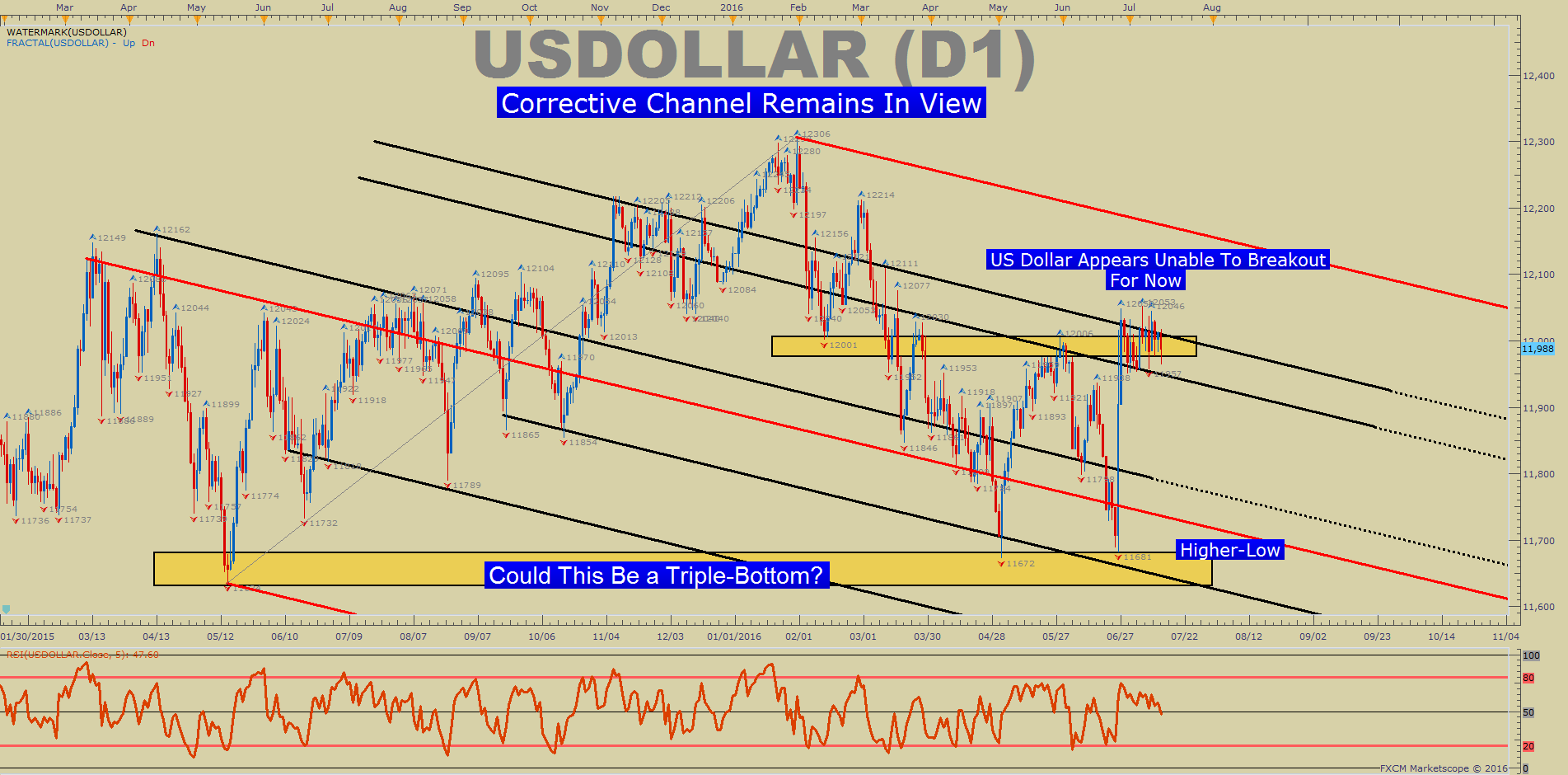

Given the technical picture on the charts, we are now seeing fault lines before the ceiling breaks on US Dollar. Currently, we have resistance at 12,050/53 (post-Brexit high). A breakout above the H2 Opening range high would favor the USD is beginning to flex its muscle as a reserve currency despite the Fed’s wishes. Below, we’ll discuss what levels to watch, and what other markets could complement such a strong move.

The Bearish channel (red) has done a fine job of framing price action. When combining the bearish price channel with the 200-Day Moving Average (12,023), you can begin to see that we are still in a corrective price channel. Therefore, we must await a breakout before we celebrate the strength of the US Dollar and only a break above resistance should favor the Bulls well into Q3.

Leave A Comment