The Elastic IPO (NYSE: ESTC) will price tonight. The price was bumped up to $33-35 but given the company position in software infrastructure, the shares should still perform well from that level.

We have our summary comments below but investors in this one will want to review the ESTC prospectus and read our transcript of the ESTC IPO roadshow.

Technology

The name of the company is a little misleading. It’s true that the core product “Elasticsearch” provides a search and analytics engine. But it does this as a data store. That means for *some* applications it can obviate the need for a separate database to be the system of record. For example, many applications that might require MongoDB ($MDB) could use Elastic instead.

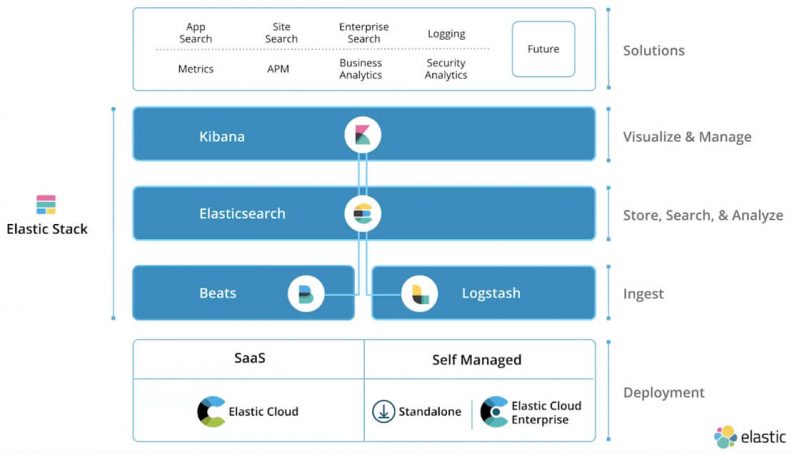

Elastic is really a data management company that puts search functionality at the core of their design vision. The “Elastic Stack” includes a development console (Kibana) and tools for ingesting and enriching data which are the domain of “extract, transform and load” ETL tools from companies like Talend ($TLND).

Elastic is also built to be embedded in other applications. The company cites companies like Uber, Instacart, and Tinder where Elastic is the “engine inside” their applications. Elastic can also run completely inside a customer data center or in the cloud hosted on AWS, Google Cloud, or Azure. This removes a key obstacle for some enterprise customers who either can’t or won’t run everything in the cloud.

Elastic has a subscription-based, open-source rooted business model which is what customers and investors like best. The majority of the subscription revenue is for on-premise deployments but the cloud portion is growing even more rapidly than the overall business. Revenues for the fiscal year ended April 2018 were up 81% to $160M. The company still has negative operating margins but their business model and 70%+ gross margins should translate into 20%+ operating margins when the company is more mature.

Leave A Comment