Check out this article on an absolutely mind-boggling phenomenon taking place in Switzerland. Apparently Local Cantons (what states are apparently called over there) are actually telling taxpayers not to send the money they owe in to the government – at least not right away. They’re saying just hold on to the cash until the deadline.

What could possibly be a good reason for Leviathan to not want its food/funding ASAP? Well, when you live in a land of negative interest rates, things get a bit tipsy turvy. I guess it’s a bit like bizarro-world from that episode of Seinfeld – where up is down and bad is good.

As the article states:

The longer it has cash on its books, the more likely it will incur costs as a result of negative interest rates charged by Swiss banks. The canton calculates that the move will save SFr2.5m ($2.5m) a year.”

You see, instead of cash in the bank being an asset, suddenly it becomes a liability. Instead of it earning interest and giving you a solid payout, negative interest causes you to actually lose money as it sits in the bank. Hence the Swiss government saying – you guys hold on to those funds (and pay the negative interest instead of us) a bit longer. It’s like a crude game of financial hot potato. Whoever gets stuck with the cash in the bank loses.

As anyone with even a modicum of common sense (i.e anyone who is not a mainstream economist) will tell you this doesn’t seem right. And they’d be right. Because this is indeed not right at all. This is in fact a signal of looming disaster for the Swiss franc and its financial system. These negative interest rates are the death knell of their currency.

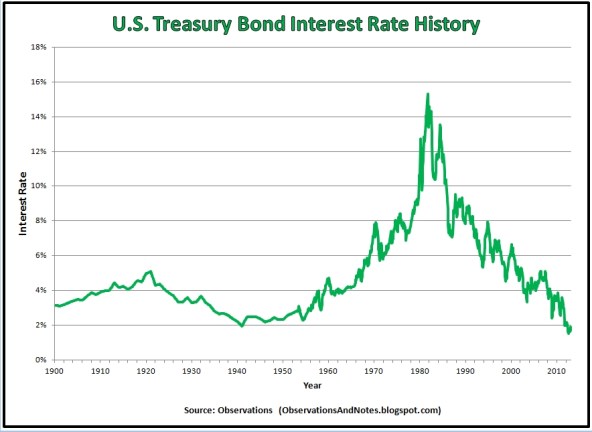

And sorry to say but this isn’t going to be a disease isolated to Europe. This negative interest rate-itis is coming stateside. Rates have been falling for 34 years after all, and they will keep going.

Why? Because interest rates are supposed to be set by the free market and as such should tend towards equilibrium. (Just to review briefly how it should work…when people want to borrow this will push rates up as it makes funds more scarce and when a firm can’t afford high rates of borrowing because a particular project won’t be profitable enough this will pressure them down. And if people don’t like the rate of interest they’re getting at their savings account given the risk they’re undertaking by lending it to a third party, they can withdraw their money – and stuff it in a mattress. This pressures savings account interest rates back up.)

Leave A Comment