Elevate Credit (NYSE:ELVT) filed an S-1/A with the SEC, providing the details of its upcoming IPO. The company intends to offer 7.7 million shares, with an additional 1.155 million shares as an overallotment option for underwriters, at a marketed price range of $12 to $14. The underwriters for the IPO include: UBS Investment Bank, Credit Suisse, Jefferies, William Blair and Stifel.

Assuming Elevate prices at the mid-point of its price range, it would have a market cap value of $467.4M and trade at a price/sales multiple of 0.80x.

We previewed the deal on our IPO Insights Platform.

Business overview

Elevate Credit Inc. offers online credit services to non-prime borrowers in the U.S. and the U.K., which include people whose credit scores are below 700. The company reports that an estimated 170 million people in the two countries are non-prime borrowers. It reports that it has served more than 1.6 million customers by lending them $4 billion. Elevate lends to borrowers with credit scores between 575 to 625 and plans to provide lending to borrowers with even lower credit scores as it expands.

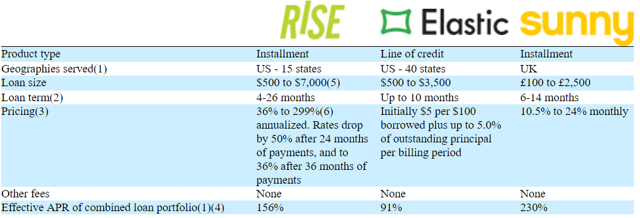

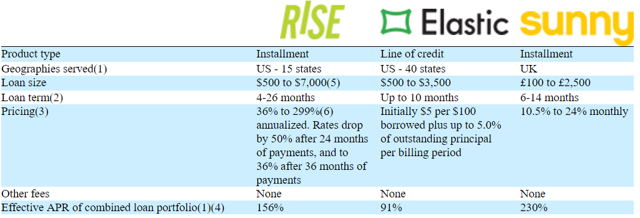

Elevate online products include: Rise, Elastic, and Sunny. The average weighted APR for RISE is 160 percent, which is significantly lower than the 500% APR payday loan, that is the traditional route for non-prime borrowers in need of cash. RISE loans are reduced to 50% after 24 months and to a fixed APR rate of 36% after 36 months.

(S-1/A)

The company is based in Fort Worth, Texas and has 400 employees to date. The company has received investments from: Sequoia Capital and Technology Crossover, among others.

Executive management team

Kenneth E. Rees is the chief executive officer and chairman of Elevate Credit. He has served in those roles since 2014. He previously served as CEO of Think Finance Inc., the predecessor of Elevate. Think Finance has faced legal problems for allegations of unlawfully collecting debt. Elevate was spun off of Think Finance in 2014. Rees holds a Master of Business Administration in statistics and finance from the University of Chicago and a Bachelor of Arts in mathematics from Reed College.

Leave A Comment