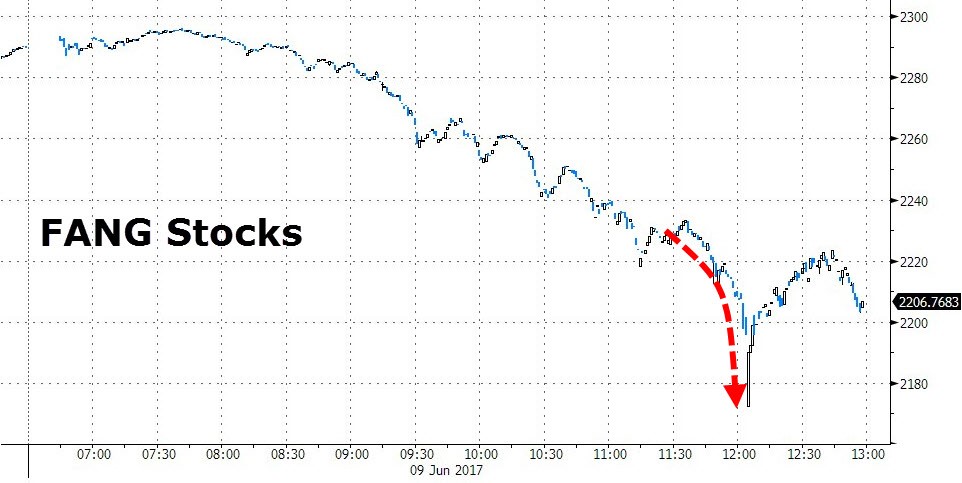

Friday was a great day for the market as most sectors were up. Energy and the financials did well as the S&P energy sector was 2.48% and the S&P financials sector was up 1.93%. However, in the afternoon the technology sector had a bit of a flash crash led by NVIDIA (NVDA) which was down 6.46% on the day. The Big 5 technology stocks were all down sharply. You can see the FANG’s crash in the chart below. Amazon lost $17 billion in market cap in 5 seconds. The Nasdaq fell 1.80% as it had its worst week of the year.

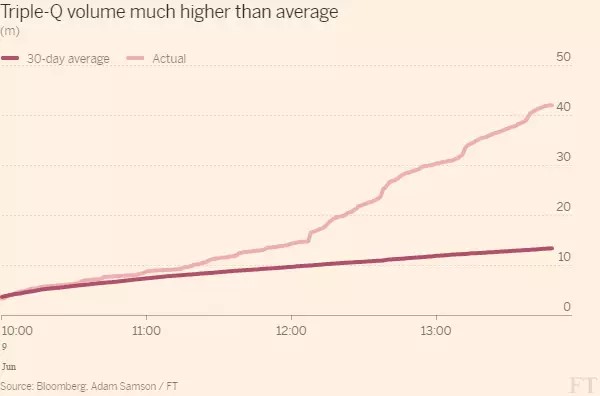

One of the reasons for NVIDIA’s crash was the negative note by short seller Andrew Left from Citron Research. However, the main culprit of this selloff was likely fact that all the momentum traders were leaning in one direction. Just like with bitcoin and the 1990s tech bubble, when every trader is leaning in positively, the market is vulnerable to a sharp reversal. The chart below shows the volume in the QQQ, which is the Nasdaq 100 ETF. As expected, volume skyrocketed way above the 30-day average as traders scrambled to react to the crash.

It’s important to understand that while this selloff is big relative to the action we’ve seen in tech this year, it’s only a blip on the charts. The Nasdaq is still up 15.32% year to date. The chart below is of the Semiconductor ETF. The SMH had its highest volume day of the year. Total year to date returns are still 19.51%. The 3.81% selloff only gave back 6 days of gains.

![]()

As I said, the selloff in tech is simply the stocks being a victim of their own success. As you can see from the chart below, the FAANG market cap as a percentage of the S&P 500 has almost doubled since mid-2013. This doesn’t imply a crash is coming because their earnings are also up. I don’t see this selloff lasting more than a few days because there wasn’t any fundamental reason for it. With record profits from the tech stocks and oil in the mid-$40s, I don’t see how energy stocks can outperform tech stocks over the next few months. Obviously, when you buy the momentum/tech stocks with the worst fundamentals which would be Tesla (TSLA), Netflix (NFLX), and SNAP, you’re taking more risk than if you buy Facebook or Alphabet.

Leave A Comment