In case you haven’t noticed, folks are getting nervous about tech.

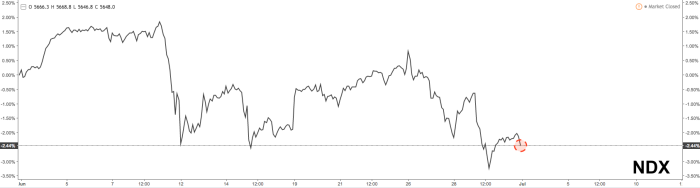

Here’s what the Nasdaq 100 did in June:

And that’s a real shame, because tech was the glue holding everything together in the face of increasingly lackluster data and jitters about the Fed hiking into a deflationary backdrop. Indeed, it’s been no contest YTD as the Nasdaq just turned in its largest H1 gain since 2009:

But investors are starting to question the sustainability of a situation in which a handful of tech-y names are shouldering a disproportionate share of the burden.

And Goldman didn’t help matters by reminding investors that FAAMG is becoming increasingly correlated with momentum, growth, and low vol. Recall the following excerpt from the bank’s now infamous FAAMG warning:

The bigger story in our view is FAAMG – Facebook, Amazon, Apple, Microsoft and Alphabet – a group of five stocks which have been the key drivers of both the SPX & NDX returns year-to date. This outperformance, driven by secular growth and the death of the reflation narrative, has created positioning extremes, factor crowding and difficult-to-decipher risk narratives (e.g. FAAMG’s realized volatility is now below that of Staples and Utilities).

If FAAMG was its own sector, it would screen as having the lowest realized volatility in the market. How can low vol create a problem? Investors are increasingly focused on “volatility-adjusted” returns as they are deciding which stocks to invest in. We believe low realized volatility can potentially lead people to underestimate the risks inherent in these businesses including cyclical exposure, potential regulations regarding online activity or antitrust concerns or disruption risk as they encroach into each other’s businesses.

Mechanically, we expect that as the realized volatility of a stock drops, more passive “low vol” strategies buy the stock, pushing up the return and dampening downside volatility. The fear is that if fundamental events cause volatility to rise, these same passive vehicles will sell and exacerbate downside volatility.

Leave A Comment