The Top?

Video length: 00:05:20

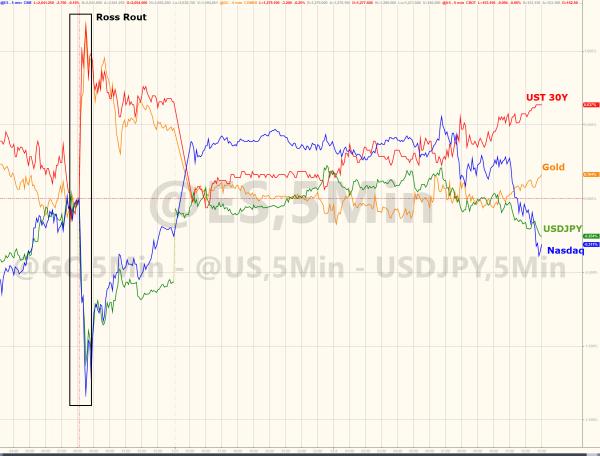

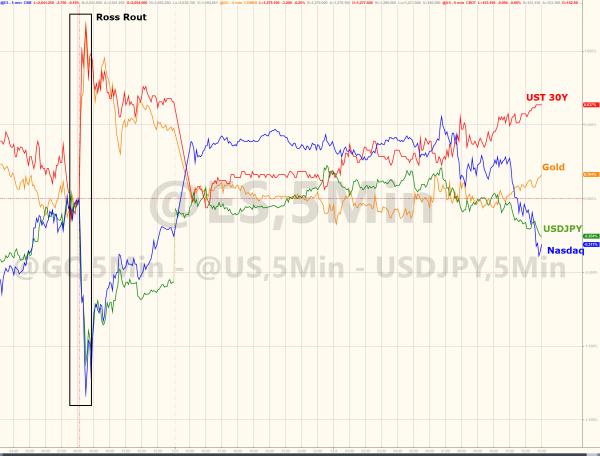

Bonds & bullion remain bid post the Ross Rout as Nasdaq sinks…

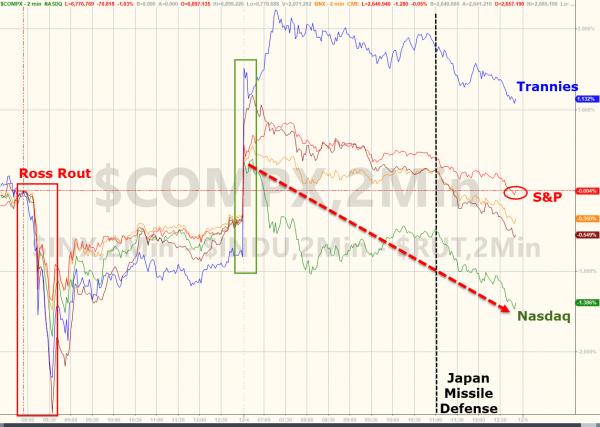

And while stocks were exuberant overnight, only Trannies remain positive from the start of the Ross Rout… with Nasdaq getting monkey-hammered… (biggest reversal in the S&P 500 since Feb 2016)

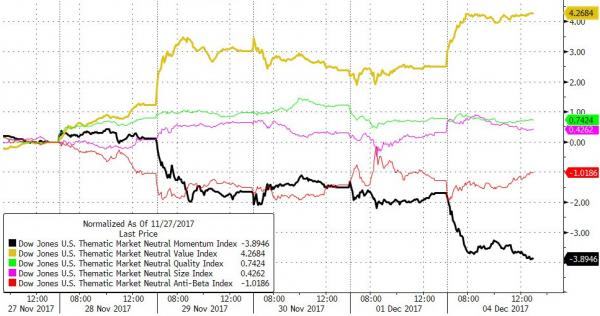

Equity momentum is getting smacked as investors rotate into Value…

Today’s 4% divergence between Momo and Value is the biggest since the election…

Did President Trump jinx it?

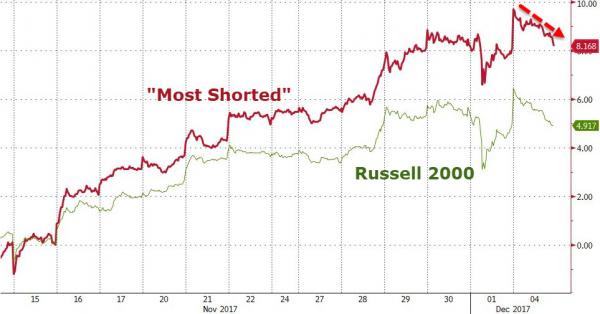

11 of the last 12 days have seen shorts squeezed (but note today’s opening squeze rolled over notably)…

Big day for banks again…

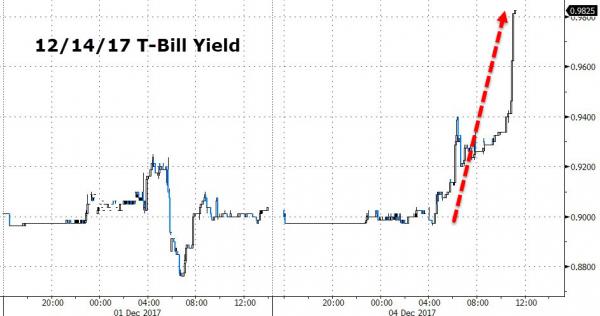

Amid Freedom Caucus emergency meetings and ‘Chuck-and-Nancy’ meeting Trump, anxiety about the government shutdown deadline is starting to be seen in the T-Bill market…

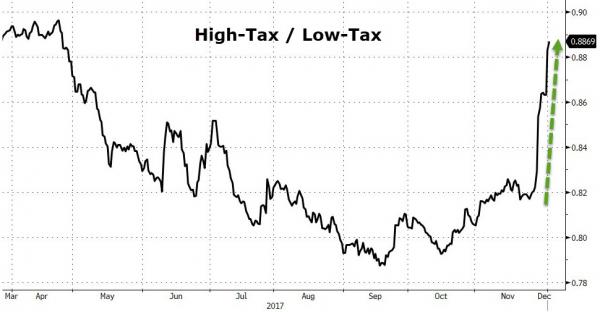

But the rotation from low- to high-taxation companies is accelerating wildly…

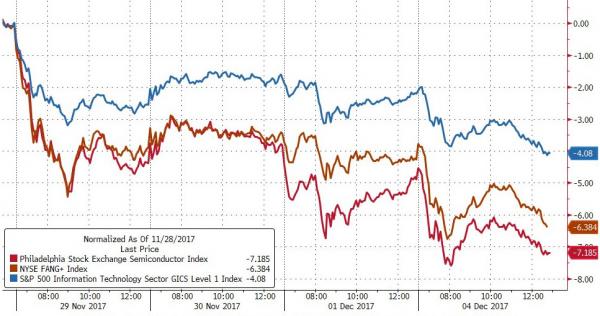

Which slammed tech stocks everywhere.

The S&P has outperformed Nasdaq for six straight days – this is the biggest divergence between their performance since May 2009…

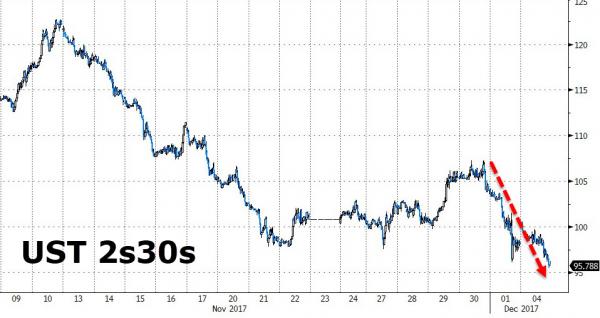

Treasury yields ended higher on the day with notable underperformance once again at the front-end…

Flattening the yield curve once again to new 10 year cycle lows…

The Dollar Index trod water today after knee-jerking higher at the open last night…

Commodities were lower aross the baord with Crude leading the way lower…

And as stocks sank today, Bitcoin was bid back towards record highs…

Leave A Comment