This past weekend, I discussed the current extension of the market. To wit:

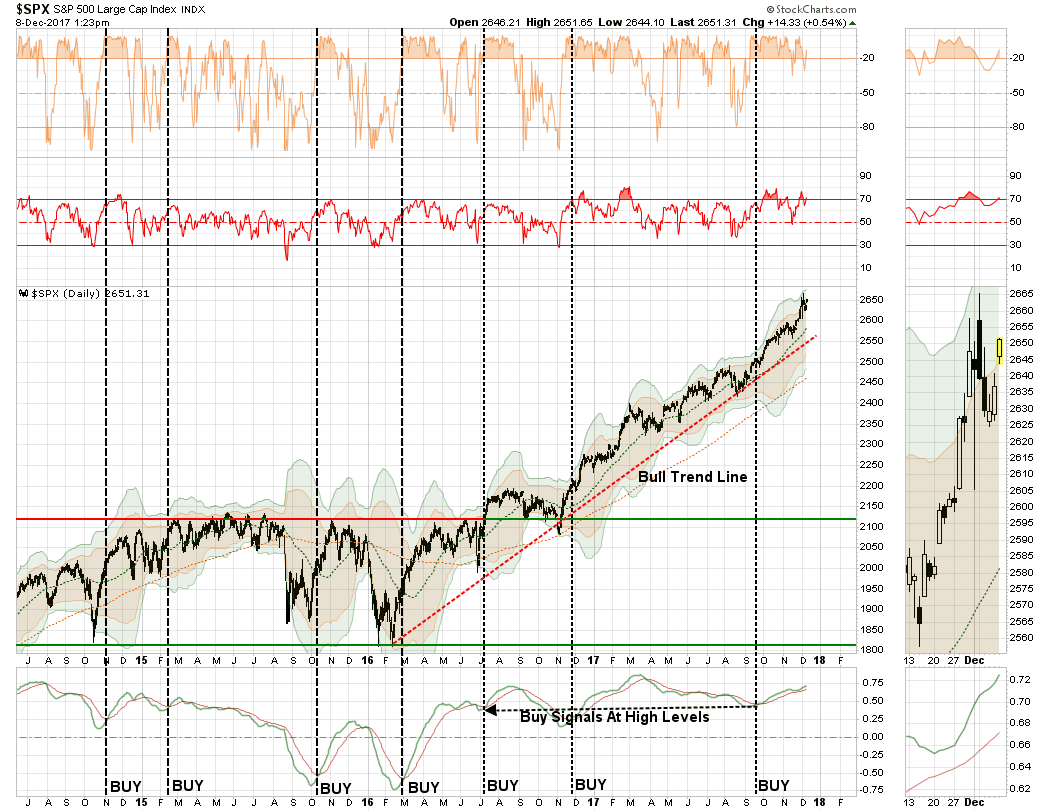

“In the short-term, the market trends are CLEARLY bullish, very overbought, but nonetheless bullish.”

“As such, our portfolios remain ‘long’ on the equity side of the ledger…for now. “

The current momentum behind the market advance is clearly bullish, and with the “smell of tax reform” in the air, there is little to derail the bulls before year-end.

As I previously wrote, I am still somewhat suspicious of the markets going into 2018. As I laid out over the last couple of weeks, I believe the risk of “tax-related” selling is a strong possibility at the beginning of the year as portfolios lock in gains without having to pay taxes until 2019. While the risk to the overall market trend remains small, a correction of 3-5% is possible. I am still looking for the right “setup” by the end of the month to add a small “short S&P 500” position to portfolios and increase longer-duration bond exposure to hedge off some of the potential risks.

I will keep you apprised, of course.

However, in the meantime, there seems to be nothing stopping the market from going higher. As stated in the title, the current push higher puts 2700 in sight by the time Santa fills the “stockings hung by the chimney with care.”

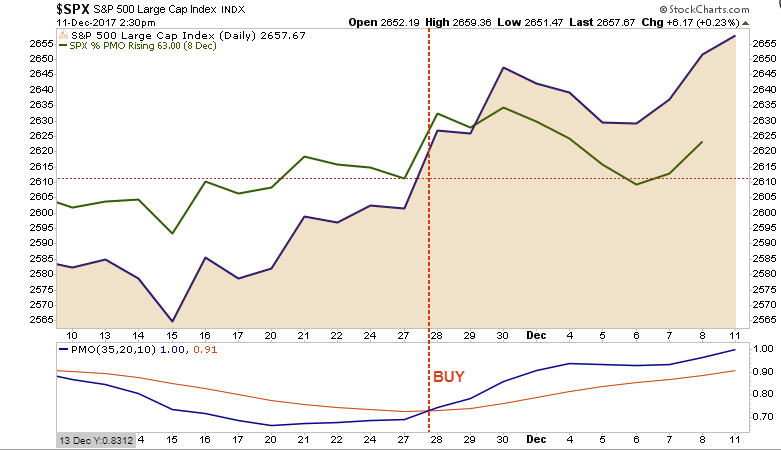

As shown below, price momentum triggered a short-term “buy” signal following Thanksgiving, and after the brief “AMT Tax Debacle” in the Senate Tax Bill, momentum again has turned up as prices continue to press higher.

As noted above, this “momentum” keeps portfolios allocated towards equity risk, but we continue to be prudent about the risk we are taking and continue to hedge risk as necessary.

Leave A Comment