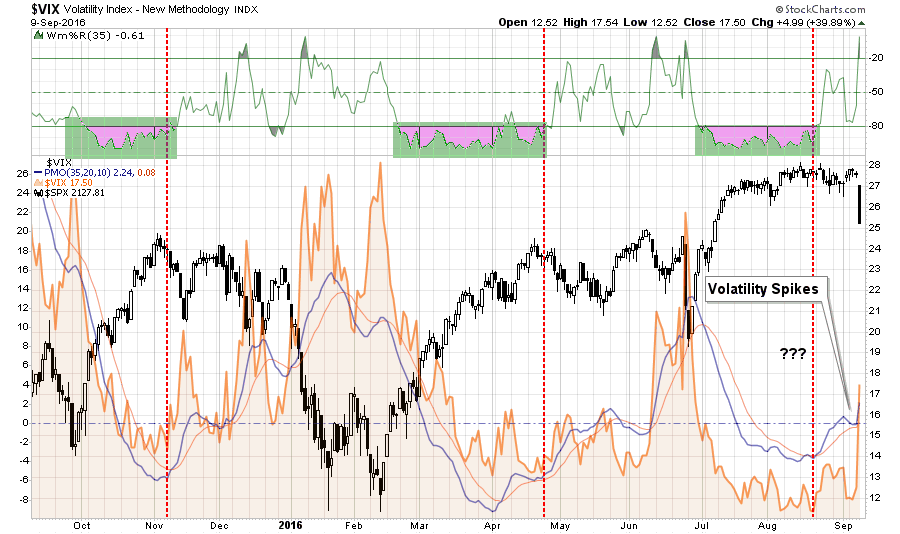

In this past weekend’s newsletter, I discussed the return of volatility to the market:

“While it seemed for a while that volatility had been completely eliminated from the market by an ever present Fed, I warned this was a dangerous assumption to make.

On Friday, volatility returned with a vengeance.”

(I closed out my VXX long on Monday which served its purpose of protecting declines in portfolios this past Friday.)

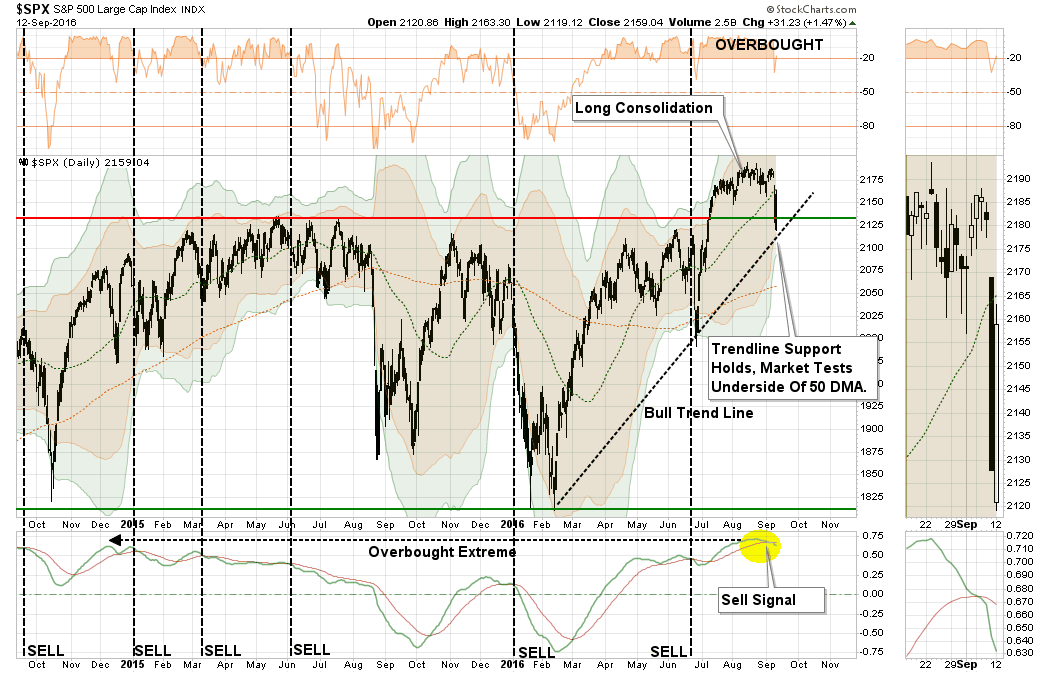

“Analysts, the media, and Wall Street talking heads rushed to grab every excuse available to explain the sudden sell-off on Friday from the Fed, ECB, and Japan to interest rates and the dollar. However, the reality is I have been warning about a pending correction over the last month as market extensions had reached extremes.”

Of course, discussing the potential of a market correction is almost always perceived as being “bearish” and by extension must mean that I am either out of the market completely or short the market and have “missed out” on previous advances. This is particularly the case when you have a “round trip” market advance like we did yesterday which leaves investors sitting “flat footed” and unsure about what to do next.

This reminds me of something famed Morgan Stanley strategist Gerard Minack said once:

“The funny thing is there is a disconnect between what investors are saying and what they are doing. No one thinks all the problems the global financial crisis revealed have been healed. But when you have an equity rally like you’ve seen for the past four or five years, then everybody has had to participate to some extent.

What you’ve had are fully invested bears.”

While the mainstream media continues to misalign individuals expectations by chastising them for “not beating the market,” which is actually impossible to do, the job of a portfolio manager is to participate in the markets with a predilection toward capital preservation. It is the destruction of capital during market declines that have the greatest impact on long-term portfolio performance.

It is from that view, as a portfolio manager, the idea of “fully invested bears” defines the reality of the markets that we live with today. Despite the understanding that the markets are overly bullish, extended and valued, portfolio managers must stay invested or suffer potential “career risk” for underperformance. What the Federal Reserve’s ongoing interventions have done is push portfolio managers to chase performance despite concerns of potential capital loss.We have all become “fully invested bears” as we are all quite aware that this will end badly, but no one is willing to take the risk of being grossly underexposed to Central Bank interventions.

Leave A Comment