Last week, I discussed a recent article by Mark Hulbert on “8-Measures Say A Crash Is Coming.” In that article, we discussed the issue of valuation and forward returns specifically. To wit:

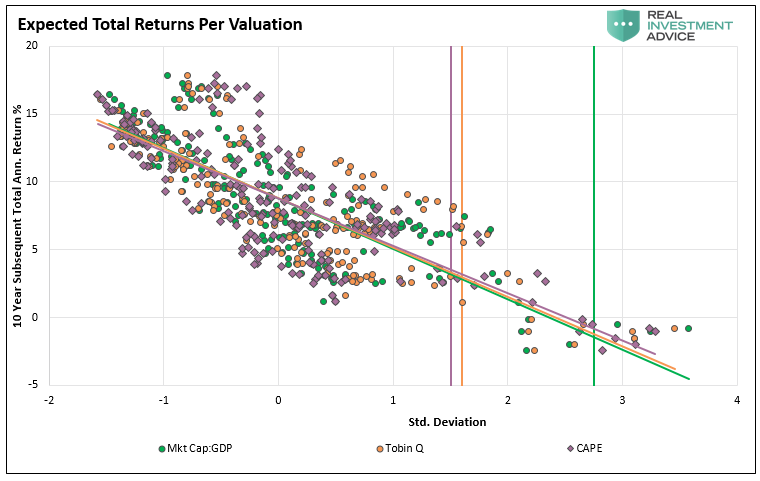

“No matter, how many valuation measures I use, the message remains the same. From current valuation levels, the expected rate of return for investors over the next decade will be low.

This is shown in the chart below, courtesy of Michael Lebowitz, which shows the standard deviation from the long-term mean of the “Buffett Indicator,” or market capitalization to GDP, Tobin’s Q, and Shiller’s CAPE compared to forward real total returns over the next 10-years.”

In the short-term, a period of one year or less, political, fundamental, and economic data has very little impact on the market. This is especially the case in a late-stage bull market advance, such as we are currently experiencing, where the momentum chase has exceeded the grasp of the risk being undertaken by unwitting investors.

As I noted this past weekend,

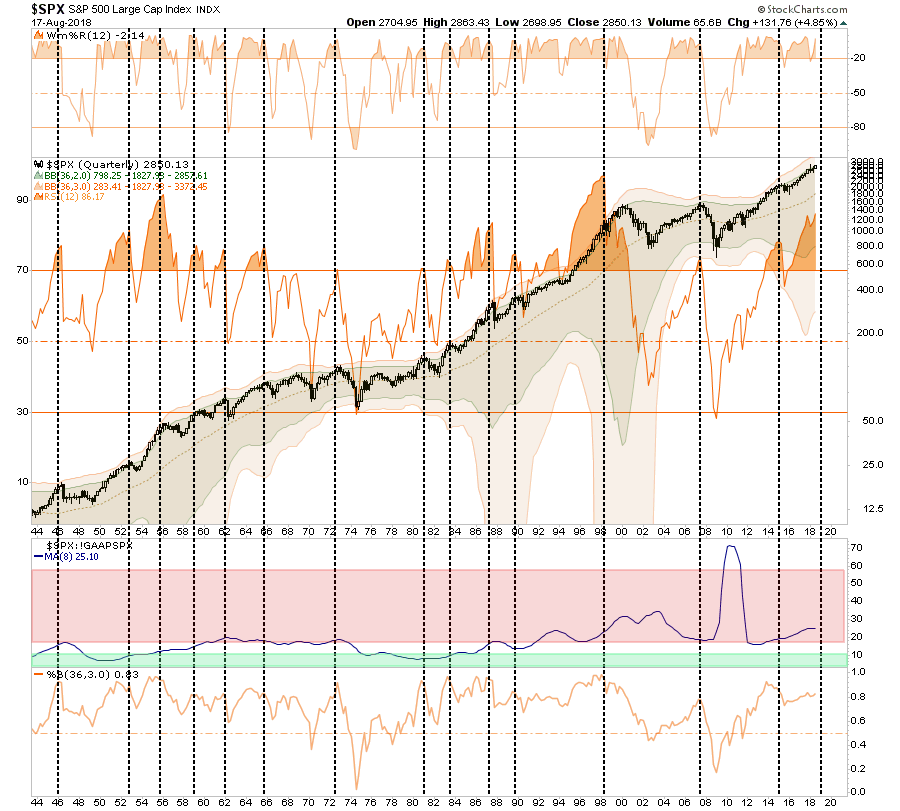

“As we head into 2019, the odds of a recessionary drawdown in the market rises markedly. On a QUARTERLY basis, the market is currently at one of the most overbought, extended and deviated levels in history going back 75 years. Every previous period has led to a correction of some magnitude. The only difference between a correction, and a more serious crash, was the level of valuations at the time.”

“While this certainly doesn’t mean the market will mean revert tomorrow, it does imply that forward returns for current levels will be substantially lower than they have been over the last several years.”

As I stated, over the next days, weeks, and even the next few months, “price is the only thing that matters.”

“Price measures the current ‘psychology’ and ‘direction’ of the ‘herd.’ It is the clearest representation of the behavioral dynamics of the living organism we call ‘the market.’”

Leave A Comment