This past weekend, I discussed the recent weekly violation of the market back below its respective 50-dma and the triggering of actions in our underlying portfolios.

‘If the market fails to hold the 50-dma by the end of this week, we will add our hedges back to portfolios, rebalance risk in portfolios and raise cash as needed.

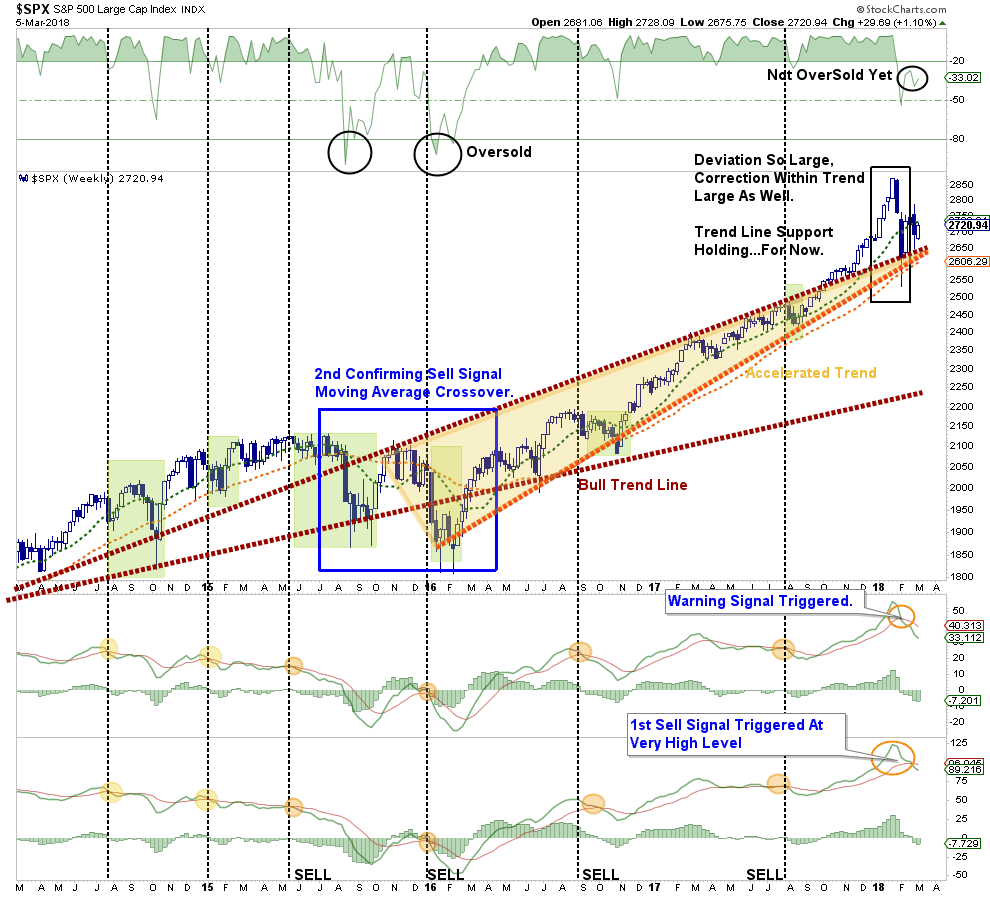

We did exactly that on Friday by reinstating our short-market hedge and raised some cash by reducing some of our long-equity exposure. While previously we had only hedged portfolios, the action this past week to simultaneously reduce some equity exposure was due to both of our primary “sell” signals being tripped as shown below.”

Notice that while the much surged more than 1% on Monday:

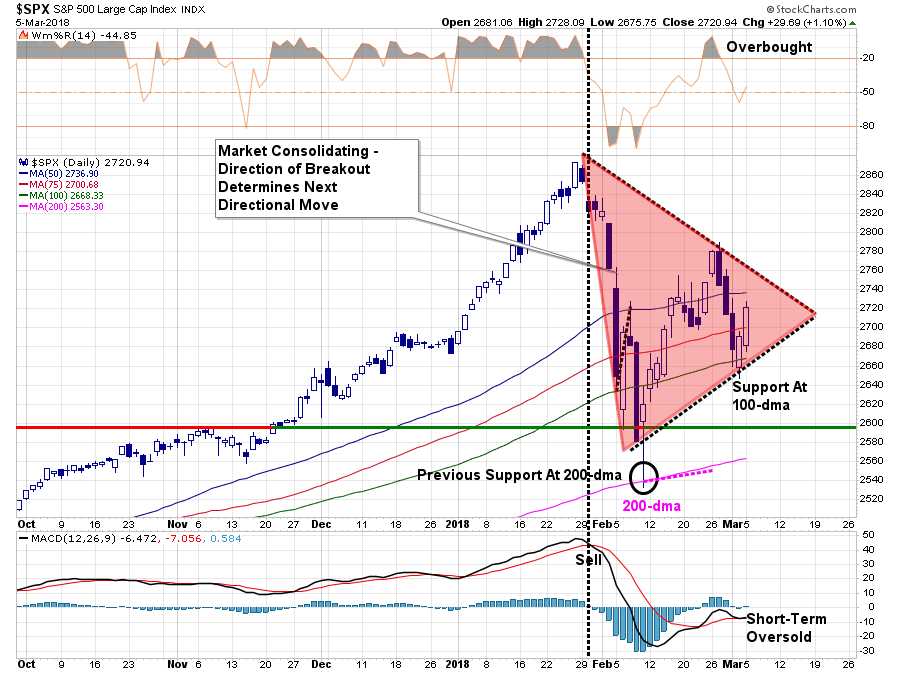

All of this suggests the correction process is not yet complete.

On a short-term trading view, the consolidation process continues with the Monday’s rally also remaining below the 50-dma keeping short-hedges in place for now. This is particularly the case given the confirmed “sell” signal on a weekly basis as noted above.

“Most importantly, the market is currently in the process of building a consolidation pattern as shown by the ‘red’ triangle below. Whichever direction the market breaks out from this consolidation will dictate the direction of the next intermediate-term move.”

“Turning points in the market, if this is one, are extremely difficult to navigate. They are also the juncture where the most investing mistakes are made.”

Over the last several weeks, I have been providing constant prodding to clean up portfolios and reduce risks. I also provided guidelines for that process – click here.

The rally on Monday was not surprising, due to the short-term oversold conditions that existed. However, as discussed in the newsletter:

“It isn’t too late to take some actions next week as I suspect we could very likely see a further bounce on Monday or Tuesday.

Use that bounce wisely.”

For now, it is important to note the “bullish trend” remains solidly intact and, therefore, we must give the “benefit of the doubt” to the bulls. However, with “bearish signals” beginning to mount, the increase in risks certainly justifies become more cautious currently. Goldman Sachs recently noted the potential of a further corrective process:

“As has been discussed in previous updates, the market could also be starting a much bigger/more structurally corrective process, counter to a V wave sequence from the ‘09 lows. If that’s the case, there should be room to continue a lot further over time. At least 23.6% of the rally since ‘09 which is down at 2,352.

Bottom line, it’s worth considering the possibility of continuing further than 2,467-2,449. Doing so might imply that this is not an ABC but rather a 1-2-3 of 5 waves down, in a larger degree ABC count that could take months to fully manifest. While it is still far too early to make this call, the important thing to note is that the 2,467-2,449 area will likely be trend-defining.”

Leave A Comment