This past weekend, I discussed the correction last Friday as concerns over “Turkey Turmoil” grabbed headlines.

“The market did indeed attempt to test all-time highs this past week, but, as noted, the overbought condition provided the fuel for a correction given the right catalyst.

That catalyst appeared on Friday as the Lira plunged and Turkey edged closer to an economic crisis.”

However, as of this morning, all seems to have been quickly forgotten as the market is set to open higher. The money flows into FAANG stocks have also once again resumed. (Where do you put your money when there is nowhere else to put your money? The 5-biggest market cap Technology stocks, obviously. #SafeAsCash #WhatCouldGoWrong.)

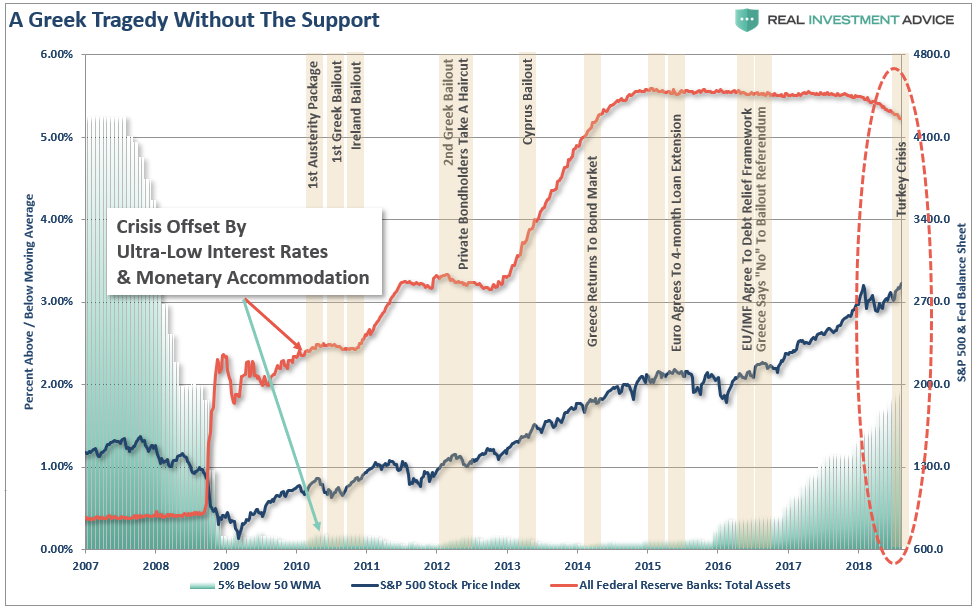

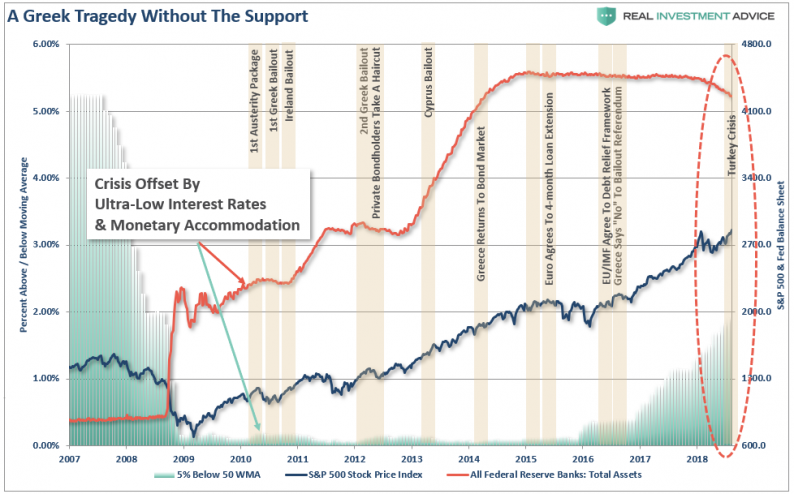

The reality, however, is that nothing has been “fixed” with respect to Turkey, and as I noted in the newsletter, the backstop of Federal Reserve liquidity which supported the markets during the “Greek Crisis” does not exist currently, in fact, it’s running in reverse.

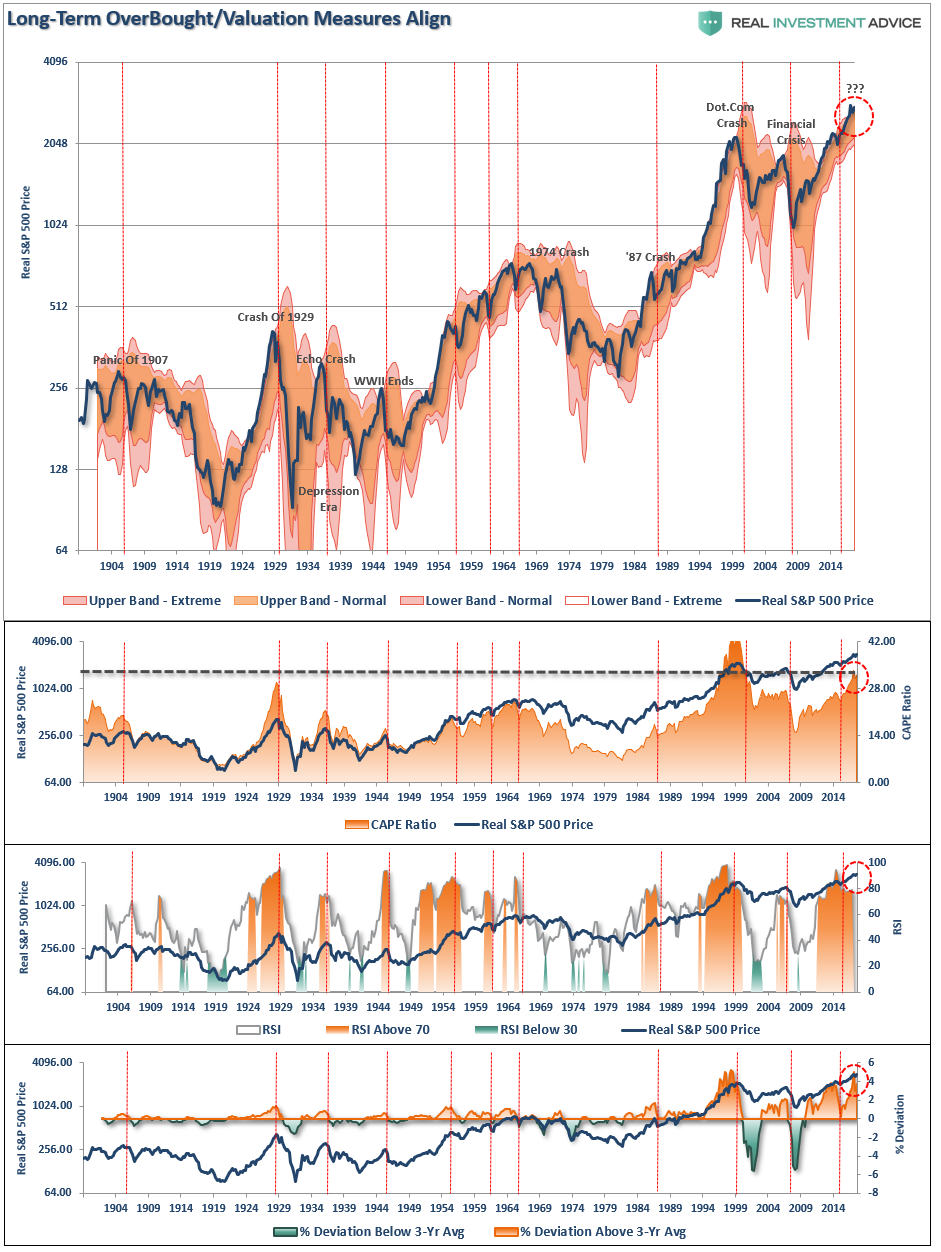

But therein lies the danger. Despite the bullish short-term optimism, longer-term conditions currently persist which have led to extraordinarily sharp market reversions in the past.

Regardless, the market is currently ignoring such realities as the belief “this time is different” has become overwhelming pervasive. Importantly, such levels of exuberance have NEVER been resolved by a market that moved sideways.

Importantly, traders are once again piling into the same trades on several fronts which we can see by viewing the “Commitment of Traders” report data.

As Bob Farrell’s Rule #9 states:

“When all experts and forecasts agree – something else is going to happen.”

Positioning Review

The COT (Commitment Of Traders) data, which is exceptionally important, is the sole source of the actual holdings of the three key commodity-trading groups, namely:

Leave A Comment