In last week’s update, I discussed the question of whether the recent rise in the markets was actually being driven by the underlying improvement in the fundamentals. To wit:

“The chart below expands that analysis to include four measures combined: Economic growth, Top-line Sales Growth, Reported Earnings, and Corporate Profits After Tax. While quarterly data is not yet available for the 3rd quarter, officially, what is shown is the market has grown substantially faster than all other measures. Since 2014, the economy has only grown by a little less than 9%, top-line revenues by just 3% along with corporate profits after tax, and reported earnings by just 2%. All of that while asset prices have grown by 29% through Q2.”

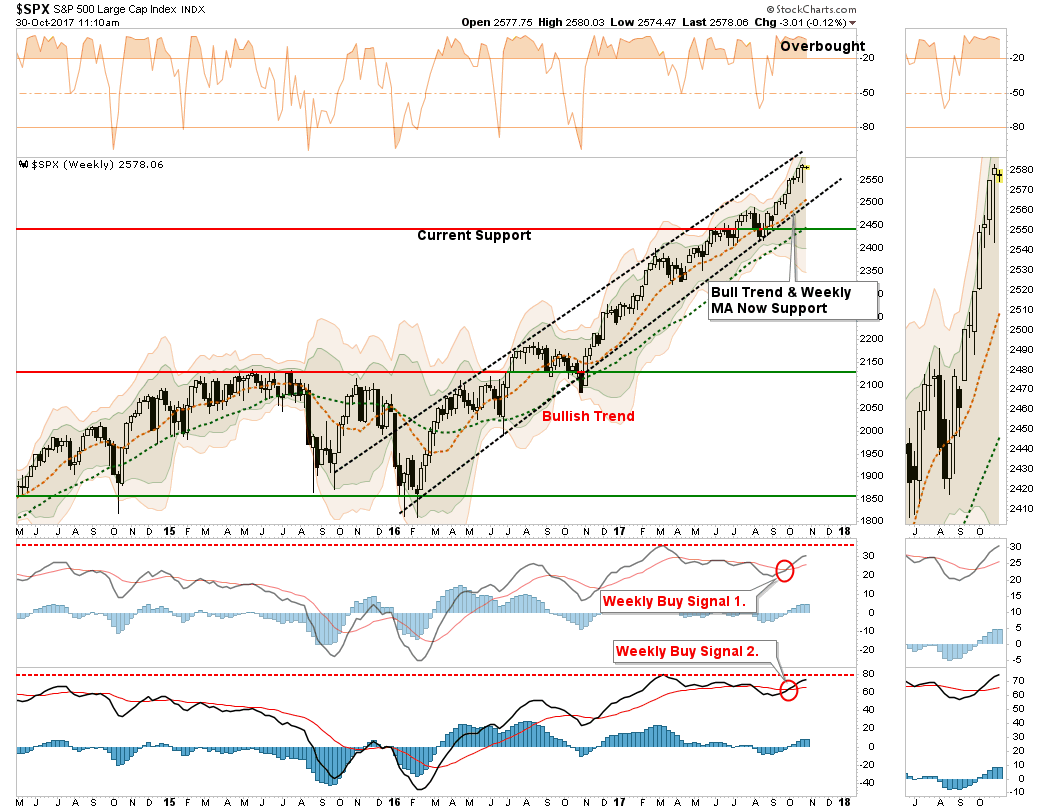

As I have been repeatedly stating in each weekend’s missive, despite my reservations and caution regarding the surge in prices, portfolios remain allocated to equity risk currently. As shown below, the trend of the market is clearly bullish and “fighting the trend” has always been a losing battle.

With the market currently on WEEKLY buy signals, both short and intermediate term, the trend and momentum are clearly in favor of the bulls. However, (and you knew this was coming) with the market pushing large deviations from both the trend and running support levels, a correction of 3-5% is not out of the offing. This suggests that increasing equity risk at these levels is outweighed by the risk of a corrective action.

Patience will likely be rewarded.

There are two other concerns currently worrying me at the moment as well. The first is the outrageous level of complacency in the markets as denoted by the extremely lopsided trade in volatility options. While the net-short positioning was reduced a bit last week, it is still the largest net-short positioning in history. The concern, of course, is not the positioning, but the “fuel” it eventually provides to a “sell off” when the unwinding of those speculative shorts occurs.

The second is the deterioration in the participation rate of the market, as I pointed out this past weekend.

“It is worth noting, that just as we saw during the run-up in the markets in 2014 and into 2015, the participation rate, as measured by the number of stocks trading above their respective 50 and 200 day moving averages, were declining which signaled a deterioration in participation. That deterioration eventually led to the decline in late 2015 and early 2016.

Currently, even as the market has made a seemingly unstoppable advance this year, the breadth of the advance has once again narrowed markedly.”

Leave A Comment