Back in April, I penned an article laying out 10-reasons why from a fundamental and technical perspective the bull market may have ended. To wit:

“I think the 9-year old bull market may have ended in February. I could be wrong. Actually, I hope that I am because managing money is far easier when markets are rising.”

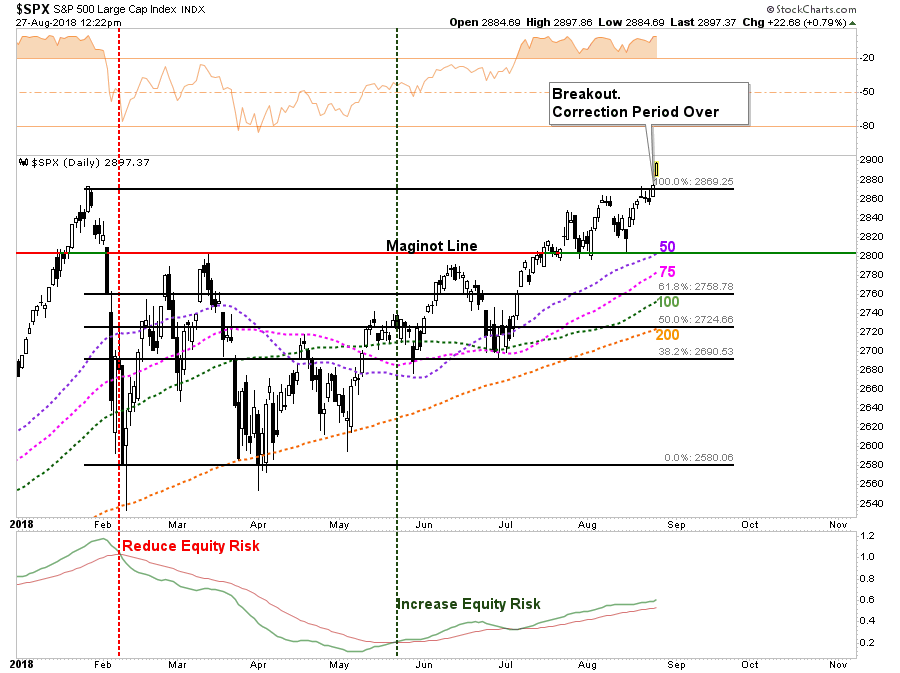

Fortunately, after 145 days of making up lost ground, the bull market has resumed.

While this is good news, the reasons for my previous concern still exist, along with others, which I reiterated in this past weekend’s newsletter:

“While the market was temporarily distracted by ‘Jerome Powell’ on Friday, and now NAFTA, in the rush to push the S&P 500 to ‘all-time highs’ (insert roar of crowd), earnings season is coming to its conclusion and all eyes will refocus back on trade, tariffs, and geopolitical risks. Here is my list of concerns from last week:

- Technical deviations

- Emerging market debt and economic stabilities

- U.S. dollar strength

- Oil prices (below $60)

- Interest rates (Fed)

- Economic strength

- Earnings

- Leverage (Margin)

As I stated then, the issue isn’t any one of them in particular – but the linkages between all of them which is important to watch.

We can now add to that list:

- Geopolitical Risk (China, Russia & North Korea)

- Tariffs

- Trade

- The Fed

Again, it is never just ‘one thing’ that causes a reversion. Rather, it is the ‘one thing’ that triggers the cascade of dominoes to fall.

Unfortunately, we generally never know what the ‘one thing’ is until after the fact. This is why having a plan to manage risk, a discipline to act, and a process to follow which is critically important to long-term investing success.”

3000 Or Bust!

Regardless of the reasons, the breakout Friday, with the follow through on Monday, is indeed bullish. As we stated repeatedly going back to April, each time the market broke through levels of overhead resistance we increased equity exposure in our portfolios. The breakout above the January highs now puts 3000 squarely into focus for traders.

This idea of a push to 3000 is also confirmed by the recent “buy signal” triggered in June where we begin increasing equity exposure and removing all hedges from portfolios. The yellow shaded area is from the beginning of the daily “buy signal” to the next “sell signal.”

Leave A Comment