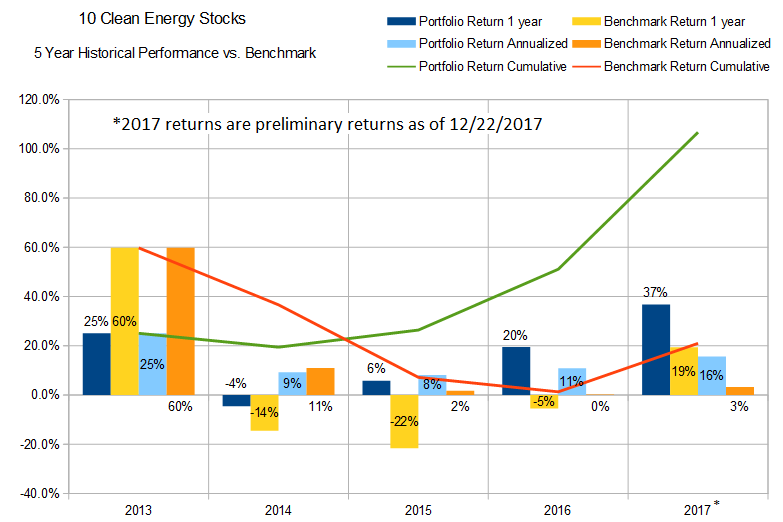

Annual total return for 10 Clean Energy Stocks model portfolio compared to benchmark through 12/222017.

2017 is turning into a second banner year in a row for my “Ten Clean Energy Stocks” model portfolio. I expected at best to make high single-digit returns after the impressive 20% (while my benchmark fell 4%). Instead, the portfolio produced a 36.8% total return while its benchmark is up 19.5% with only four trading days left in the year.

Such returns are obviously cause for celebration, and also for profit taking. I plan to replace at least five of this year’s list with new stocks in the 2018 (tenth annual) “Clean Energy Stocks” model portfolio.

Two companies on the cusp are software-as-a-service vehicle and fleet management provider MiX Telematics Limited (MIXT) and energy-from-waste (EfW) operator and developer Covanta Holding Corp. (NYSE: CVA).

I’m tempted to keep both of these stocks because they seem to be entering phases of long-term growth. With MiX, the growth is the result of the company’s long-term strategy of diversifying into new markets and emphasizing its bundled subscription offerings, which are finally taking off. The stock has taken off as well, more than doubling since the start of the year.

Covanta has long been a low growth, high dividend company because of the high capital costs of developing new EfW plants. However, Covanta recently announced a new partnership with the Macquarie-owned Green Infrastructure Group which should allow Covanta to fund its next four projects in the UK without any new equity capital. In the week since the deal was announced, the stock has jumped 20%.

While I’m still bullish about both these companies for the long term, if their stock prices continue to climb rapidly in the next week, the potential for further gains over the next year will be reduced. Since I build this list based on my estimate of expected return over the following year, I may decide to drop either from the list despite their longer term potential.

Leave A Comment