Eight years after the beginning of “Bull & Fed’s Excellent Adventure”, BofA’s Michael Hartnett is starting to have his doubts.

The bull market catalyst – extraordinary, unprecedented central bank policies – is fading globally and the so-called “Humpty-Dumpty’ Trade looms:

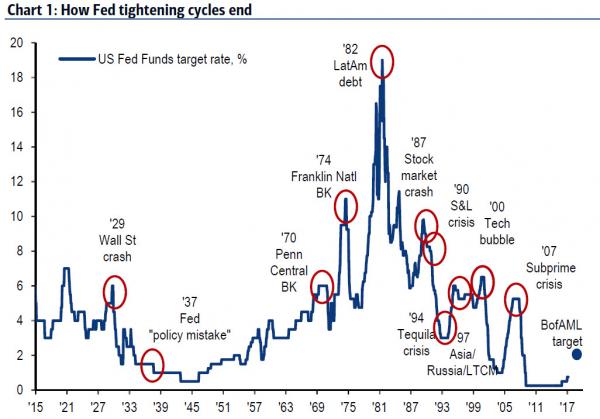

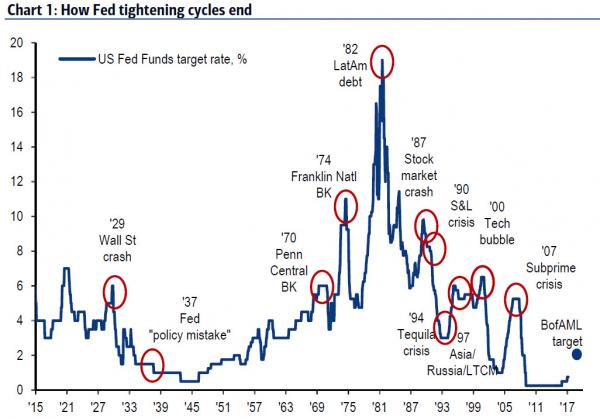

The Fed has hiked 2 times in past 10 years; March 15th will be the 2nd hike in 3 months and they will continue tightening until “event”.

This is the “great fall” in risk assets catalyst = hawkish Fed & weaker EPS in H2 – BofAML suggests buying long-dated SPX puts (June FOMC/ECB = volatility); accumulate gold; avoid “ZIRP winners”…CRE, HY, EM debt, NZ$.

But Hartnett suggests there are still opportunities among the “Biggest Picture” trades.

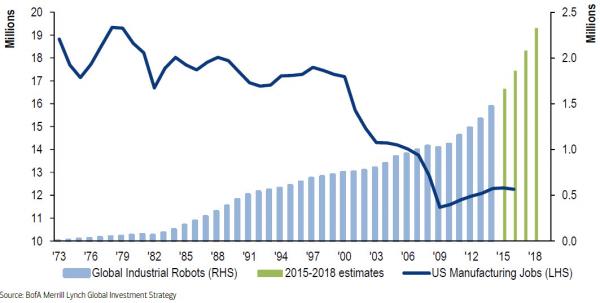

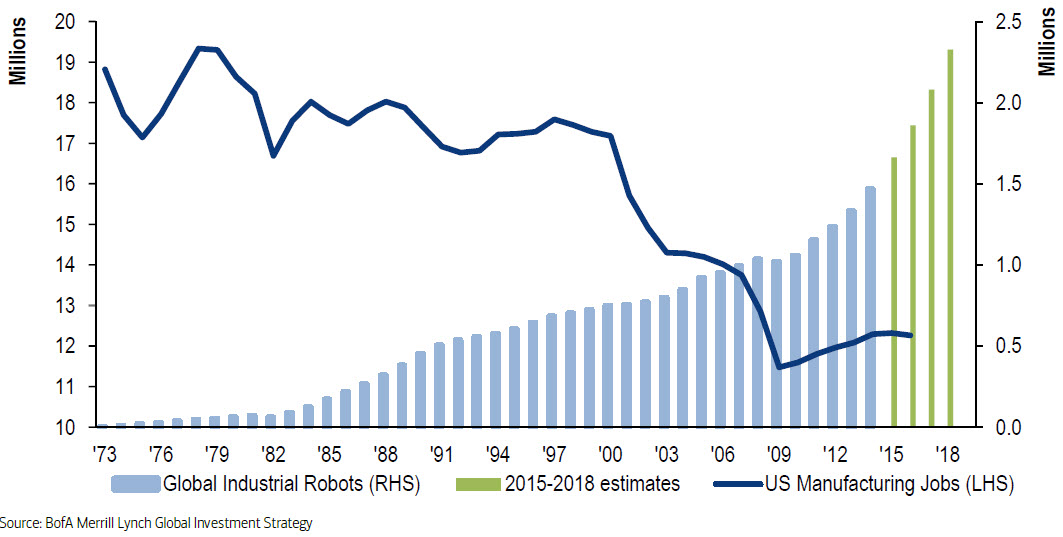

1. Long Robots, Short Humans

“You can’t build a wall to keep the robots out”

- Number of global robots by 2020 = 2.5 million; in 2010 was 1 million

- Until we “tax the robots” (which we are likely to end up doing) Disruption, Demographics, Debt likely caps rise in inflation & interest rates

- The “deflationary D’s” won’t prevent cyclical rise in inflation; but are likely to prevent a secular rise in inflation

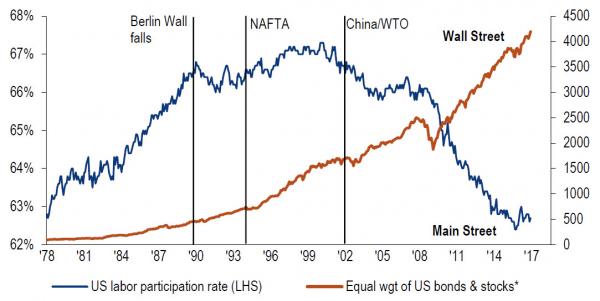

2. Long Main Street, Short Wall Street

Economic nationalism is back.

- Electorates are voting for trade & immigration policies to boost wages on Main Street, not for central banks to support stock & bond prices on Wall Street

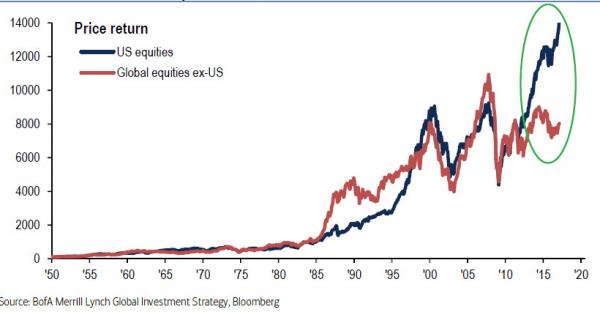

3. Long Global, Short US Stocks

A multipolar world looms.

- US equities @ all-time highs; global equities 27% below all-time peak in 2007

- US equities trade on 3.0X book; non-US equities trade on 1.3X book

- Japan & Europe to outperform US stocks

Leave A Comment