(Photo Credit: randychiu)

Tesla (TSLA) has quickly become a cult favorite come earnings season, with investors waiting with bated breath to hear from CEO Elon Musk.

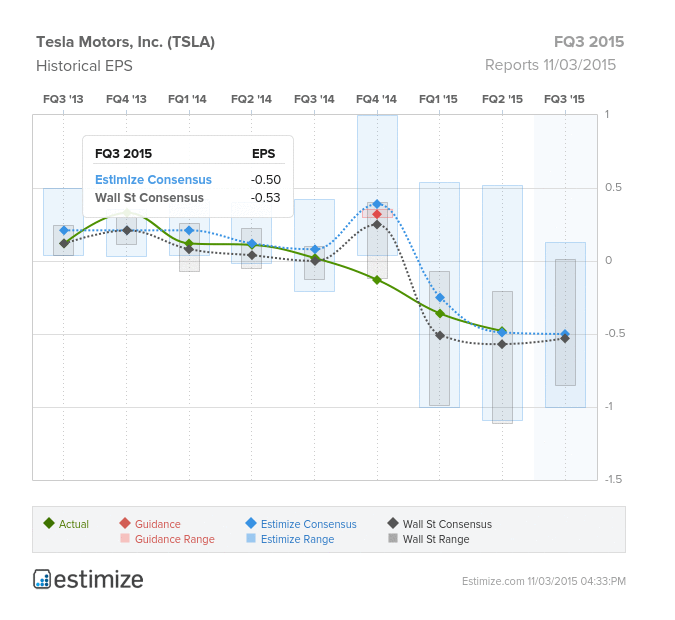

Despite heading into its fourth straight quarter without being profitable, Estimize is expecting EPS to be less negative than the Street is anticipating. Currently the Estimize community is calling for EPS of -$0.50, 3 cents higher than Wall Street. Revenue estimates are also slightly higher at $1.231B vs. Wall Street at $1.214B. After missing on the bottom-line in Q1 and only meeting top-line expectations, Q2 numbers were a touch better, with a beat on both. While revenues have been growing at an impressive clip for the past 8+ quarters, EPS growth has been negative for the last 5, and is expected to be so again in Q3, with sales anticipating growth of 33%.

Tesla’s stock took a big hit last quarter after the company lowered the number of vehicles it plans to deliver in 2015 to 50,000-55,000 from 55,000. However, the company’s popular Model S became the best-selling electric car in the U.S. during the quarter, with the newer Model S 70 retailing for $70k, $30k less than the earlier version. Investors will not only be looking for updates on the Model S but for progress on new vehicle launches, particularly the Model X. The company has poured a lot of money into its first full size SUV, and reported last quarter that those costs would increase 5 – 10% in Q4. Launching just a little over a month ago, investors will want to see that sales of the Model X are offsetting the costs to produce it. Lastly, the Model 3 will be Tesla’s most cost effective model yet, starting at $35k. The company said they will start taking orders in March; we’ll be looking to see if they can stick to that timeline.

Beyond its vehicles, Tesla will need to provide an update on its battery segment. The company has been hard at work assembling its gigafactory outside of Reno, Nevada which should produce cheaper batteries, set to be fully operational in 2016. Investors and analysts alike have been speculating about future destinations for gigafactories, with India seen as a possibility. Tesla has been seeking new battery making partners, such as LG Electronics affiliate, LG Chem out of South Korea with which it recently signed a contract. The collaboration will help with upgrades to the company’s first vehicle, the Tesla Roadster, which has since been discontinued. The state of Powerpack and Powerwall, the company’s stationary batteries, is also expected to be addressed.

Leave A Comment