Income investors rely on utility stocks for steady dividends. Utilities have earned a strong reputation among income investors, and for good reason.

Utilities are widely recognized for their ability to generate steady profits each year, regardless of the economic climate. With their reliable earnings, they consistently pay dividends each year.

Many utility stocks have paid uninterrupted dividends for several decades on end, with annual dividend increases along the way.

There are many utility stocks on the list of Dividend Achievers, which have raised their dividends for 10+ consecutive years.

The other attractive aspect of utility stocks is that their high dividend yields.

Utilities can keep paying dividends so consistently, because their business models are heavily regulated, and are a necessity to modern society. And, utility stocks extremely resistant to recessions. Everyone needs to keep the lights on, even when the economy enters a downturn.

Add it all up, and it is abundantly clear why income investors favor utility stocks.

This article will discuss the 5 top utility stocks today—in no particular order—based on their fundamentals, valuations, and dividends.

Utility Stock #5: Brookfield Renewable Partners (BEP)

Dividend Yield: 6.2%

Price-to-Earnings Ratio: 23.4

Leading off is Brookfield Renewable Partners. It operates in the utility sector, but it is much different than most other utilities.

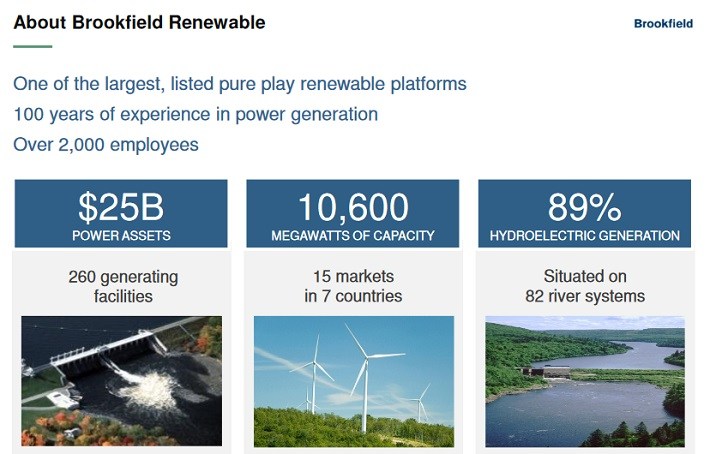

While most utilities derive electricity from coal and natural gas, Brookfield has a portfolio of renewable energy assets. Nearly 90% of its generation comes from hydroelectric power, with the remainder from wind energy.

Source: Q1 Earnings Presentation, page 6

Approximately two-thirds of the company’s generation is based in the U.S., but it also has a significant international presence:

Brookfield is a unique stock. Not just because of its business model, but also because of its unusually high dividend yield.

While most utility stocks yield 3%-5% right now, Brookfield has a yield exceeding 6%.

It is one of 405 stocks with a 5%+ dividend yield.

Another differentiator for Brookfield, is that it operates as a Master Limited Partnership, or MLP.

MLPs are a unique asset class with a tax advantaged structure, which helps them pay such high dividend yields.

Brookfield is seeing growth rates above that of most traditional utilities, thanks to the renewable energy boom. Revenue increased by more than 50% last year.

Brookfield’s adjusted FFO (Funds From Operation, a non-GAAP financial measure similar to earnings-per-share) increased 8% in 2016, to $1.83.

Brookfield uses FFO to determine its dividend rate. It declared distributions of $1.78 per share in 2016, which means the dividend was sufficiently covered.

For the first quarter of 2017, Brookfield’s generation increased 4.5% from the same quarter last year. Adjusted FFO-per-unit increased 10% year over year.

Going forward, Brookfield has a promising growth outlook, thanks to rising demand for renewable energy.

Source: 2016 Investor Meeting Presentation, page 7

Brookfield intends to pursue growth in these areas, through organic investment, as well as with acquisitions.

For example, in its Brazil operations, Brookfield commissioned a 25-megawatt hydro facility last quarter, which is expected to add $20 million in annual FFO moving forward.

It has additional projects set for 2019 and 2020, which are expected to add another $25 million-$30 million in annual FFO.

The company has also made significant acquisitions over the past several years, including the purchase of a 51% interest in TerraForm Power (TERP), which added approximately 3,600 megawatts of capacity to Brookfield’s portfolio.

Continued growth will allow Brookfield to continue raising its dividend. Management maintains a forecast of 5%-9% distribution growth per year, moving forward.

Brookfield has a modest capital structure, which helps support the dividend payout. The company has a manageable debt-to-capitalization ratio of 38%. It has an average debt maturity of 7.1 years, at a reasonable interest rate of 4.5%.

Assuming its growth projects are completed on schedule, the company should be able to pay its debts, and have enough cash flow left over to raise the dividend as planned.

Brookfield stock carries a slightly above-average valuation compared with the broader utility sector. However, the company justifies its premium valuation, with its growth potential and high dividend yield.

If Brookfield’s growth remains on track, the stock could be very appealing for income investors, because of its rare combination of high yield and high dividend growth.

Utility Stock #4: American Electric Power (AEP)

Dividend Yield: 3.5%

Price-to-Earnings Ratio: 17

American Electric Power is another giant in the utility sector. It is one of the largest electric utilities in the U.S., with over 5 million customers across 11 states.

Its assets consist of more than 40,000 miles of electricity transmission, the largest such network in the country. It also possesses approximately 26,000 megawatts of generating capacity.

Leave A Comment