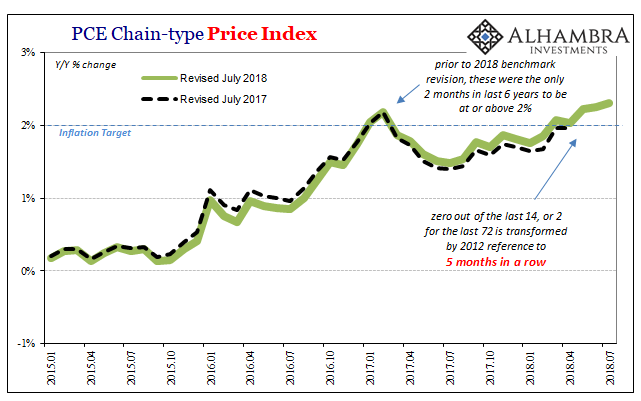

The PCE Deflator rose 2.31% year-over-year in July 2018, according to the Bureau of Economic Analysis. That makes five in a row for Jay Powell to try to make his case. Prior to March, the central bank had missed its target for the PCE Deflator in 68 out of 70 months using the 2012 dollar reference. Has something changed?

Yes and no. The “yes” is convenient enough for central bankers like Chairman Powell (or BoC Governor Stephen Poloz), but it isn’t actually what they want to see. They’ll take it, of course, since it beats constant questions about undershooting from even the compliant media. These are oil-driven numbers, however. There isn’t to this point any indication beyond WTI (and US crude exports) that inflation is going to stick around here.

In that respect, central bankers have to be concerned about the 2011 case. There are echoes of all the prior episodes in 2018; there’s the economic ceiling of 2014, the EM deflation signal of 2013, and the oil contributions of 2011. The last in the list is also the last time US inflation (like Canadian inflation) was at these levels.

With oil surging after the (official) end of the Great “Recession”, beginning December 2009 inflation quickly reestablished its target. Many attributed the speed to the presumed dark side of QE, too much “money printing”. The deflator would only remain above 2% for six months before (eurodollar) retrenchment resumed.

Following QE2 and more “money printing”, crude prices would rise further and consumer price indices with them. Starting in March 2011, the PCE Deflator would stay above 2% for fourteen straight months until the middle of 2012 when the full weight of the 2011 eurodollar episode finally settled (in evidence; narrative remains a different story) the confusion over money printing.

The trick for central bankers is not getting there, though that was quite the lengthy period of undershooting in between, it is staying here. The self-imposed mandate is a consistent 2% inflation environment. Therefore, some consideration has to be given as to why it didn’t work last time, or what might be different this time around as compared to 2011 and 2012.

Leave A Comment