My Swing Trading Approach

I still think this market could easily roll over at this point. That has yet to happen, but price action of late raises a lot of concerns. If the bulls can breakout here today, I will close the short position and keep the current long positions running.

Indicators

Industries to Watch Today

Energy rallied well yesterday. All of your favored sectors of late, were the ones that struggled. Utilities, Real Estate and Defensive sectors were near the top. Not your usual market leaders.

My Market Sentiment

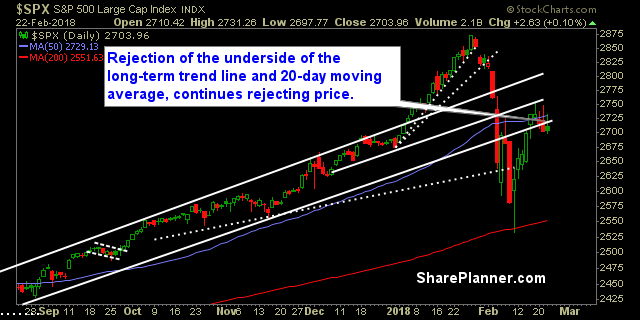

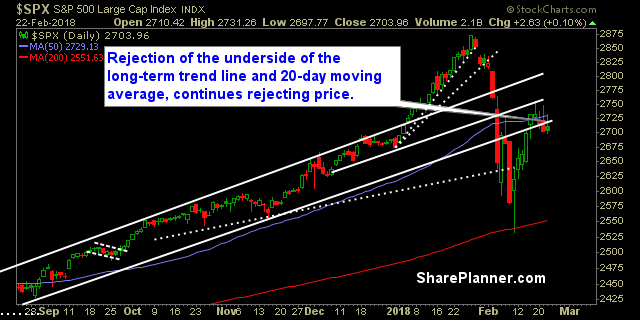

Fourth straight day of price being rejected at the 20-day moving average and third day of rejection at the 50-day moving average. The bears continue to sell the market off each afternoon. There is a good chance of a market roll over, if this bull flag pattern can’t be broken very soon.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment