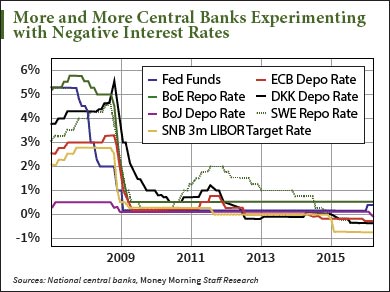

Negative interest rates used to be a thing of central banking fiction, but central banks across Europe have been experimenting with the risky monetary policy for over a year.

Now it looks like our Federal Reserve is considering negative interest rates, too.

At a testimony before Congress on Feb. 10, U.S. Federal Reserve Chairwoman Janet Yellen said there was nothing to prevent the United States from adopting negative-interest-rate policy (NIRP).

NIRP signals a lack of confidence in an economy to investors. When the Fed turns to negative interest rates, it will encourage investors to exit stocks and stockpile their cash.

That’s why Money Morning Resource Investing Specialist Peter Krauth has found the one perfect investment to protect your money against this disastrous monetary policy.

But first, let’s look at what negative interest rates are and how they’re affecting certain countries…

Negative interest rates charge banks for hoarding cash at central banks. The goal is to force banks to withdraw that excess money and lend it to their customers. People would then use that money to spend and stimulate a country’s economy. At least that’s how it’s supposed to be.

But when we look at three European countries that have been practicing NIRP, we see the monetary policy is having the opposite of its intended effect.

As bank interest rates in Sweden, Denmark, and Switzerland have approached zero (or below zero), people have actually increased their savings.

Given that the goal was to increase spending, it’s clear these policies have failed.

But that won’t stop the United States from replicating these countries’ mistakes.

Fed Vice Chairman Stanley Fischer recently said in a Bloomberg interview that NIRP was working in Europe “more than I expected.”

“I’m not sure just what indicator Fischer has used to reach his conclusion,” Krauth said in response, “but then again the Fed’s never let real data get in the way of a bad decision.”

Leave A Comment