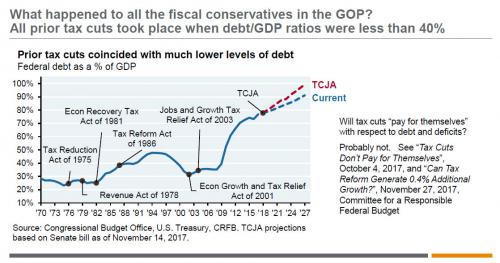

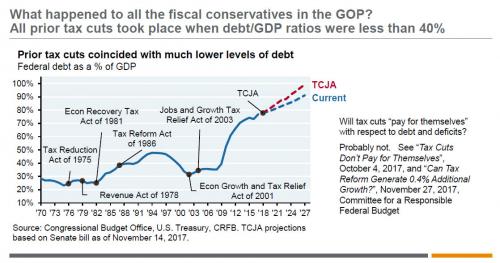

While the jury will be out for years whether the Trump tax cuts will boost the economy (they already had an outsized impact on markets, pushing the Dow by nearly 5,000 points higher since Trump’s election), there are several key problems that remain outstanding. The first one, as the following JPMorgan chart shows, is that all prior Republican tax cuts in US history took place when debt/GDP ratios were less than 40%. Now, the number is double that, and is expected to hit 100% in a few years, which means that absent some miracle, the only economic outcome will be much higher levels of debt. And with rates now rising, one can forget about economic miracles.

Looking at the chart above prompted JPM’s Michael Cembalest to ask, rightfully, “what happened to all the fiscal conservatives in the GOP?” What indeed.

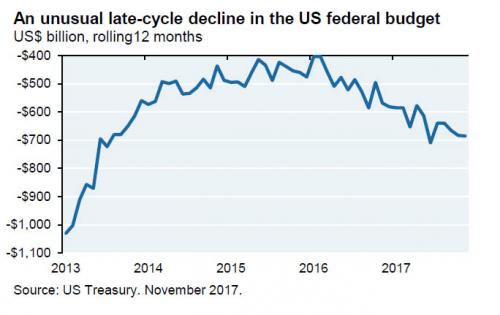

There is another problem with the tax cut: while typically at this late point in the business cycle, the US budget deficit is improving, this time around it is already growing again, having troughed two years ago. This, as JPM says, is unusual.

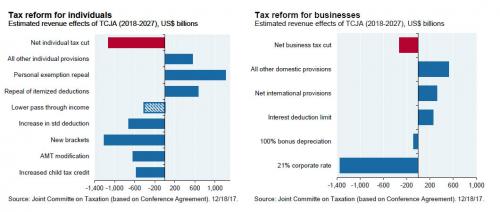

Macroeconomic considerations aside, the Tax Cuts and Jobs Act is, for all intents and purposes, very big. In fact, as a % of nominal GDP, it is one of the larget tax cuts since 1969, with the exception of 1981.

What is just as notable, is that while the TCJA was sprung from a desire to cut corporate taxes and improve competitiveness, the individual tax cuts are now 3x as large, or as JPM puts it “the tail wags the dog.”

Which brings us to what is the biggest problem with the Tax Cut and Jobs Act: the people it benefits the most. Here, the broad conesnsus is that TCJA tax cuts are primarily channeled to taxpayer with incomes between $100K and $500K, i.e., the upper middle class and self-employed Americans.

Leave A Comment