The CAC 40 continues to range, with the Index down -.35% on the day. The CAC 40 along with other European indices are relatively unchanged as markets await the release of the minutes from the U.S. Feds April FOMC meeting. With interest rates back in focus, traders are looking into last month’s meeting minutes to give insight into the possibility that rates may be hiked in the U.S when the Fed reconvenes for their next FOMC meeting on June 15.

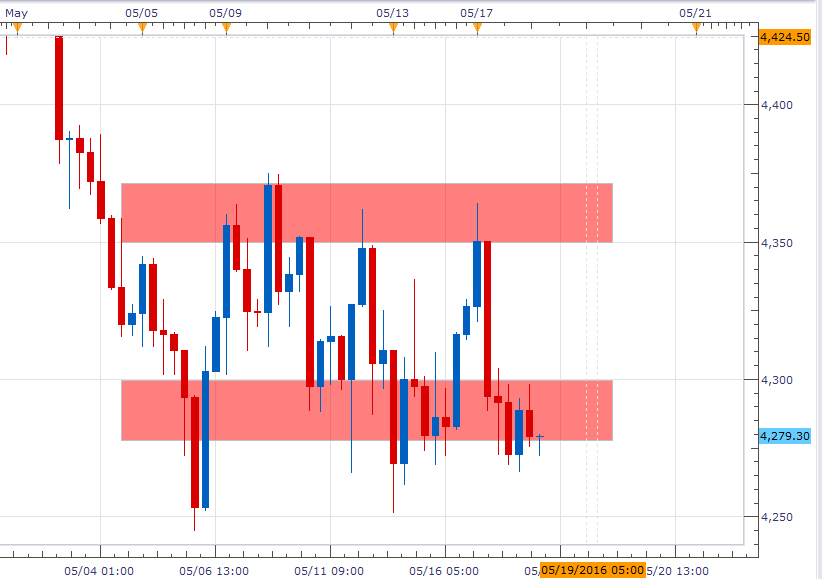

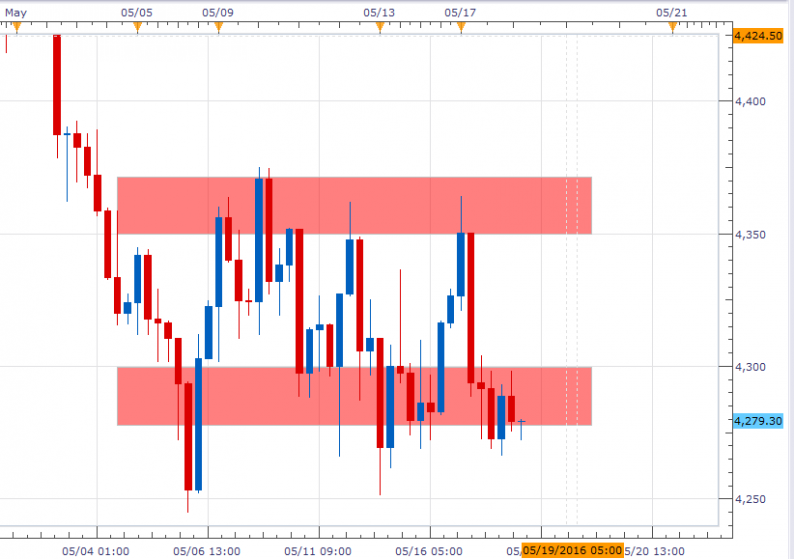

Traders watching price action should note that the CAC 40 is again testing a key value of support below 4,300. This Index has now been locked inside of a range for the last 10 trading days, and has so far traversed this range 6 times. If prices again bounce from support, traders should note that range resistance begins near 4,350. In any range bound environment, there is always the risk of a change in market conditions. If prices continue to decline and breakout below support, it may suggest the start of a new bear trend. This would open up the Index to test the standing May low at 4,244, followed by the April’s swing low located at 4,211.

Sentiment data for the CAC 40 (Ticker: FRA40) continues to move to fresh extremes as SSI (speculative sentiment index) has advanced to a reading of +3.14. With SSI reaching a positive extreme, it suggests the Index may be preparing for further declines. Alternatively, in the event of a bullish reversal, traders should look for SSI to flip back towards a negative extreme.

Leave A Comment