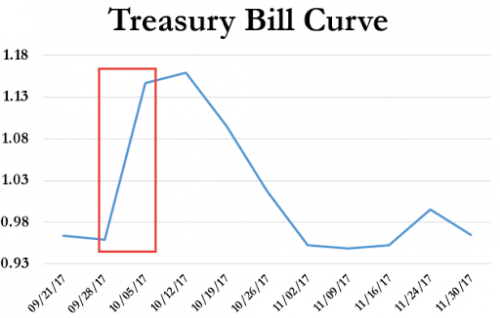

For all the breathless newsflow over the past 7 days, the single most consequential event of last week was the sudden jump in debt ceiling/government shutdown odds following Donald Trump’s confrontational Phoenix speech, which laid out a problematic dilemma: Trump’s Mexican wall, or a government shutdown. While various financial pundits rushed to discount the odds of a worst case scenario, the market – in Treasury bills, if not so much equities – was spooked, sending the “pre-post default bill” spread to the widest on record…

… as October 5/12 Bill yields continued to blow out after various politicians were quoted with doomsday predictions, some suggesting the odds of a spooked%.

The biggest concern as we head into the X-Date period of late September, early October is that the resolution of these problems, either the debt ceiling or the government shutdown, is not a simple linear decision tree, but is one where any momentary whim, or tweet, by Donald Trump can abort any compromise at a moment’s notice. Or, as Deutsche Bank puts it in a Friday report looking at the Debt Ceiling Dynamics, “thecurrent political backdrop is concerning” and as it adds, sarcastically, “a failure to raise the debt ceiling is a very bad outcome. And even a small probability of a very bad outcome is still a very bad outcome. Any kind of default would likely have far reaching negative ramifications for global financial markets and the US economy.”

Still, as discussed previously, while the T-Bill market is clearly paying attention, equities and VIX have yet to respond: as DB’s Dominic Konstam writes, “despite this tail risk and the apparent turbulence surrounding DC, markets remain comparatively unperturbed. Recent spikes in the VIX have proved short-lived although a little more elevated than before.” Still, there remains the risk of a sudden reaction as the deadline approaches if default risks become more tangible.

Leave A Comment