The data, according to many analysts, have been broadly supportive, with stronger growth and a tightening in the labor market that should allow the Fed to be “reasonably confident” that inflation will gradually return to target. That said, heightened global risks could lead to a tactical delay.Economisseds remain evenly split on the prospect of the first rate increase in 9 years.

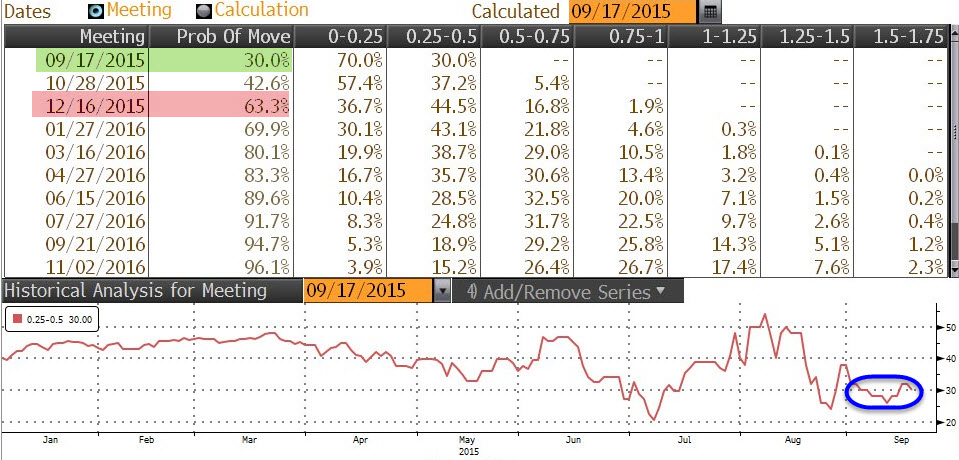

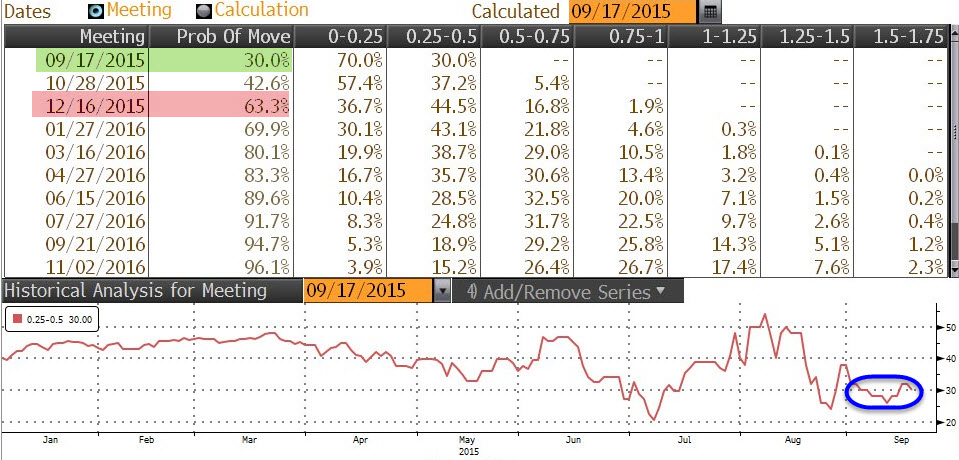

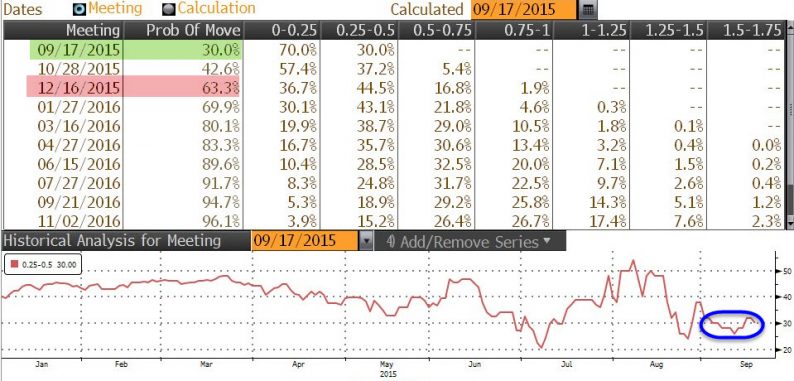

Fed fund futures price 30% odds of move this mo. and more than 50% chance in Dec.

Click on picture to enlarge

Barclays (Michael Gapen, Rob Martin, Blerina Uruci)

Fed to stay on hold for now, lift rates in March

FOMC should delay liftoff as it assesses downside risks to outlook

BMO (Aaron Kohli)

“Our core view remains that liftoff is a 2015 event”

Whether Fed hikes or not is less important than impact of their “net communication” on mkts; “real question” is whether communication eases or tightens conditions

BNP (economists)

FOMC to give dovish projections at this mtg, delay liftoff

Yellen to reiterate action later this yr

BoT-Mit (Chris Rupkey)

Fed should be “propelled into action” at this mtg

U.S. economy remains on track for Fed to raise rates

Brean (Russ Certo)

Fed may be ready for rate hike, not mkts

Credit Agricole (David Keeble)

Fed Sept. mtg is “very live,” yet may lead to delay in liftoff

Credit Suisse (research analysts)

FOMC won’t hike in Sept., may hint at Oct. or Dec.

Timing largely contingent on global conditions/financial mkt volatility

DB (Joseph LaVorgna, Brett Ryan, Aditya Bhave)

FOMC likely to say prudent course is “to do nothing,” favor waiting to see how economic/financial “landscape” evolve before Oct. mtg

FTN (Chris Low)

Fed will choose to raise rates now; officials will agree 25bps is no “big deal one way or the other”

Leave A Comment