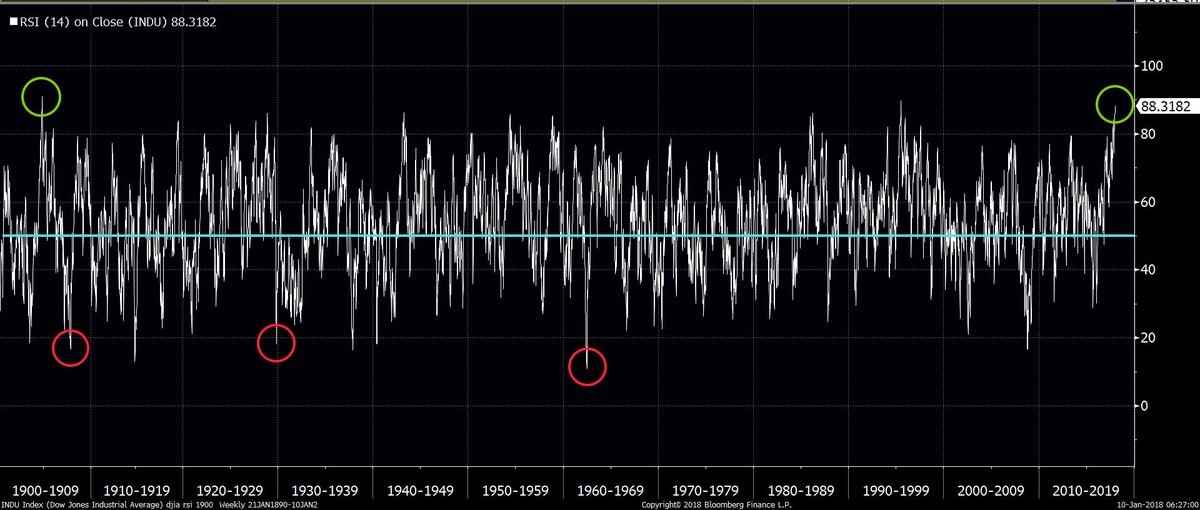

End Of The Streak- Stocks Still Overbought

The stock market finally ended its remarkable run to start the year, but stocks are still euphoric. This 0.11% sell-off in the S&P 500 only ends the streak; it doesn’t make stocks less overbought. As you can see from the chart below, the 14 day RSI on the Dow Jones Industrial Average was the highest since 1904. These types of indicators are tough to analyze because stocks being extremely overbought in the near term doesn’t mean much for returns in the next 6-12 months, but it seems like these records are being broken all at once especially since this is the longest string of positive monthly returns in the S&P 500 and next week it will become the longest streak without a 5% correction. When looking at these stats, if the metric isn’t at a new record, it’s surprising. Records falling is the norm as this is the Wayne Gretzky of bull markets.

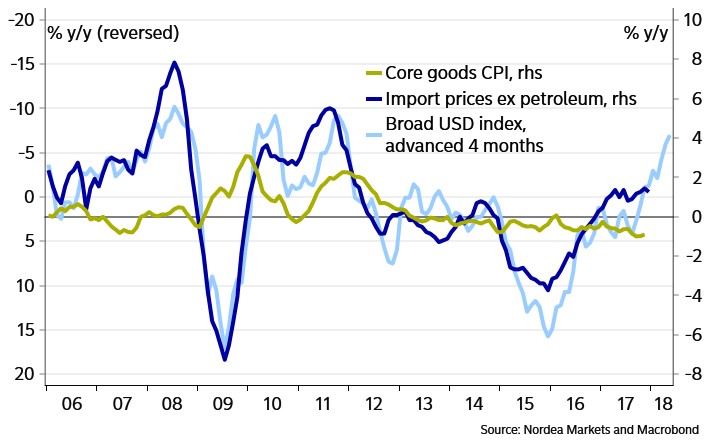

Inflation Looking Like It Might Increase

We’ve discussed that the inflation rate should increase in 2018. The 10 year break even inflation rate recently rose to 2.05%. As you can see from the chart below, the year over year core CPI has some correlation with the year over import prices and the dollar index. Import prices for consumer goods went from a source of deflation to one of inflation. The dollar index is advanced 4 months ahead showing its recent correction might mean the core CPI will increase. The December CPI report will be released on Friday. The expectation is for a 2.1% increase year over year which would be a decline from the 2.2% growth in November. The core CPI is expected to increase 1.7% year over year which would be flat with November. I am looking for it to beat expectations.

Commodity Pressures Usually Cause Problems

It’s funny to see investors keying off the Fed by complaining about low inflation. These low commodity prices have been the fuel for the rally in the past 2 years. The chart below shows the commodity prices compared with recessions. As you can see, when they spike, it’s bad news for the economy. This cycle is slightly different because some regions benefit from high oil prices because of the fracking boom in America. We might be seeing the benefits of balance economy because consumer spending was helped by the oil crash, but the energy sector was killed. Now energy firms are benefiting from higher oil prices which will start to hurt the consumer. If the labor market brings wage growth partially because of the improvement from the energy sector, the consumer will probably be able to handle the increases.

Leave A Comment