ECB’s Big Decision

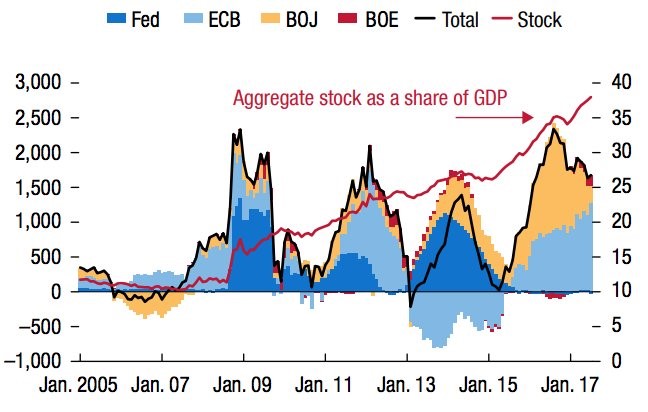

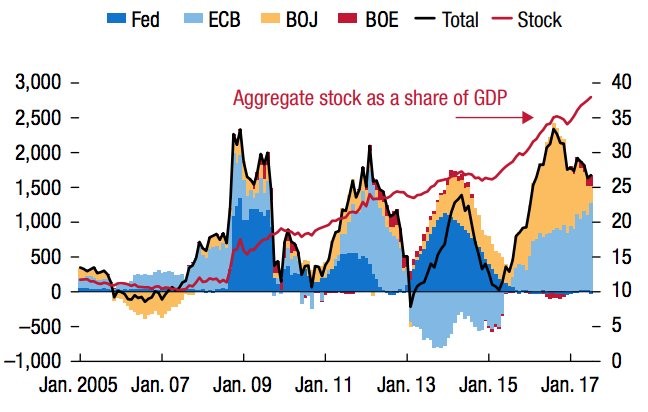

The chart below shows the aggregate assets the 4 major central banks from developed market economies have been acquiring over the past 12 years. As you can see, the asset buying has slowed and accelerated in the past few years, but the aggregate share of GDP has almost never stopped going up. The biggest purchases in the past two years have come from the JCB and the ECB. In this article we’ll look at the future policy the ECB will set on Thursday. We’re about to see the black line fall to the negatives for an elongated time. That would be the first real move lower for the aggregate stock as a share of GDP. The current move lower is still above the peak in 2014. The real effect on the markets will begin in the middle of 2018.

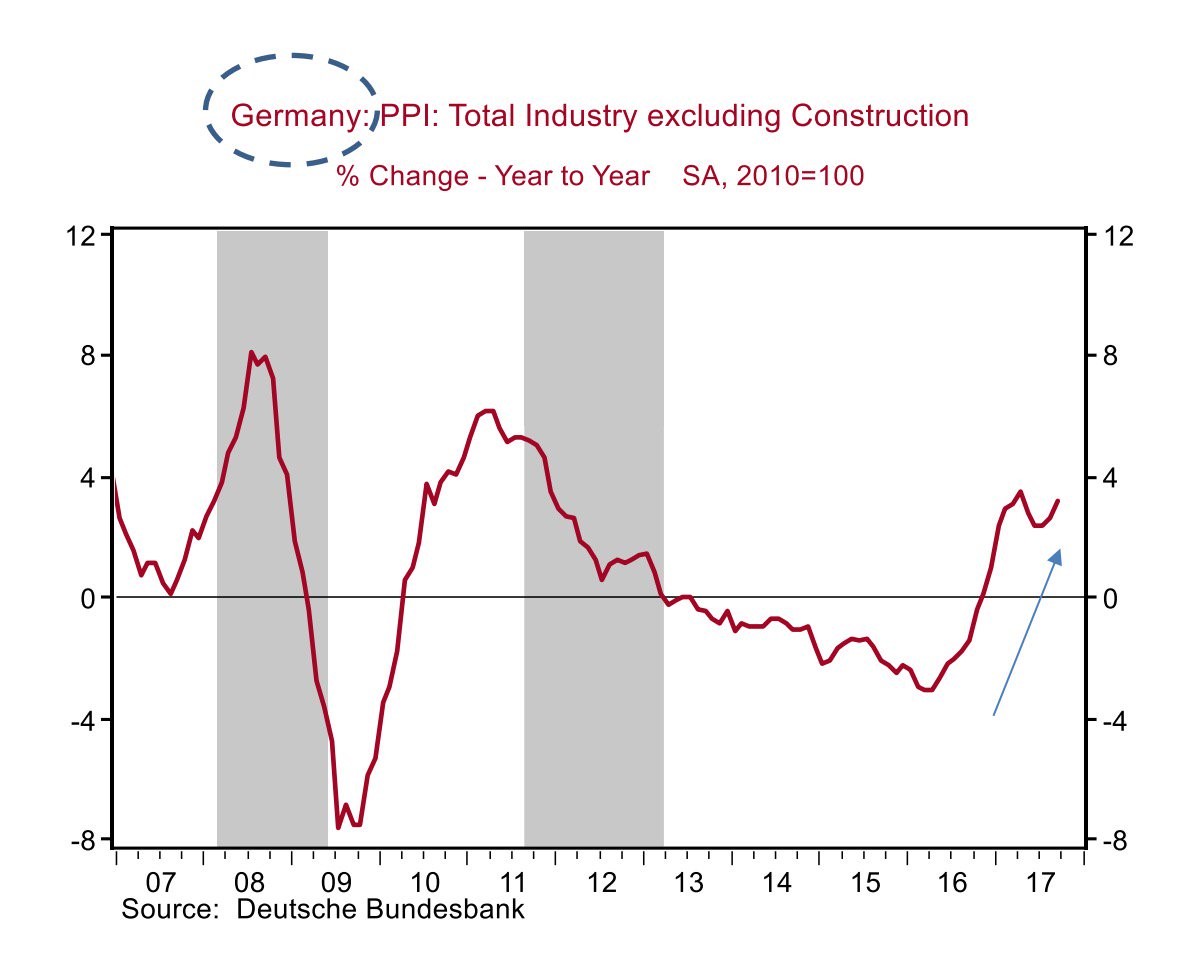

The biggest data point which effects what the ECB does with QE is inflation. As you can see from the chart below, the German PPI for all industries except construction has started to pick up in the last few months. Germany is thought to have the most power in the EU, but not with monetary policy. Germany’s inflation increasing is something the ECB considers when deciding policy, but it is just one country; it’s not more important than the others. Clearly the PPI and ECB’s balance sheet size are only tangentially related because the ECB’s balance sheet expanded at an accelerated clip from 2011 to 2013 while the PPI decelerated.

It’s not only Germany that’s signaling the time for the ECB’s QE might be up. As you can see from the chart below, the employment PMI and employment numbers in France are the strongest in this economic cycle and near the peak in 2007. The wage growth in France has been elusive much like the other developed countries, but on a quarter over quarter basis, wage growth increased 0.5% in Q1 2017 which is the fastest growth since Q1 2015. With this wage growth in France and the German PPI accelerating, I’d expect a sharp decline in QE in 2018. Personally, I think these improvements have more to do with the global growth acceleration which stems from the strength in emerging markets, but the policy makers will give QE all the credit and use this as a reason to say QE did its job. In the next recession, we may see QE implemented; I don’t have faith that it will be able to turn the European economy around. If policymakers were able to fix all the problems with the EU economy by using QE, there wouldn’t have been such a sharp slowdown in 2012 when the Grexit crisis was in focus.

Leave A Comment