Debt Curse

NEW YORK – “Not a bad view. That’s the mayor’s house right beneath us.”

We were on the 16th floor of a new apartment building, looking out over the East River. With us was President Reagan’s former budget advisor and Wall Street veteran David Stockman – a man who has been closer to the Bubble Epoch than almost anyone.

The Dow rose 183 points on Wednesday – or just over 1% – after starting the day in the red.

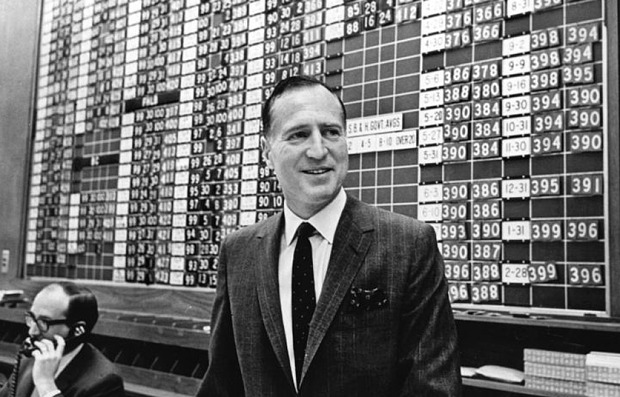

William Salomon in Salomon Bros. & Hutzler’s trading room in 1965. Salomon Bros. sold the first ever mortgage-backed bond on Wall Street in the 1980s

Photo credit: Arthur Brower / The New York Times

“I was there at the creation,” said David.

“After leaving government, I went to Salomon Brothers in the late 1980s. We were just starting to put together packages of mortgage-backed debt.”

Bubble finance has taken many shapes and sizes. Mortgage-backed derivatives. Private equity. Junk bonds. Student debt. Subprime auto loans. Stock buybacks. This debt was a curse to most Americans. But it blessed Manhattan.

The weekend’s Financial Times included real estate listings from New York City. There was a penthouse apartment for sale on the Upper East Side for $60 million. Luxury digs on the West Side were going for $30 million… another for $16 million.

You don’t make that kind of money parking cars… or making them. So, if you want to buy one of these places, you almost have to work in finance. Most people have no idea how the financial world works. They think investments go up or down and you make money depending on your luck or your skill – just like any other game. They don’t know the game is rigged.

Central banks make credit available to the big banks at preferential rates. The banks then earn a fat “spread” by making loans to government, industry, and households. They make money lending… and then, they make money again by packaging and selling the debt to investors, pension funds, and insurance companies.

Leave A Comment