And now back to your regularly scheduled recession predictions.

Last month, the 5s30s was on everyone’s radar screen when it dropped below 91.6bp for the first time since December 2007. A couple of fleeting steepening episodes notwithstanding, things haven’t really changed since.

Well now, with the Fed looking hell-bent on sticking to their near-term rate path irrespective of lackluster inflation, good ol’ Lacy Hunt (whose opinion on this is definitely not colored by his long-held outlook on yields) wants you to know that this experiment in normalizing the balance sheet isn’t likely to work.

“I’m very doubtful that they’ll be able to unwind the balance sheet to the extent they say they will,” Hunt told Bloomberg, in a new interview, adding that while “the long bond is notoriously volatile, what will determine the long-bond yield is inflationary expectations.”

As the Fed unwinds the balance sheet, they’ll end up curbing credit growth thus dampening inflation even further, Hunt contends.

Hunt’s conclusion: they’ll have to stop it with the balance sheet runoff within 5 short months.

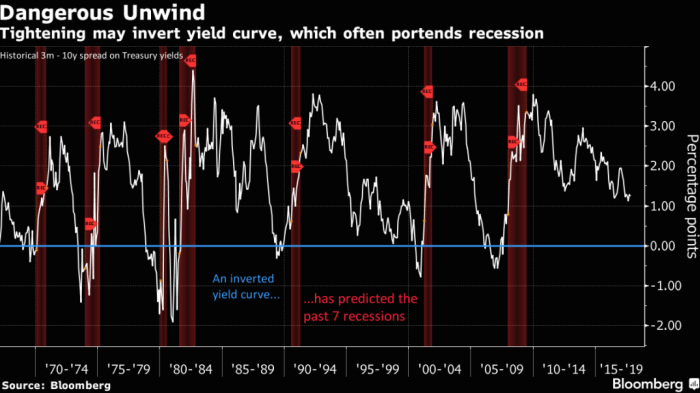

What happens if they don’t, you ask? Well, according to Lacy, an inversion from 3 months out to 10 years, an event which is batting 1.000 when it comes to predicting the last 7 recessions:

Draw your own conclusions.

Leave A Comment