When it comes to the Fed’s upcoming rate hike, only one simple shorthand matters: higher rates means less liquidity, and vice versa.

What does that mean for inflation/deflation and bond yields? According to the following simple and understandable analysis by Deutsche Bank, nothing good.

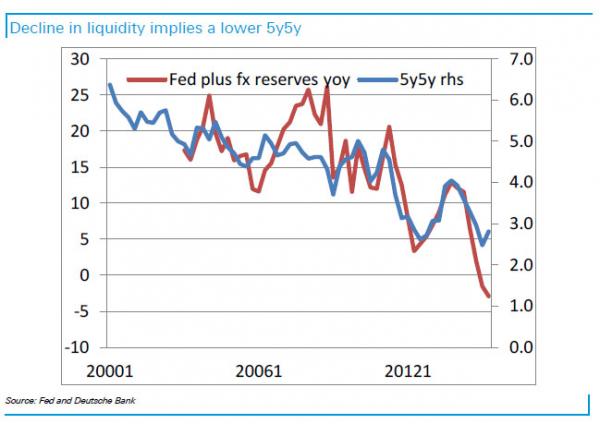

Here is the TL/DR version: “5y5y is well correlated with changes in global liquidity and based on recent trends should be closer to 2 percent.”

Here is the extended explanation:

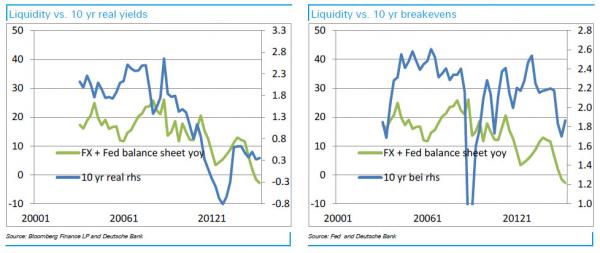

Breaking down the breakeven and real yield components verifies that central bank liquidity has been more associated with real yields then breakevens, however the relationship is perverse! Real yields have tended to fall when balance sheet expansion is slowing while breakevens have generally been more sticky. This suggests that risk assets drive (real) yields and that breakevens anticipate a (delayed) liquidity injection.

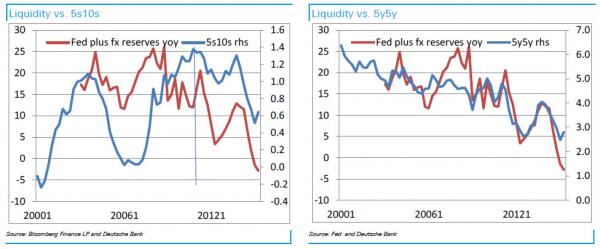

This is corroborated by also considering the curve. Like real yields 5s10s is well correlated (positively) with real yields. Note that prior to the crisis the relationship looked more “normal” in that expanding liquidity drive yields lower and vice versa. So something has changed since the crisis—this we think is very important and again, will revisit below.

The relationship between 5s10s and 10s in real terms screams 5y5y! And indeed we overlay 5y5y to liquidity there is a very tight, almost scary, relationship. The relationship even predates the crisis. Tighter liquidity essentially forces the 5y5y nominal rate lower reflecting some combination of a flatter curve and higher yields with a steeper curve and lower yields. Fundamentally we think this ultimately speaks to a lower terminal policy rate so that it doesn’t really matter whether the term structure is trying to shift higher or lower but the curve will more than compensate so that if the trend is towards less central bank liquidity, the terminal rate is falling.

Right now the decline is central bank liquidity suggest 5y5y should be closer to 2 percent or below not 3 percent to above. And this is before the Fed has tightened and China has potentially “finished” its adjustment.

And of course the breakdown in 5y5y between real and inflation reinforces the story that it is the real rate not inflation expectations that drive this result. And this is again consistent with the risk asset concern that it is the lack of liquidity that undermines risk assets that in turn drives real yields lower, despite keeping breakevens relatively inflated. One conclusion is that if investors believe that liquidity is likely to continue to fall one should not sell real yields but buy them and be more worried about risk assets than anything else. This flies in the face of recent concerns that China’s potential liquidation of Treasuries for FX intervention is a Treasury negative and should drive real yields higher. It is possible that if risk assets do very well then maybe the correlation with interest rates is broken. But like all these relationships for us, it is easier to work with the correlations that currently persist rather than to predict random breaks. And the potential breaks should be more cheaply hedged rather than making for a core portfolio allocation. I.e. cheap SPX calls based on rates lower. More generally the simple point is that falling reserves should be the least of worries for rates – as they have so far proven to be since late 2014 and instead, rates need to focus more on risk assets.

Leave A Comment