Back in June, this website first “solved” the “mystery” behind America’s missing inflation, when we showed that a record number of US renters are unable to afford housing, suggesting that record amounts of “disposable income” were being diverted for use as a shelter “tax” instead of being spent on true discretionary goods and services, leading (together with the Obamacare tax) to the broad and distressing decline in not only traditional retail sales and moribund consumer spending, and the “secular” economic slowdown observed over the past several years.

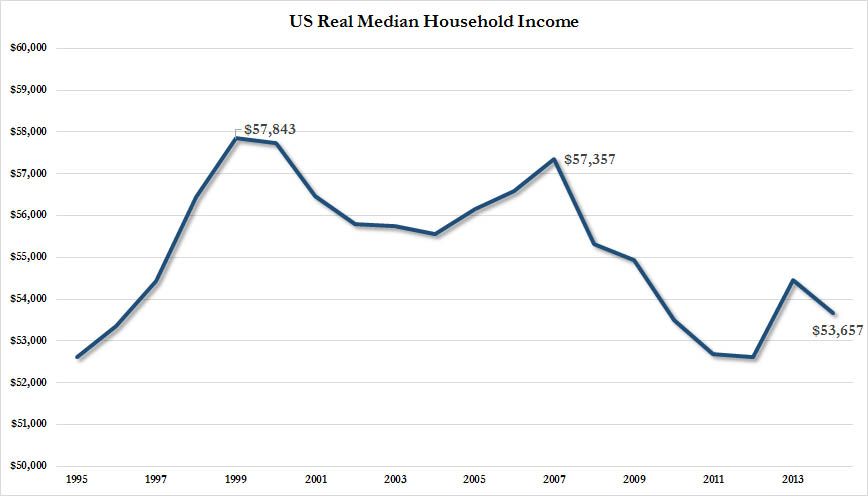

We followed this in September with another expose titled” in September with another expose ” explaining why the Fed is about to make a historic mistake and unleash an even more acute housing crisis if it hikes into an economy where the only core inflationary “impulse” if that from rent inflation, at a time when median real household incomes have tumbled to levels last seen in 1989.

As we explained in July, one major problem is that the Fed’s measures of inflation are wrong, if not with malicious intent, then purely due to definitional purposes. But a bigger problem for the the Fed’s measures of how the overall economy is doing (and/or overheating) is that the Fed telling the vast majority of Americans that inflation is negligible, leads to riotous laughter.

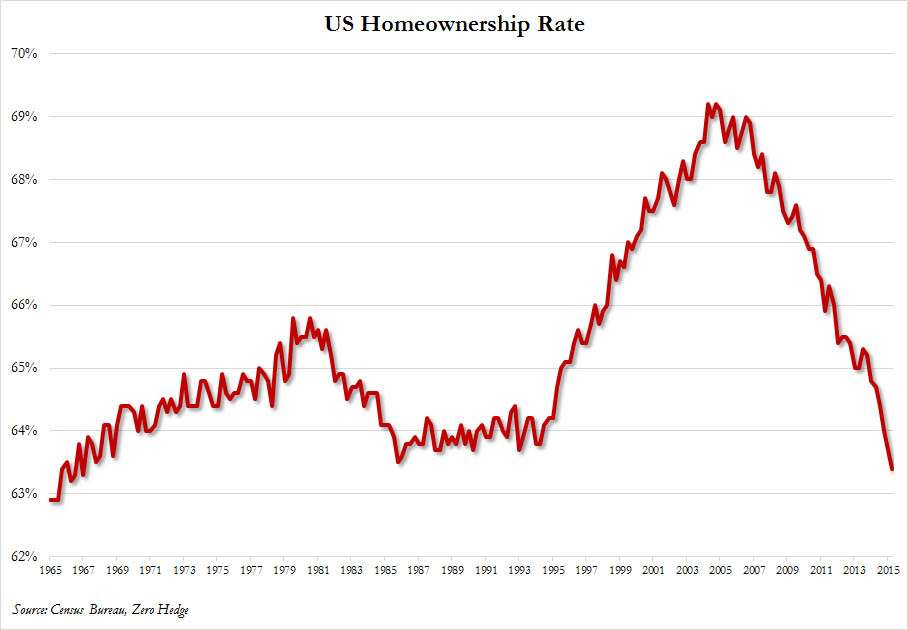

The reason for this is a simple, if dramatic, one: the U.S. transformation from a homeownership society, to one of renters.

In fact, the only age group that has seen an increase in homeownership in the “New Normal” are those aged 65 and over!

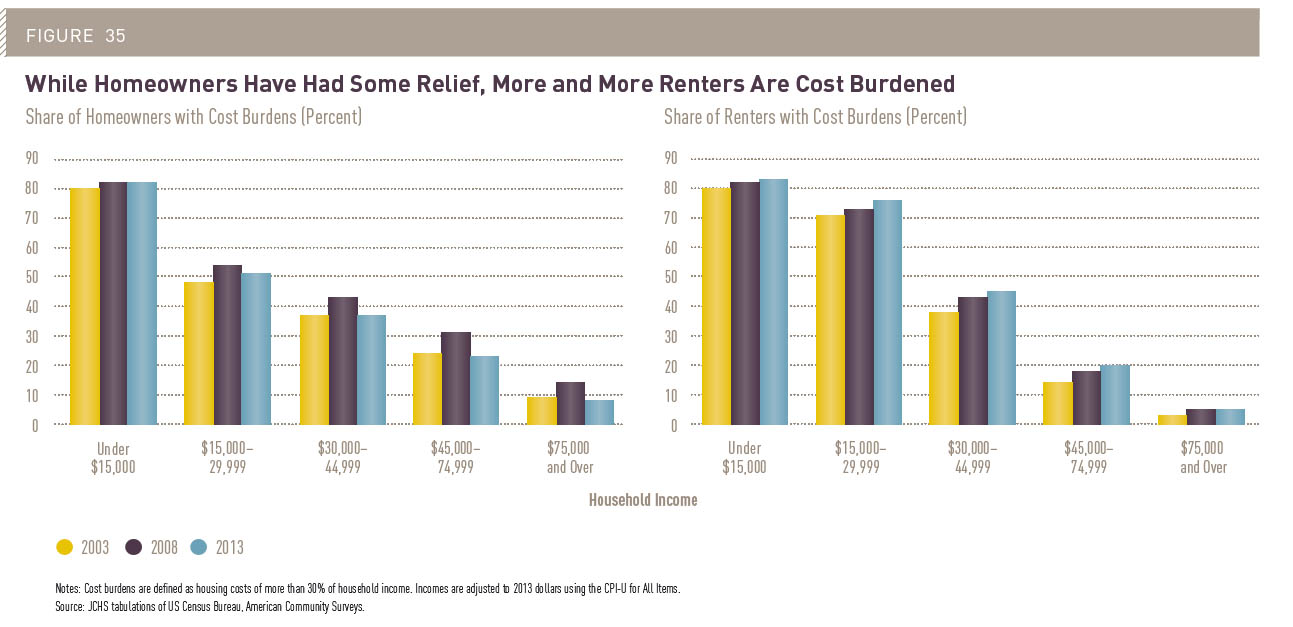

Showcasing the plight of renters was the “State of the Nation’s Housing” report from the Center for Housing Studies, according to which for American renters 2013 marked another year with a record-high number of cost burdened households – those paying more than 30 percent of income for housing. In the United States, 20.7 million renter households (49.0 percent) were cost burdened in 2013.

As more Americans are forced into a limited number of rental units, prices have exploded at a far greater pace than what is officially reported in the shelter or core CPI metric, for all – but especially for those in the lower income buckets: as seen in the lower right chart, the rental “cost burden” of households making under $30,000 is the higest ever, at well over 70%.

It gets worse: a whopping 11.2 million, or more than a quarter of all renter households, had “severe cost burdens, paying more than half of income for housing.” The median US renter household earned $32,700 in 2013 and spent $900 per month on housing costs. Renter housing costs are gross rents, which include contract rents and utilities.

Leave A Comment