Asset markets aren’t prepared for a hawkish Fed. As Bloomberg’s Richard Breslow notes Fed speakers have even taken to the Sunday talk shows to beat the rate-rise drum as economics is morphing into punditry. They’re going to raise rates because they can, are independent, apolitical and can’t be bullied by foreigners. The numbers notwithstanding…

Hallelujah

Perhaps we’ll know more when Chair Janet Yellen speaks on Friday in the more rarefied surroundings of Radcliffe Yard. For all the talk, one thing is true: asset markets aren’t priced for a FOMC ready to raise rates and looking to do more.

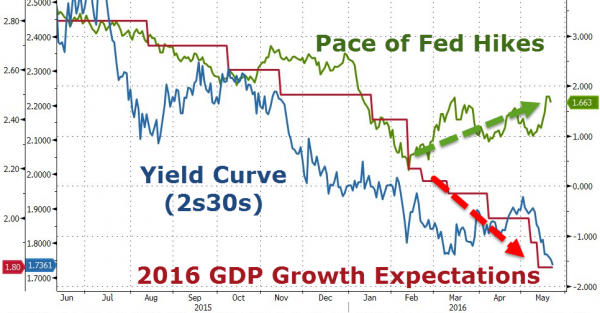

The yield curve continues to flatten, reaching its tightest levels since 2007. That’s a sign of low medium-term inflation expectations and concern that the economic cycle is closer to recession than boom.

It also reflects investors continuing to extend duration in search for yield, exactly what the Fed has forced them to do.

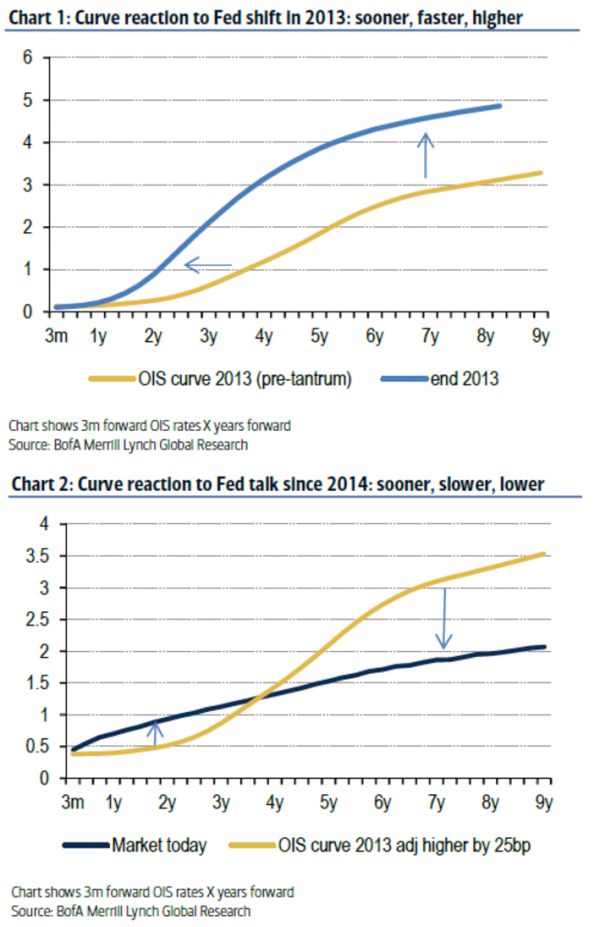

Simply put, as BofAML warns, a lack of credibility constrains Fed effectiveness drastically as they have “cried hawk” one too many times…

The policy mistake angle assigned to the Fed is visible in more areas than the yield curve.

As we have said repeatedly stated before, the TIPS market continues to believe that the Fed will deliver real rates that are far too high and miss on its long-term inflation target by at least 50bp.

To us, the lack of focus and the inability of the Fed to improve longer term expectations priced-in to the rates market the line of igniting a bigger concern: getting dangerously close to the market pricing in inverted yield curves, two to three years forward.

The policy mistake feedback loop in the rates market will unwind only when the focus shifts to boosting longer-term global growth and inflation expectations as opposed to shifting near-term hike probabilities in an environment where structural risks remain (China, potential growth).

Leave A Comment