If you Google “dot com bubble,” you will get nearly 1.2 million hits, and 3.3 million hits if you Google “tech bubble.” A Google search of “housing bubble” will return nearly 11 million hits. (The searches were conducted on March 29, 2017). And if you search Amazon books for financial crisis 2008 you will get more than 1200 hits.

Given all the books, monographs, essays, articles, and editorials that have been written about back-to-back bubbles that occurred within two decades, one would think there would be nothing else to write about.

The purpose of this book is to present to the general public, my fellow academicians and policymakers with an brief account and review of one of the most turbulent periods in United States history without the usual jargon academics are noted for.

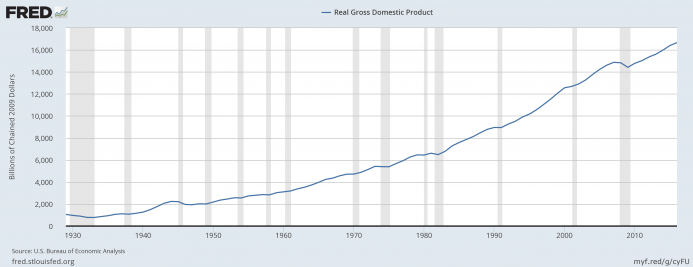

As the two quotes from the Federal Reserve’s website above reveal, the Fed has been given the responsibility by the Congress of the United States to essentially promote sustainable prosperity, stabilize prices and maximize employment. During the past 100 years of the Federal Reserve’s operations, the economy has grown substantially (see Figure 1 for data since 1929), but the path to higher living standards have been interrupted by depressions/ recessions, a few bouts with double-digit price inflation and occasionally widespread unemployment. Although the Congress has expected the Federal Reserve to be a wise and prescient “helmsman,” navigating the economy from becoming overheated or plunging into a recession or worse, the Fed’s track record belies its mandates.

Figure 1

The Federal Reserve’s primary tool, open market operations, the buying and selling of US government securities with money created out of thin air, is supposed to provide sufficient “liquidity” to grease the wheels of commerce so the US economy reaches its optimal output of goods and services and maximizes employment. Thus, the Federal Reserve has what every American wishes it had, an unlimited checking account.

The US Congress created the Federal Reserve in 1913 to stabilize the economy after the Panic of 1907 and was “sold” to the American people as a measure to rein in the banks for their reckless behavior and enormous power over the economy. The fact that bankers and their allies helped draft the Federal Reserve Act seems to have been downplayed by most economists and financial historians. Others have taken a less sanguine view of central banking.1

Leave A Comment