A considerable amount of time has passed since the financial crisis of 2008 and the “great recession” that followed. March 2016 marks the seventh year since the economy began its long, slow recovery and the current bull market in stocks began.

The current economic recovery and stock price gains have been accompanied by a considerable degree of skepticism, however. Many have argued that we’re in the least-respected bull market in history, and discredited naysayers with nicknames like “permabear” and “Dr. Doom.” In this article I will take a long-term view of the pros and cons regarding the past and current state of the U.S. economy and financial markets, explain why such a wide range of opinions prevail among analysts, investors and the financial media, and identify the main force that propelled stock prices to record levels in 2015.

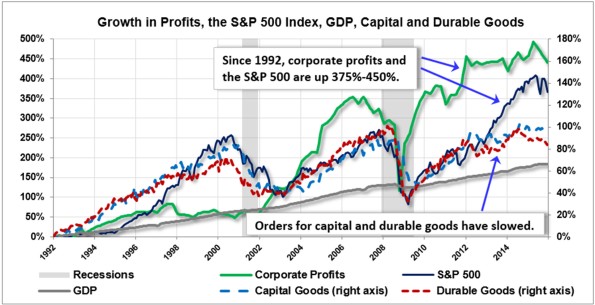

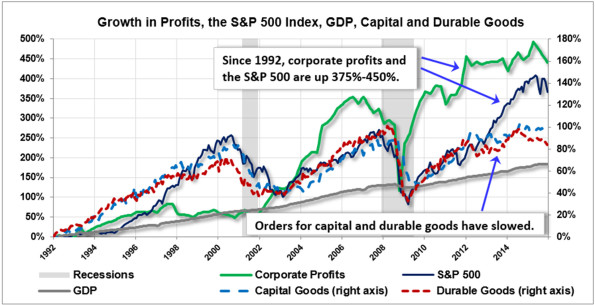

We’ll start by considering Figure 1, which shows the long-term growth rates of corporate profits, stock prices, gross domestic product (GDP, the value of all goods and services produced in the U.S. over time), and new orders for capital and durable goods (spending on big-ticket items by businesses and consumers). Following the 1991 recession, orders for capital and durable goods grew rapidly, with profits and stock prices following along until the late 1990s. Although spending by consumers and business continued at a brisk pace until 2000, it is now widely-recognized that the stock values had crossed over into “bubble” territory, which happens when stock prices rise without accompanying growth in fundamentals (such as corporate profits). Because the excess technology investments of the late 1990s did not lead to further increases in profits, stock prices retreated into bear market territory in 2000, with the events of 9/11 prolonging the decline all the way into early 2003.

The bull market of the early 2000s seemed poised to right the wrongs of the previous bull, as this time capital and durable goods orders grew proportionately with stock prices, and corporate profits grew even faster – what could go wrong? It turned out that markets had yet another lesson to teach, because profits and stock prices had received significant tailwinds from dual bubbles in real estate and credit. In 2008 the bear caught up with markets again, and the carnage in both the economy and financial markets was more severe than anything seen in the 2000-2003 bear market.

Leave A Comment