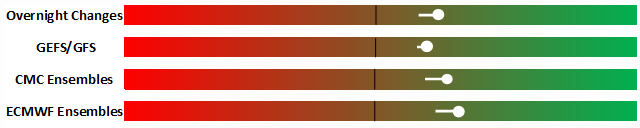

Continued hotter trends in the medium and long-range continued to support natural gas prices, with the September contract logging a 1.3% gain on the day.

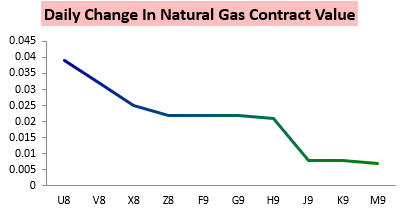

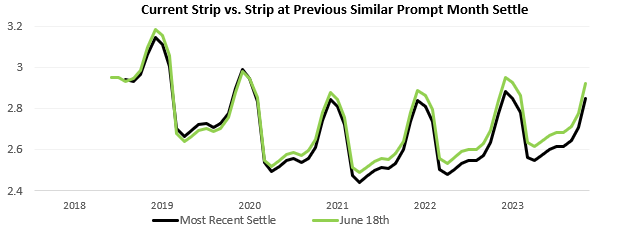

Expectations of heat continued to help support the front of the natural gas strip the most.

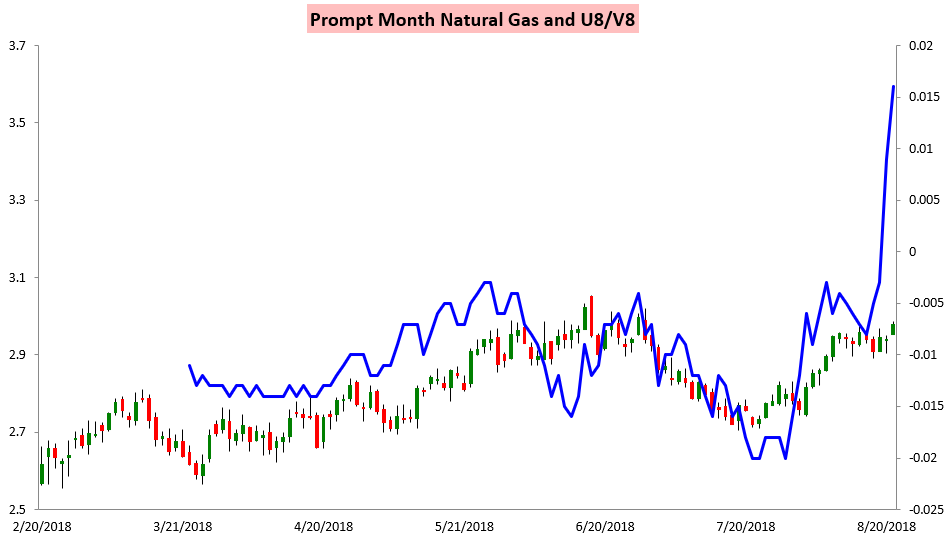

This has resulted in a continued blowout of the U/V September/October contract spread.

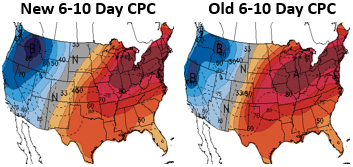

Additionally, these heat risks have only become higher confidence across the country in the 6-10 Day forecast, with Climate Prediction Center output very consistent in coverage.

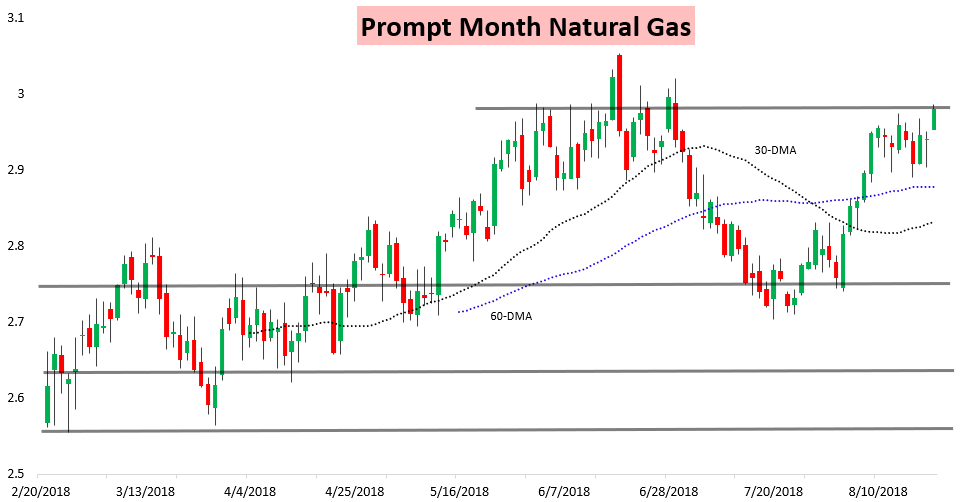

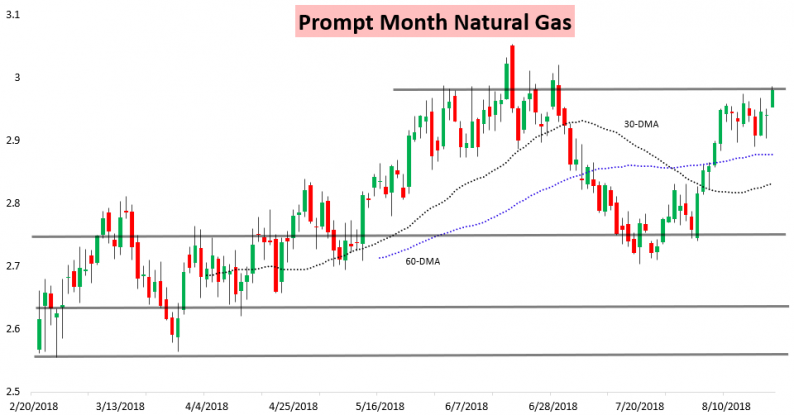

Our Morning Update for clients highlighted increased confidence in bullish heat across models, alerting subscribers that the $3 level was in play for the September contract. It got up to $2.991 this afternoon, but continued to bounce off the $2.98-$3 resistance level we had also highlighted yesterday was similarly a possible test early in the week.

We also published our Seasonal Trader Report for clients today, where we looked at recent action along the natural gas strip as well as our 5-month Gas Weighted Degree Day forecast, current reading of weather-adjusted supply/demand balance, and our latest end of injection season storage forecast.

Then in our Afternoon Update we looked closer at how price risk was skewed into Thursday’s EIA print, as w

Leave A Comment