Two weeks ago, we discussed the recent report from Artemis Capital Management, “Volatility and the Alchemy of Risk – Reflexivity in the Shadows of Black Monday 1987”, authored by Christopher Cole. See “In the Shadows Of Black Monday – “Volatility Isn’t Broken…The Market Is”. The full report can be accessed here.

Perhaps because we posted it on a weekend, we feel that this must read report – one of the best reports we’ve read in years – has not received the profile it deserves. We think that it’s important to highlight it again, as it explains the mechanics which are likely to drive the next financial crisis. We begin with a ten bullet point summary.

In the Global Short Volatility Bubble:

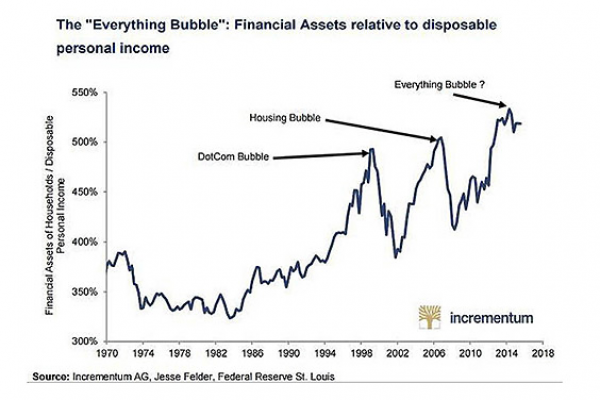

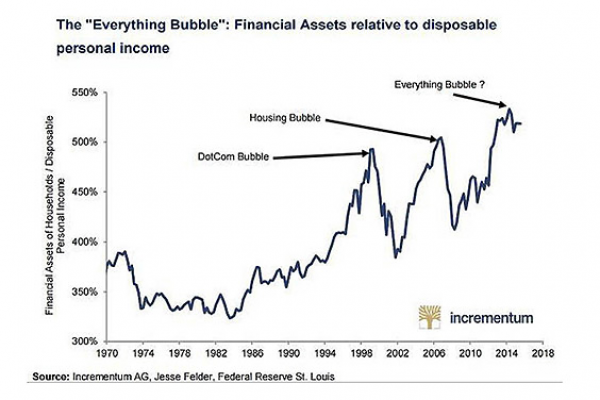

It’s become fairly common for the current central bank-created bubble in financial markets to be labelled the “Everything Bubble”. We can’t remember who coined the phrase, it might have been John Hussman, who describes current financial conditions as “the most broadly overvalued moment in market history”. No matter, here is one representation from the portfolio managers at Incrementum AG.

However, when you think about the markets in holistic fashion, there is no way that this is the “Everything Bubble”. It can’t be when some asset classes – and precious metals and many commodities immediately spring to mind – are far from all-time highs. Gold, especially, stands out, being a financial asset.

As keen students of the esoteric in markets and literature, we’ve found a kindred spirit in Artemis’s Christopher Cole. Cole refers to alchemy in the context of the ouroboros – the snake devouring its own tail. Besides demonstrating an understanding of true alchemy, rather than the profane, Cole uses the ouroboros as a metaphor for today’s central bank-driven financial markets. In Cole’s opinion, the financial markets are in the process of self-cannibalizing and, as he posits.

In nature and markets, when randomness self-organizes into too perfect symmetry, order becomes the source of chaos. The Ouroboros is a metaphor for the financial alchemy driving the modern Bear Market in Fear. Volatility across asset classes is at multi-generational lows. A dangerous feedback loop now exists between ultra-low interest rates, debt expansion, asset volatility, and financial engineering that allocates risk based on that volatility. In this self-reflexive loop volatility can reinforce itself both lower and higher. In a market where stocks and bonds are both overvalued, financial alchemy is the only way to feed our global hunger for yield, until it kills the very system it is nourishing.

This is not an “Everything Bubble” but, in our opinion, a multi-trillion dollar global short volatility bubble (GSVB). This is Cole’s description.

The Global Short Volatility trade now represents an estimated $2+ trillion in financial engineering strategies that simultaneously exert influence over, and are influenced by, stock market volatility. We broadly define the short volatility trade as any financial strategy that relies on the assumption of market stability to generate returns, while using volatility itself as an input for risk taking. Many popular institutional investment strategies, even if they are not explicitly shorting derivatives, generate excess returns from the same implicit risk factors as a portfolio of short optionality, and contain hidden fragility.

Leave A Comment