The estimable Martin Feldstein put the wood to the Fed in a recent op ed and in so doing hit the nail directly on the head. He essentially called foul ball on the whole inflation targeting regime and the magic 2.00% goalpost in part due to the measuring stick challenge.

A fundamental problem with an explicit inflation target is the difficulty of knowing if it has been hit.

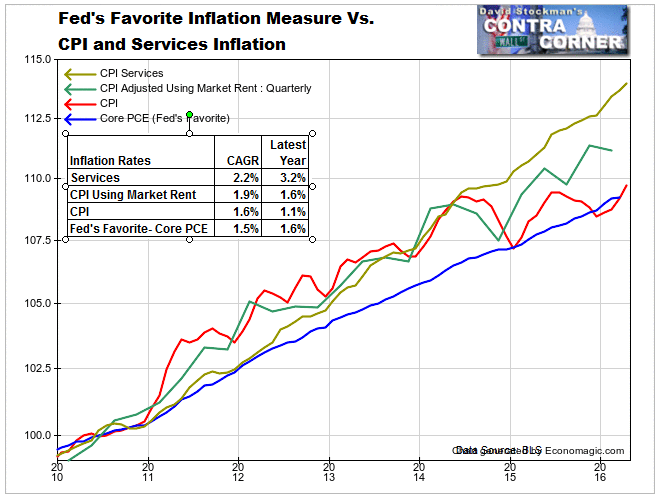

That problem is plainly evident in the chart below. You could very easily make the argument that goods prices are beyond the Fed’s reach because they are set in the world markets and by the marginal cost of labor in China and the EM.

Therefore the more domestically driven CPI index for services such as housing, medical care, education, transportation, recreation etc. is the more relevant yard stick. Alas, if there is something magic about 2.00%, why then, mission accomplished!

On a five year basis, services inflation is up at 2.2% annually, and during the past year it has heated up to 3.2%.

Then again, if the Fed were not comprised of power-hungry apparatchiks looking for any excuse to intrude in the financial markets and dominate their hourly behavior, it might well recognize the merit of what we have termed “CPI Using Market Rent” (box).

That’s because the regular CPI gives a 25% weighting to the OER (owners equivalent rent), which is more than a little squirrely.The BLS actually asks a tiny sample of homeowners what they would charge per month if they were to rent out their castle.

They have no clue! So the BLS plugs some survey questionnaire noise into an algorithm and calls it 25% of the entire damn index!

To improve upon this nonsense, we just swapped out the OER in the chart above and replaced it with an asking rent index that a private vendor provides to real clients in the housing rental business. The results get us exactly to the title of Feldstein’s post called “Ending the Fed’s Inflation Fixation”.

After all, can any adult really believe that there is any significant difference between 2.0% and 1.9% on a five-year trend basis? Or even that 1.6% is a significant “miss” that adversely impacts an $18 trillion economy during a year where the global collapse of oil and commodities has clearly temporarily depressed the overall CPI index?

Leave A Comment