It wasn’t meant to be, because, amid the carnage in Macy’s, Nordstrom, and JCPenney…

… not even the US Department of Commerce would be so bold as to suggest retail spending has rebounded.

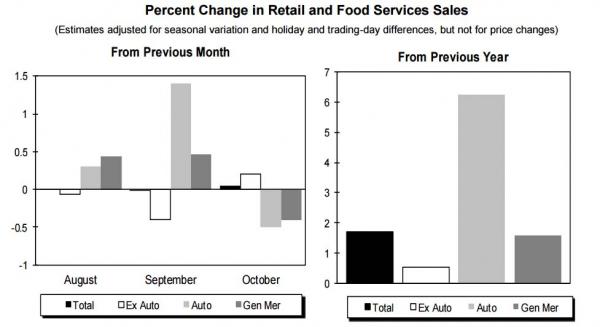

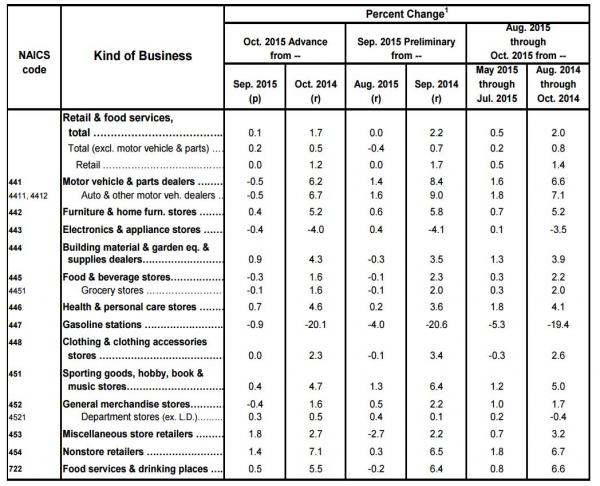

Sure enough, following a 0.1% dip in September, ‘control group’ retail sales rose just 0.2% (half the expected 0.4% rise). Furthermore, having fallen 0.3% MoM last month, retail sales ex-autos rose just 0.2% (again missing the expected 0.4% gain).

October saw retail sales declines in Motor sales, Electronics, Food and Beverage, Gasoline Sales, and General Merchandise.

Most notable is the drop in year-over-year gains (and downward revisions) to a rise of just 1.7% – the 2nd weakest since the financial crisis.

* * *

But the picture is clearest when excluding the debt bubble-funded auto-spending spree. When one excludes autos, what we find is that the last two times retail sales were this weak, The US was already in recession.

Leave A Comment