My Swing Trading Approach

Volume should start to dry up today. Surprising to me that there was above average volume yesterday, considering it was a holiday week. I won’t rule out adding an additional position to the portfolio, but right now, I am content with my current crop of trades. I will certainly increase the stop-losses.

Indicators

VIX – Dropped 8.6% to 9.73. Massive decline over the last five trading sessions, as has become typical of any significant rally in the VIX.

T2108 (% of stocks trading below their 40-day moving average): Day 4 of the bounce – up 7% to 53%. The health of this indicator has quickly improved over the last week.

Moving averages (SPX): Back above the 10-day moving average, and all other moving averages.

Industries to Watch Today

Technology and Consumer Cyclical are the two main industries to be trading in right now. Industrials and Healthcare are bouncing hard. Stay away from Energy.

My Market Sentiment

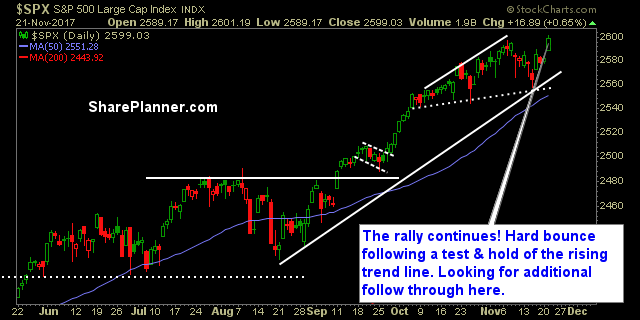

Yesterday’s move was huge, because it suggests, with the market establishing new all-time highs, that it is ready for the next leg higher in the stock market.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Recent Stock Trade Notables:

Leave A Comment