After several relatively orderly down days that began last Monday with a bang, panic is beginning to creep in around the edges. China’s stock market unleashed a fresh round of global turmoil Thursday, diving more than 7% in just 30 minutes before breakers kicked in and halted trading. Geopolitical events are not helping matters, with Saudi Air Force planes reportedly striking Iran’s Yemen embassy. Oil, in particular, remains under tremendous pressure.

It’s important that you don’t give in to the market sell-off – that’s what Wall Street’s big boys want.

Remember, we’re here to build Total Wealth no matter what the markets throw our way. It’s YOUR money that matters most – how to make it and, just as importantly, how to protect it.

Today we’re going to make sense of the headlines by taking a look at what you’re not hearing at the moment – including a quick look at why the market sell-off could be a monster buying opportunity!

As usual, I’ve got a recommendation you can add to your portfolio immediately to capitalize on the chaos.

Sell If You Have To – But Only for the Right Reasons

After Thursday’s market close, the S&P 500 was down 4.7% for the week, while the Dow had shed 5.2%. Naturally, emotions are running high.

Still, don’t reach for the “sell” button reflexively. That never ends well – not for you and certainly not for your money.

You see, big sell-offs have a habit of stopping when most investors least expect it. Worse, having sold in a panic, they’ve now got an even bigger problem… getting back in.

I’m bringing this up because one of my favorite indicators suggests that last week’s sell-off could be a monster buying opportunity.

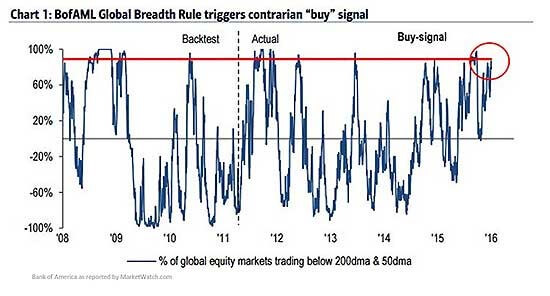

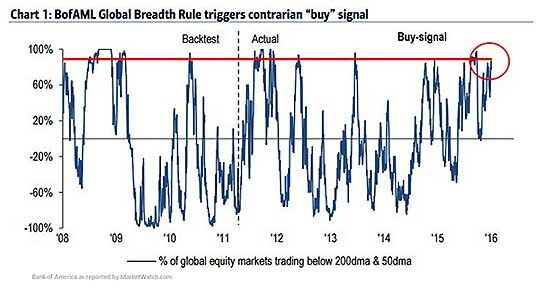

The Bank of America Global Breadth Indicator measures the percentage of global markets trading under 50- and 100-day moving averages commonly used as institutional benchmarks for program trading. As such, it’s a great way to measure overreactions in today’s highly linked global markets.

Right now, 88% of global markets are under those key measures – and here’s the exciting part – that’s consistent with other buying opportunities.

Never forget something we talk about all the time.

It’s one thing to sell when it’s part of a disciplined process using trailing stops or other risk management tactics we talk about frequently, but absolutely the wrong thing to do if it’s just based on panic or some sort of emotional input. Emotion costs individual investors hundreds of percentage points in lost returns even during the best of times.

Even though most investors think only about losses, in reality, the far more costly “loss” is the missed opportunity that comes from standing aside on a knee-jerk reaction. Especially when the markets misfire like they did last week.

Leave A Comment