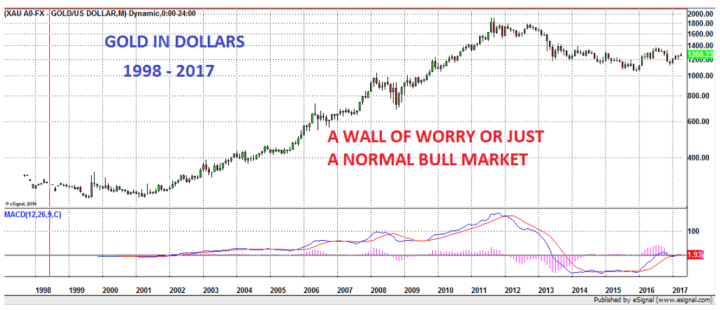

To ride a bull market is like climbing a wall of worry. Most of the time the market seems to be consolidating or correcting. The bull market in gold fits that picture perfectly. It started in 1999 at $250 but very few got in at the very bottom. We entered the market in 2002 at $300 with a very strong belief that the world economy and financial system would have unsolvable problems. Since then we have seen a very strong bull market interrupted by totally normal corrections. Admittedly, since the 2011-12 top, we have had a long wait but the uptrend resumed at the end of 2015, albeit somewhat slowly so far. The same happened in the early 2000s. Gold bottomed in 1999 but only took off in 2002.

Most investors enter a market after a big rise and then often sit through a major part of the correction before they bail out. The best time to enter is when an investment is unloved and undervalued but few have the courage to do that. Instead they wait until the media start talking about it. We are fortunate to have investors who understand the role of gold from a wealth preservation perspective. These are investors who don’t see gold as an investment but as insurance and as protection against governments’ folly and total mismanagement of the economy and financial system. Governments hate gold because it reveals their deceitful actions. No government ever tells the people that as a result of their actions, the value of paper money always goes to zero. Since 1913 for example, the dollar has lost a staggering 98% of it purchasing power. And since 1999, the dollar is down 81% in real terms, measured in gold.

Final phase of dollar destruction imminent

We will very soon, and most probably in 2017, start the final phase of the dollar destruction when the value of the dollar reaches zero. This sounds dramatic but we must remember that something that has already gone down 98% is guaranteed to finish the move by reaching a total loss of 100%. So all we have left now is the final 2% move for the dollar to reach its intrinsic value of ZERO! The only problem is that the final 2% loss, measured from today, means that the dollar will go down another 100% from here. This is likely to happen within the next 4-5 years. But it could go very fast once it starts. The $2 quadrillion of global debt, derivatives and liabilities could implode very quickly with governments futile attempts to rescue the system having no effect this time. After all, by printing or creating electronically quadrillions of dollars, all governments will do is to waste paper and electricity. Finally, the world will discover that the last 100 years were based on an illusion that paper money and electronic money actually have a value. But how can money or credit which is created without any production of goods or services ever have more than zero value. For over a century, governments and central banks have led the people to believe that real wealth has been created when most of it is based on illusions and lies. The speed at which the global financial house of cards collapses will prove that it was built on foundations of quicksand.

Leave A Comment