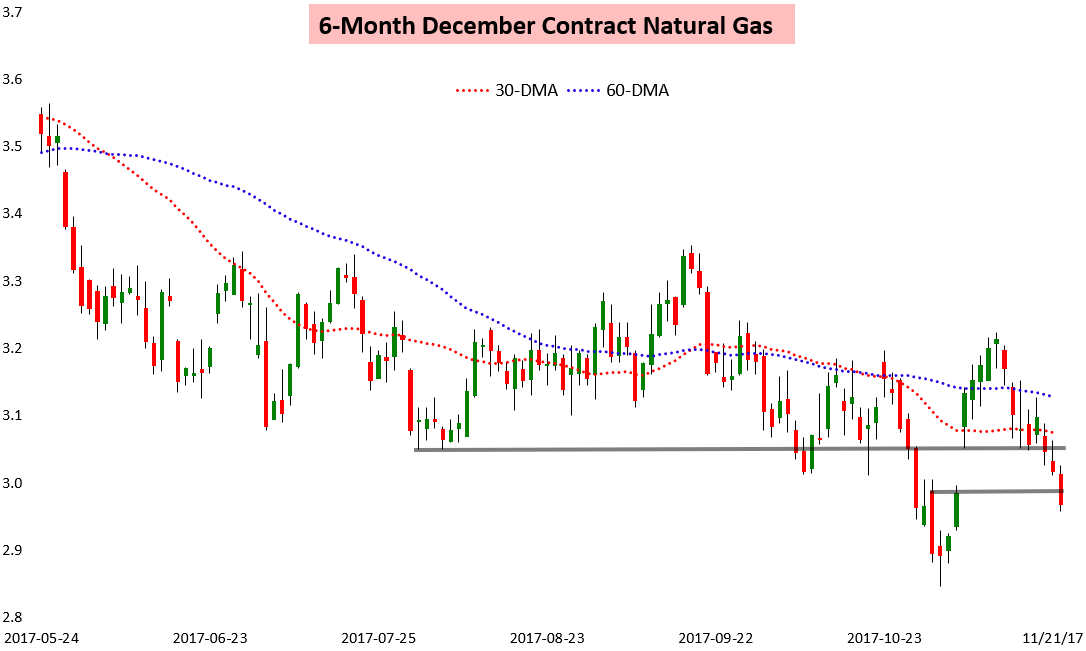

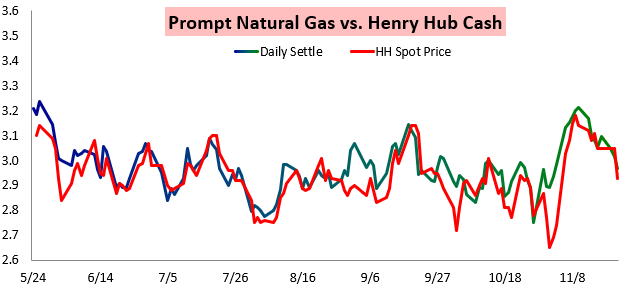

Make it 8 of the last 9 (and now 3 straight) days that prompt month natural gas prices have moved lower. Finally, prices were able to fill the gap below them, just before traders headed out for the Thanksgiving Holiday.

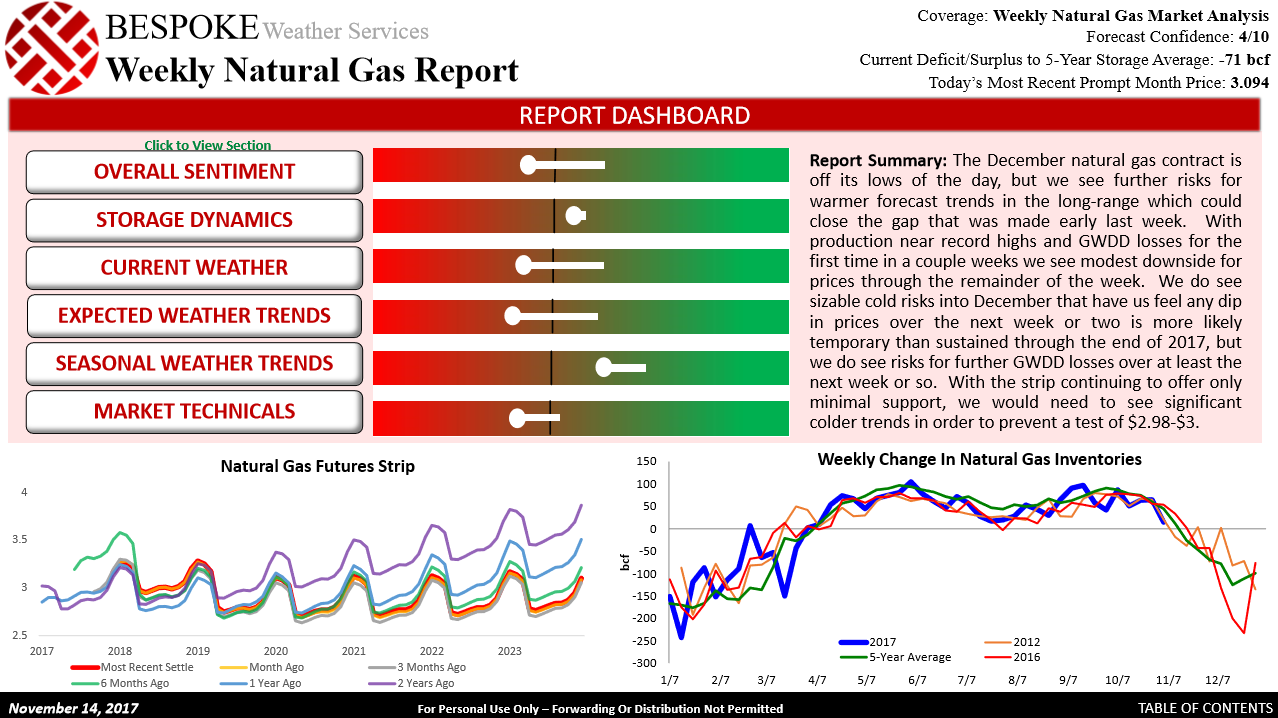

We had been all over this gap, alerting clients in our Weekly Natural Gas Report last Tuesday that the gap was likely to fill due to the warmer weather late in November and early in December that model guidance is now picking up on.

Then in a Note last Thursday (11/16) we warned that warmth was likely to still pull us lower from there, something we have seen in forecasts through this week as well.

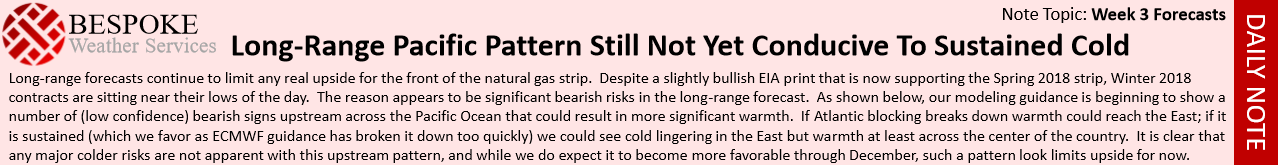

These forecasts verified and current 8-14 Day forecasts do not hold much cold risk, as seen by the latest 12z GFS ensemble forecast below (courtesy of the Penn State E-Wall).

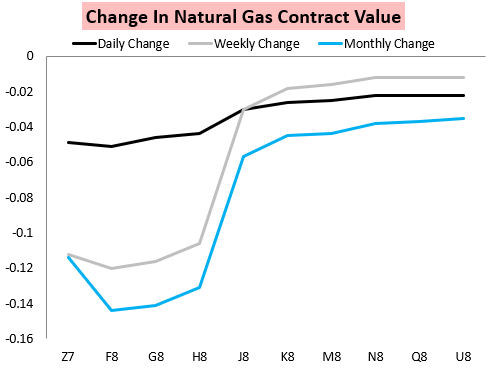

Accordingly, we saw the front of the natural gas strip lag, and over both the past day and week we have seen H/J come in and prices pull back consistently.

Today’s decline was furthered by weak cash prices ahead of the holiday weekend and warmer short-term forecasts, something that we warned clients in our Afternoon Update yesterday could be a bearish drag on the market today.

Now, traders will sit back and watch the market digest the latest model guidance on thin electronic trading over the next 36 hours before we should see some volume come in on Friday. Long-range models continue to show a volatile pattern, however, so we expect a number of weather-driven moves to come.

Leave A Comment