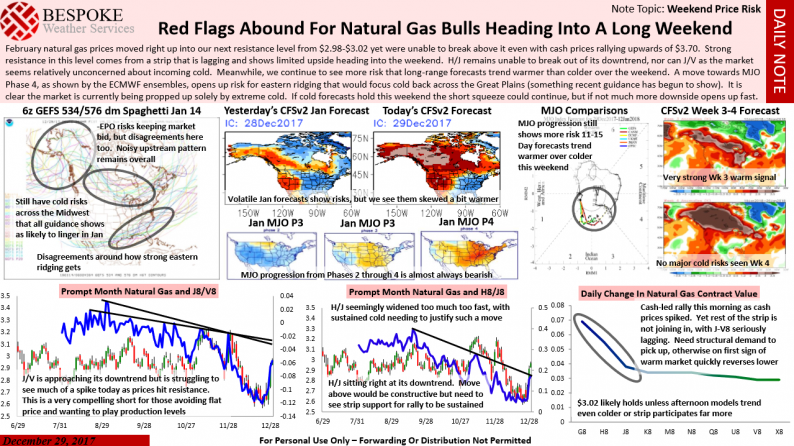

The natural gas market sold off again today as it continued to price in warmer weather expectations for the second half of January. This is something we first warned of in our Note of the Day last Friday, where we picked up on long-range warm trends that could potentially pull the market back.

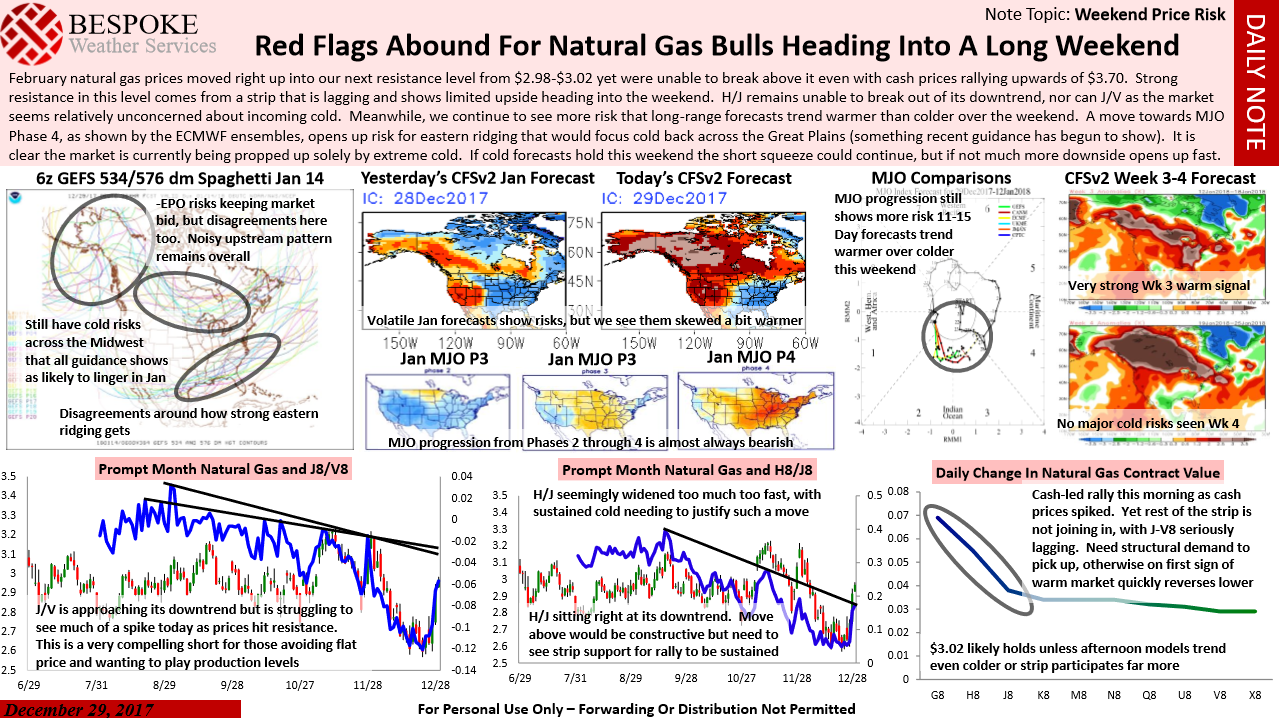

Prices did end up reversing this week, but before we saw the prompt month contract reverse we actually saw the April/October J/V spread start the reversal before hitting resistance, indicating that the natural gas market still appeared structurally loose in the face of elevated production. That spread kept selling off today as well, fitting well with our idea from last Friday.

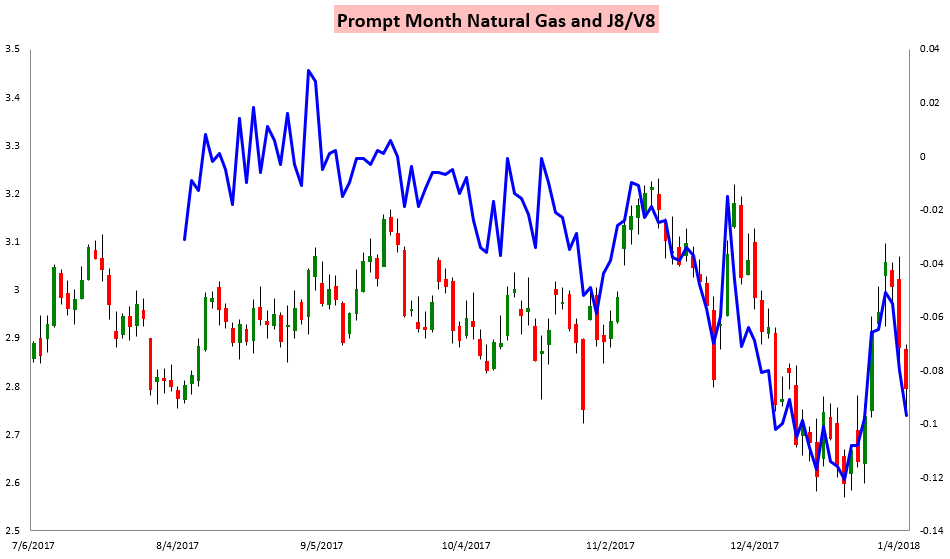

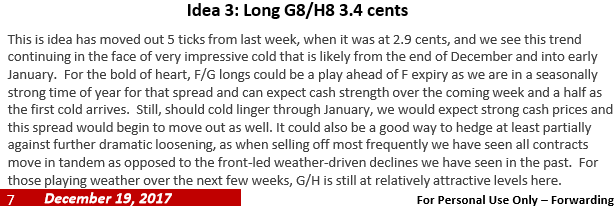

But that is just one of the spreads we watch. We also tend to watch the month 1/month 2 spread for indications of how cash is impacting the natural gas strip and what is driving prices. Back in December we saw an opportunity with the February/March G/H spread seemingly being undervalued in the face of very impressive cold to end 2017 and bring in 2018 (posted in our Seasonal Trader Report, published every Tuesday). With impressive cold, we would expect cash prices and thus the prompt month natural gas contract to be impacted the most, likely widening this spread.

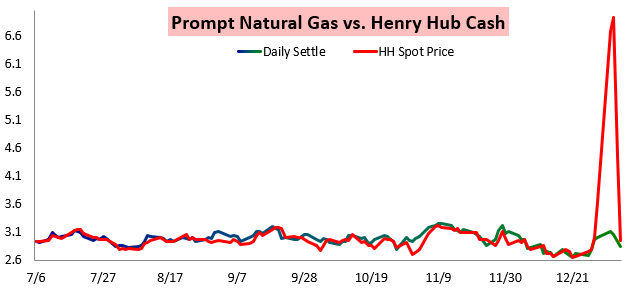

Sure enough, as cold arrived and cash prices spiked, so did the G/H spread.

After that, we saw that spread pull back the last couple of days too as forecasts later in January warmed and short-term cold eased, pulling Henry Hub spot prices back.

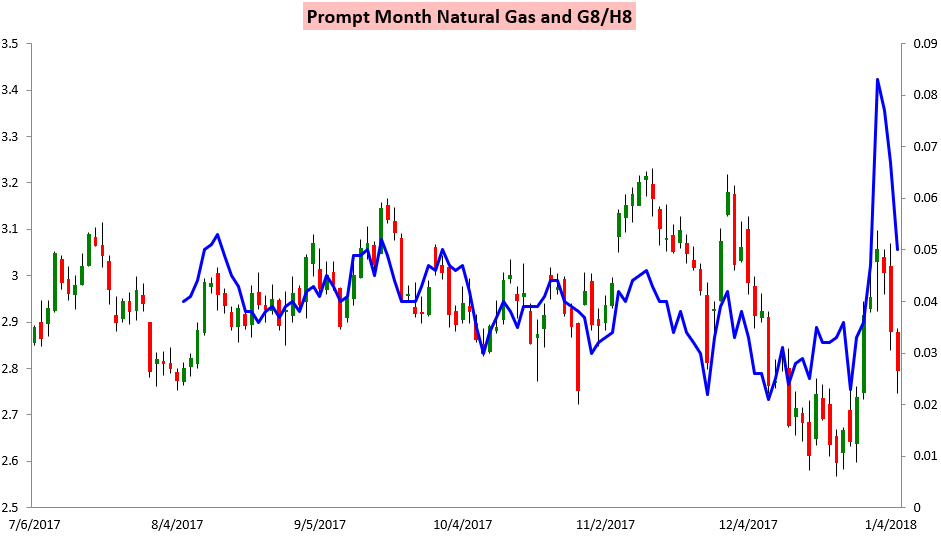

And of course another spread to watch for with the arriving warmth is the March/April H/J spread. This spread is one of the best for determining how concerned traders are about natural gas inventory levels for the remainder of winter, as March is when we finish drawing gas from storage and any shortage would be reflected in March prices but not necessarily April, where we go back to injecting gas. In our Note of the Day on Tuesday we outlined how the spread was right at the top of its downtrend already, and any warmer trends would quickly pull it back.

Leave A Comment