You know that moment when you start feeling like something in in the market isn’t quite right? Maybe it seems like stocks have reached an extreme, or that there is a big event on the horizon, or just a gnawing in your gut that something is due to change.

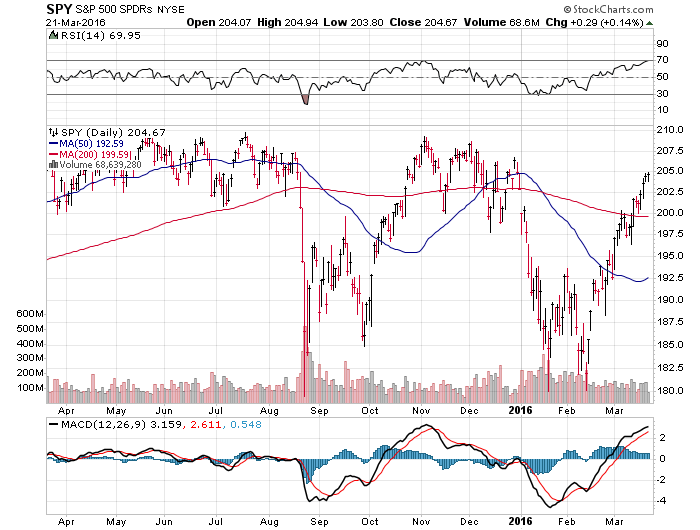

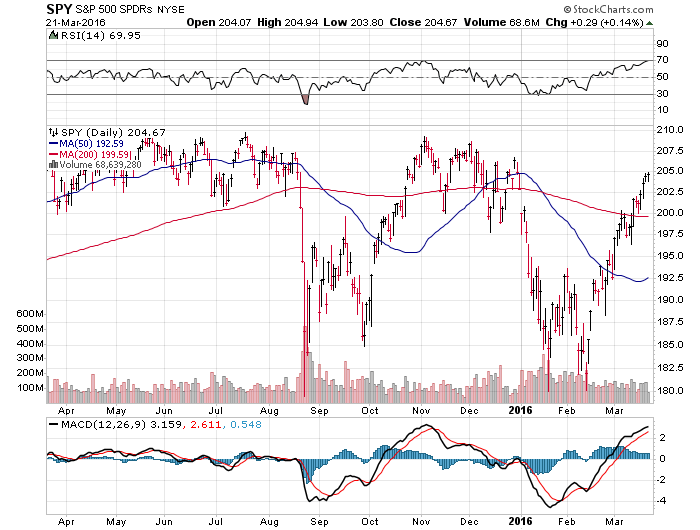

That sensation is hitting me right now with the SPDR S&P 500 ETF (SPY) up 25 points from the lows and back to the center of last year’s definable range near $205.It’s the sense that we have gone too far, too fast, and that maybe we only have a few points left before this thing rolls over again.

Do I have any empirical evidence to back this up? No

Has there been a significant change in the technical or fundamental picture? No

Have there been any particular warning signs in recent economic data? No

So basically I just FEEL like we are due for at least a short-term respite to the current upside momentum rather than having any actionable intelligence to back up my theory.

This is when I always remind myself that the market doesn’t care what I think it should do.It’s the best way of keeping myself out of trouble.It can continue on its current course far longer than I thought possible and with far worse fundamentals than anyone would believe.

The best way to damage your portfolio is to try and predict exactly when a stock, ETF, or asset class is going to turn rather than simply relying on your philosophy. Traders should have definable price levels where they will make a change.Trend followers should have markers that tell them when to adjust.Others simply buy with steady abandon no matter what the price is at any given time.

If you remember correctly, five weeks ago the world was ending. I mean literally there were experts on TV and writing articles touting the next bear market, recession, or global crisis.Credit was collapsing, sentiment was hitting extreme lows, and everyone was telling you to get the hell out.

Now we are back to within spitting distance of all-time highs. All in less than two months.

Leave A Comment