The New York Times told readers this morning that the European Central Bank (ECB) would like to cut back on its quantitative easing program but is reluctant to do so because of the weak dollar. The piece notes that a weak dollar reduces the euro zone’s trade surplus with the United States. Also by making low-cost imports available, it undermines the ECB’s effort to raise inflation to its 2.0 percent target.

The piece explains the weak dollar:

“There’s not much Mr. Draghi can do about the weak dollar, which analysts say reflects pessimism about the ability of President Trump and Congress to agree on legislation that many economists believe would help goose growth in the United States, such as infrastructure programs or corporate tax reform.

“‘Investors no longer trust the American government to push through tax reform and fiscal stimulus,’ Alwin Schenk, a portfolio manager at the German bank Sal. Oppenheim, said in a note to clients.

“The dollar’s decline is also an expression of the nervousness investors feel about geopolitics, primarily nuclear saber-rattling by North Korea and bellicose rhetoric from Mr. Trump. The euro is seen as a safe haven from the turmoil.”

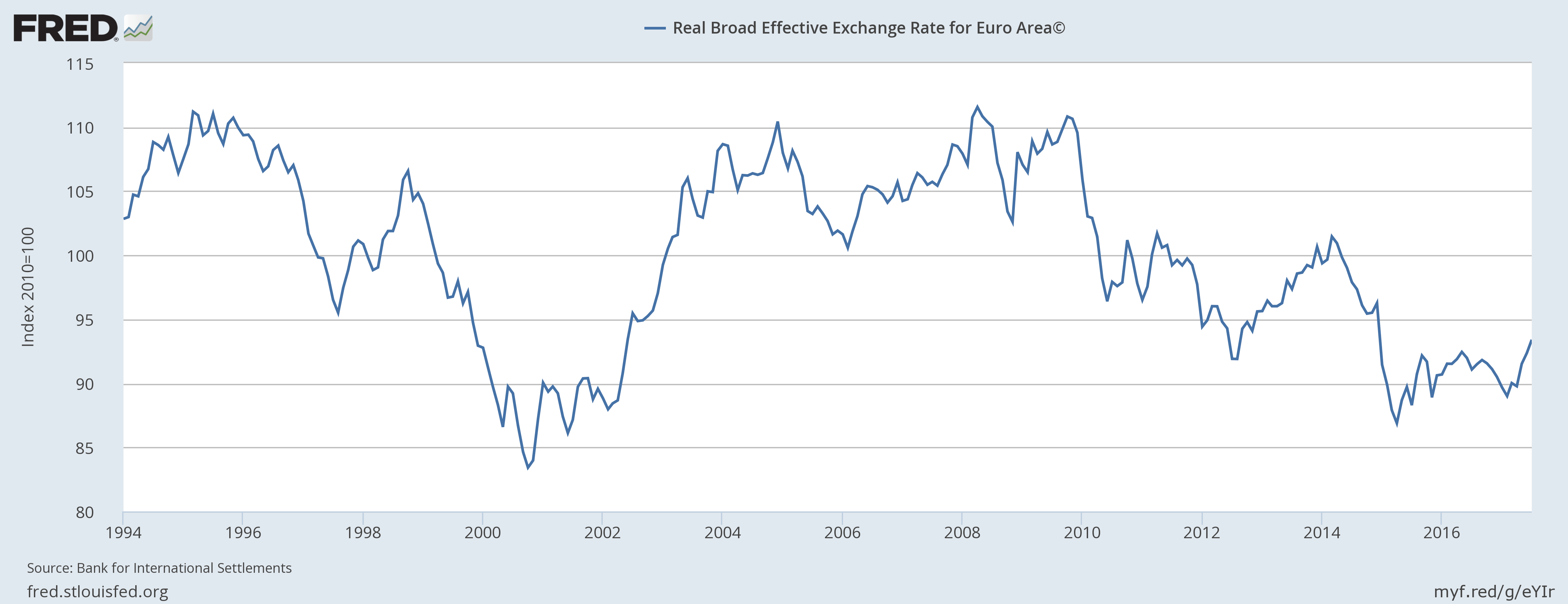

This would be a compelling story except for the fact that the dollar is actually quite high relative to euro, as can be seen.

The real value of the dollar measured against the euro is well below its average since its creation. It is more than 15 percent below the peaks hit in the middle of the last decade. While the dollar is down from its value last year, this follows a long period in which its value increased by more than 20 percent in value against the euro. (The chart shows the value of the euro, so a drop means a rise in the value of the dollar.) The complaint about a low dollar is especially bizarre since the United States has a trade deficit and the euro zone has a trade surplus.

Hopefully, this confusion about the value of the dollar stems from the NYT’s reporting and does not represent the actual thinking at the ECB.

Leave A Comment